In the evolving landscape of financial services, gaining operational efficiency and optimising the cost base are two key levers for firms to remain competitive.

Outsourced trading can help to fill the gaps in your own capabilities and focus efforts on your core activities. This can help you to access liquidity in a broader range of markets, grow or diversify your execution needs, or improve efficiency of your investment chain.

A recognised outsourced trading service provider

Dealing Services at BNP Paribas brings the expertise of our three dealing desks in Paris, Lisbon and Hong Kong[1]. These desks act as a natural extension of your investment teams and can help you to maximise your trading efficiency.

Hosted within Securities Services (the asset servicing arm of BNP Paribas), Dealing Services is independent from BNP Paribas’ brokerage business and Asset Management activities. This makes Dealing Services a broker- and client-neutral service provider, and enables all clients to benefit from best execution.

Beyond cost and efficiency, outsourced trading offers flexibility and scalability, for asset managers, asset owners or wealth managers. Clients may appoint Dealing Services for all or part of their execution needs, such as specific assets (e.g. fixed income, equities, FX execution), or specific remote markets (cross-border trading), e.g. execution in APAC markets for a EU-based investor or vice-versa.

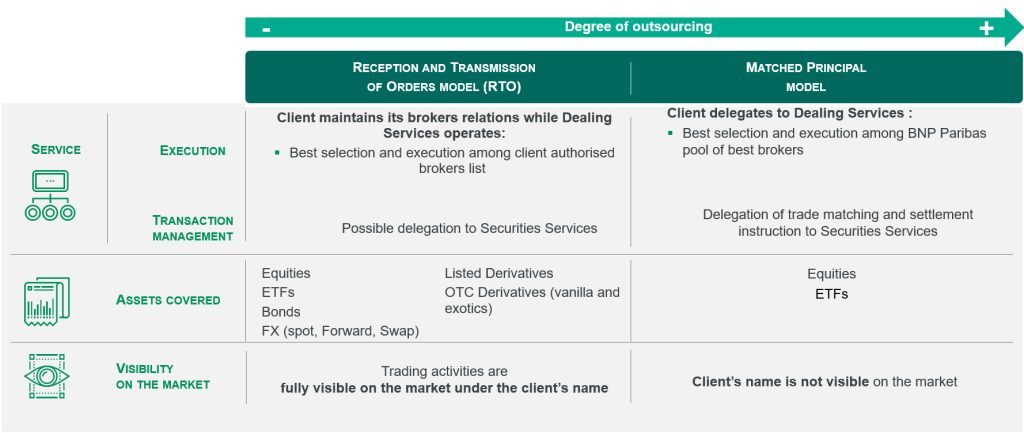

A comprehensive offer for all asset classes through two service models

Depending on your trading objectives and profile of your order book, you may opt for one of the two service models “Reception and Transmission of Orders” and “Matched Principal”, or even a combination of both.

Under the “Reception and Transmission of Orders” model, we deliver, as an agent, best selection and best execution in your name, using your list of authorised counterparties, allowing you to maintain a direct relationship with the market and counterparties (research, primary markets, etc). If needed, Dealing Services solution can be supplemented by our Middle Office outsourcing service for transaction management (matching, settlement instruction).

Under the Matched Principal model, we deliver, as principal, best selection and best execution in our own name (“BNP Paribas on behalf of a third party”), within our own set of brokers, allowing you to benefit from BNP Paribas’ volume and scale in the market. The service encompasses end-to-end execution, from order execution to matching and settlement, regardless of your custodian arrangement.

By joining our outsourced trading services, you benefit from

Flexibility and scalability

Dealing Services is a true plug-and-play solution: clients can quickly plug their own investment infrastructure (ie their Portfolio Management System) into the extensive execution setup of BNP Paribas (ie Dealing Services Order Management System), rather than (re-) build an internal execution setup.

Dealing Services may also be used as co-sourcing rather than outsourcing, ie a partial mandate designed to support an internal execution set up in case of excess volumes or coverage gaps (e.g. cross-border execution mandate).

Cost advantage

Dealing Services offers several cost benefits:

- Mutualisation of infrastructure, technology and staffing costs, relevant for investors who do not have the critical size to run their own setup

- “Pay as you trade” model: turn your fixed costs into variable costs, and benefit from the scalability of our Dealing Services unit

- Cost of operational risk is effectively transferred out

Seamless connectivity

Use your own Portfolio Management System (PMS) or our client portal solution DSLink as a single entry point to a team of senior dealers and latest technologies to improve your execution quality (price, execution promptness, market footprint) and coverage (access to new asset classes and markets).

Regulatory compliance

We provide the assurance of compliance with MIFID Regulation with best execution. We generate a broad set of reports -Trade Cost Analysis (TCA) and Request for Quotes (RFQ) reports, and other execution reports- in order to allow our clients to demonstrate best execution, and efficiently manage their brokers pool (Broker Assessment Process)

Outsourced trading desks: focus on the reception and transmission of orders’ model

We operate in a challenging business context. Costs, risk management and regulatory pressures are challenging the traditional approach to in-house dealing.

Market evolution are forcing a change. Mifid II has increased standards in dealing due to its best execution / best selection policy. In this context of increasing market complexity, fragmentation and regulatory demands, how can you increase performance in your business and attain your objectives.

Buyside companies can outsource to BNP Paribas Securities Services all or part of their dealing desk to achieve better access to liquidity, a strong best execution process and focus on their core business. To increase efficiency, you can delegate your dealing function to BNP Paribas Securities Services and optimize your cost structure, moving from fixed to variable costs.

Whether you are an asset manager, insurance company, pension fund or private bank, you can delegate this function to BNP Paribas Securities Services and benefit from global market coverage across all asset classes and geographies.

Thanks to our broker-neutral model, we will manage your orders strictly within your existing list of counterparties and apply your trading conditions. In addition, you will benefit from full audit trails as well as activity and best execution reports to comply with regulations.

Our integrated and flexible solution will provide you with a single entry point, a team of experienced dealers and a robust dealing infrastructure.

In a complex reality, we help you make your business smarter and simpler, partnering with you in attaining your strategic objectives.

[1] Hong Kong desk is not active in 2023.