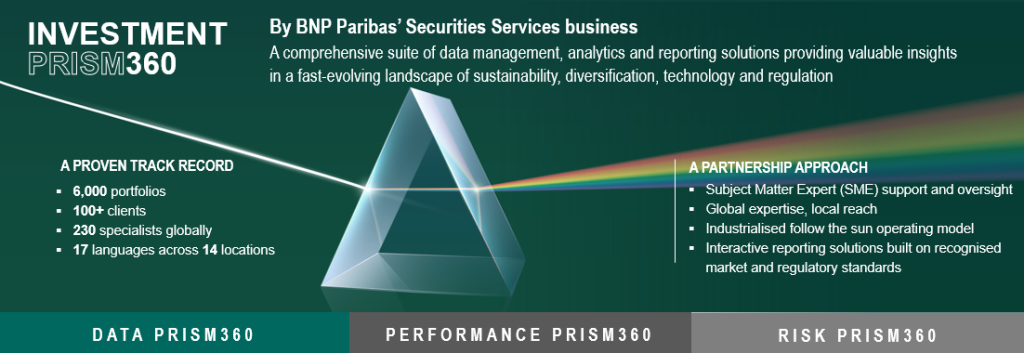

Introducing Investment PRISM360 by BNP Paribas, a newly-launched suite of investment analytics services, spanning data, performance and risk, designed to help institutional investors manage data, evaluate their portfolios’ performance, monitor their risk and meet regulatory reporting obligations across all stages of the investment lifecycle.

Navigating complex data for meaningful investment insights

Institutional investors today face rising complexity: volatile market conditions, shifting regulatory demands, fragmented data and ever-evolving investment strategies.

Investment PRISM360 by BNP Paribas’ Securities Services business is a modular service, that enables institutional investors to manage data quality, assess performance, monitor market and liquidity risk and meet regulatory reporting with confidence. It reflects decades of experience reconfigured under a modern, modular architecture to support investment insight and operational control.

A trusted partner for your analytics journey

Investment PRISM360 by BNP Paribas helps institutional investors build and maintain a high-quality, reliable data foundation, essential for informed investment decision-making.

By combining advanced performance and risk analytics, the platform enables clients to assess investment outcomes with precision, enhance transparency across asset classes and maintain oversight in an increasingly complex investment environment.

With over 230 investment analytics professionals across 14 locations, we provide hands-on expertise, operational continuity and proactive support tailored to your evolving needs.

Data management services

Data PRISM360 by BNP Paribas, launched in December 2024 in collaboration with NeoXam, is a purpose-built investment data management solution. Powered by NeoXam’s scalable Investment Data Solution (IDS) and backed by BNP Paribas expertise, it supports asset owners with complex investment structures and advanced reporting needs. Our teams manage the full data flow from ingestion to delivery: capturing and enriching data, building books of record and powering workflows to support client-defined exposure, ESG, and analytics outputs.

You can see us. Scattered fragments, fleeting visions that fail to outline a clear pattern.

You can hear us, but our story is tangled, our many voices clouded in chatter.

We are data.

What if we could speak as one and converge through a single prism?

Then, we would tell the truth, the whole truth.

Your investments revealed from all angles with crystal clear precision.

What if we were not only stored, but normalised, and fully mastered ?

We would be a source of valuable insights, even foresight.

Opacity turning into transparency, uncertainty giving way to confidence.

This is now a reality.

Data PRISM360 by BNP Paribas is your managed investment data solution:

one platform to support all your downstream analytics and reporting needs.

To help you better assess risks, balance your options, and optimise your allocation of public and private assets.

We deliver custom-built books of records, with a holistic view of your entire portfolio.

Powered by NeoXam’s technology and infrastructure, you can maintain control over your data, in your environment.

BNP Paribas goes beyond data management expertise.

As a global bank, we understand and answer your business needs: an acute vision for empowered decisions.

Data PRISM360 by BNP Paribas, in partnership with NeoXam .

Mastering complexity, enabling clarity.

Read more about our new data management services

- BNP Paribas enhances UniSuper’s post-trade data management through its Data PRISM360 solution, supported by NeoXam – Securities Services

- BNP Paribas’ Securities Services business launches new data management services in partnership with NeoXam – Securities Services

Performance analytics

Performance PRISM360 helps institutional investors assess how their strategies are performing and where returns are being generated, through clear performance, ex post risk and attribution analytics.

It provides bottom-up and top-down insights at each level of an investment structure, making it easier to explain outcomes, compare strategies and meet evolving reporting expectations.

Risk monitoring and Regulatory Reporting

Risk monitoring

Risk PRISM360 by BNP Paribas provides institutional investors a clear view of exposures, liquidity and market risk across any dimension including their investment structure, consolidations, portfolios, asset classes, currencies or geographies.

Through this service, clients can monitor a variety of risk measures including contributions, Value at Risk, stress tests (including climate scenarios), liquidity risk and predictive collateral coverage and UCITs Risk Reporting.

Regulatory Reporting

Risk PRISM360 also includes data inputs for key European regulations – i.e PRIIPs[1] MiFID[2] II, FCA UK regulation CCI[3], AIFMD[4], Solvency II[5] , which include the following reporting: PRIIPs KID[6], Transaction Cost Calculations (TCC) , EMT[7], EPT[8], UCITS KIID[9], and AIFMD Annex IV, UCITS Risk Reporting, Solvency Capital Ratio, TPT[10], etc.

Inputs range from data points to end-to-end regulatory submissions depending on client need.

Additional regulatory reporting is available in other BNP Paribas other product offers (i.e fund administration, custody, middle office, market and financing services…) as well as our award-winning Manaos marketplace platform.

Beyond asset servicing through enhanced analytics and data services

Through our Beyond asset servicing strategy, we work closely with clients to design solutions that are future-ready, outcome-focused and built for long-term value.

This approach underpins the development of Investment PRISM360 – combining robust data infrastructure with practical delivery to support investment decision-making and governance.

Explore the Beyond strategy:

[1] Packaged Retail Investment and Insurance-Based Products

[2] Markets in Financial Instruments Directive

[3] Consumer Composite Investments

[4] Alternative Investment Fund Managers Directive

[5] Solvency II through Manaos, BNP Paribas Group marketplace

[6] Key Information Document

[7] European MiFID Template

[8] European PRIIPs Template

[9] Key Investor Information Document

[10] Tripartite Template

To read more on analytics and data services

Let’s get in touch