For asset managers and asset owners, the goal has always been to deliver returns with appropriate level of risk. The increasing frequency of natural disasters linked to global warming are increasing climate transition and physical risk factors in financial markets. Climate risk has emerged as an important new risk factor when making investment decisions.

Embedding climate risk in investment decisions is ever more crucial

Climate risk can impact financial markets in many ways: depressed valuation for high-emission industries, emergence of disruptive new green technologies, new regulations causing stranded assets, increase of natural disasters.

Analysing climate risk requires thinking beyond traditional market risk measures because climate change is without precedent, will play out over many years and will depend on the actual trajectory of transition and physical risk factors.

European regulator initiatives in climate stress testing

Europe has been at the forefront with European regulatory initiatives on climate stress testing:

- The pioneering 2022 climate stress test was performed by European and Insurance and Occupational Pensions Authority (EIOPA) on pension funds across Europe, with almost 200 firms participating (Read more: Climate stress test for the occupational pensions sector 2022 – European Union (europa.eu)). This stress test defined granular shocks across industries, asset classes and geographies and it was based on the NGFS’ disorderly transition scenario.

- In May 2024 French Prudential Supervision and Resolution Authority (ACPR) published the results of its second climate stress test for Insurance companies (the first pilot exercise was performed in 2020). This stress test combined both transition and physical risks, included two long term and one short term scenarios, and involved fifteen insurance groups in France. This stress test showed that insurers are significantly exposed with consequences for both balance sheet and policy holders.

- In November 2024, European Supervisory Authorities jointly published results of the ‘Fit for 55’ Climate Stress Test for financial sector in Europe. ‘Fit for 55’ relates to the EU commitment to reduce emissions by 55% by 2030 (Completion of key ‘Fit for 55′ legislation) and this stress test was performed to assess the impact on the stability of financial sector in European Union. This climate stress test goes beyond the EIOPA 2022 exercise by providing three scenarios that give the range of potential market reactions to transition plans in Europe:

- Baseline – assumes orderly transition in line with ‘Fit for 55’ package and baseline economic forecasts (“smooth green transition”)

- Adverse 1 – focuses on negative market reaction due to reassessment of transition risk (known as the ‘run on the brown’)

- Adverse 2 – amplifies transition risks of Adverse 1 scenario by adding additional non-climate related stress factors, such as deteriorating macroeconomic and financial conditions

Climate Stress Test and scenarios for our financial institutions clients

The impact of Fit for 55 climate stress test on investment assets

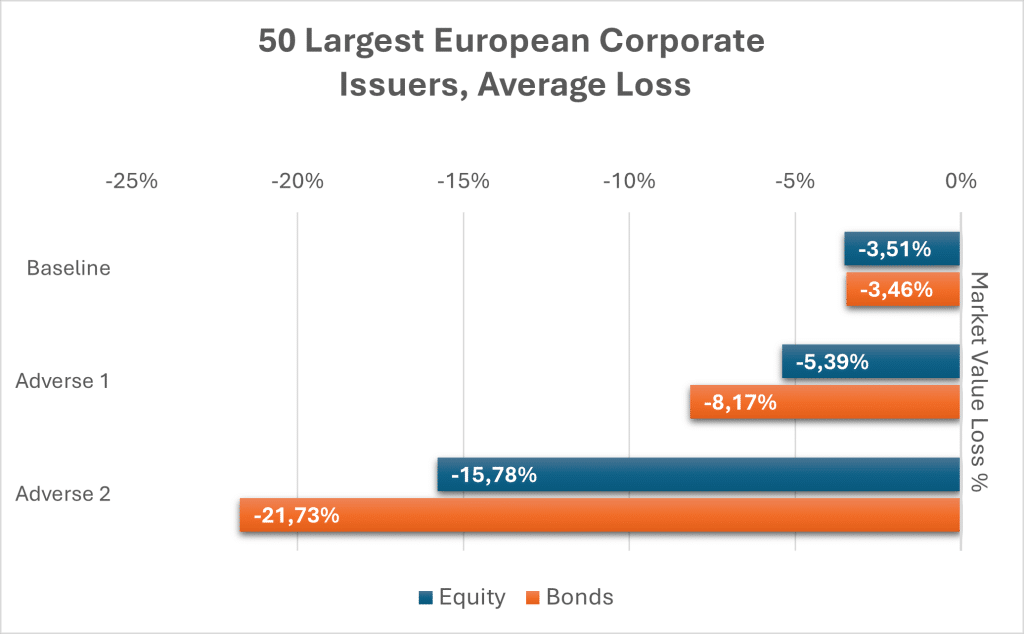

To illustrate the potential impact of the Fit for 55 scenario on investment assets we have stress tested the basket of the 50 largest publicly traded European companies for both equity and their corporate bonds based on ‘Fit for 55’ scenario specifications[1]:

[1] Equal weighted basket of equities and corporate bonds by 50 largest European issuers. Bonds chosen with 5-10 year maturity. The stress test was limited to first round losses only.

Some important observations can be made from this stress test:

- Whether it is equities or fixed income, most asset classes are negatively impacted across all three scenarios. Even in the baseline scenario there is a small loss which reflects the scenario narrative that there will be unavoidable costs in transition to a low emission economy.

- While some economic sectors in the scenario definition fare much worse than others, this test reveals that the losses approximately double from baseline to adverse 1 scenario (‘Run on the Brown’) and almost tripled in adverse 2 scenario for institutional investors holding diversified portfolios. This highlights the risk of ‘snowballing effect’ losses in the event of a disorderly transition.

2024 marked an upheaval year on the climate front:

- Reaching net zero is essential to halt global warming. However a number of large North American financial institutions have quit climate initiatives. According to the recent survey of 250 climate experts by Inevitable Policy Response (IPR) the world is going to achieve only 80% of emission reductions by 2050.

- Meanwhile the global temperatures continue inexorably going up with 2024 the hottest year on record. According to World Meteorological Organization (WMO) 2024 was also the first year that the average temperatures exceeded 1.5 degrees above pre-industrial level. The number and frequency of natural disasters attributable to climate change have increased too.

- As a result the new forecast by IPR expects the global average temperatures to rise by 2% by 2100 with 2/3 probability.

Even if we are still on track to limit temperature increase to 2 degrees, any further delays in curbing emissions and the increasing frequency of natural disasters attributable to climate change will likely force stronger action on curbing emissions. For investors it means that the odds of disorderly scenario where policy makers attempt to drastically cut emissions in short period of time have increased.

Our solutions in climate stress testing

Securities Services can assist institutional clients to assess climate risk. Our stress test solutions are an extension of our risk analytics offer and we can perform them based on either ‘Fit for 55’ or EIOPA’s 2022 climate stress test specifications.

These stress tests can support asset managers in understanding the climate risk within their portfolio in multiple ways:

- Quantify the overall impact on the portfolio(s)

- Quantify the impact by asset class

- Assess exposure to sensitive sectors

The climate stress test can be conducted at regular intervals to track the results over time.

At Securities Services, we are actively monitoring the developments in the climate space and will be implementing new stress test scenarios that rely on regulatory frameworks.

The climate stress test is just one of the solutions we have developed to help our clients with their low-carbon strategy. We are constantly incorporating new regulations and information about climate risk into our analytics solutions; it is our commitment to accompany our clients on their transition journey to a low-carbon future.