Will digital assets transform financial markets, or be a much-hyped sideshow? Some commentators suggest that tokenised assets could expand investor access to markets, improve liquidity and enhance price discovery. As often described by the market, distributed ledger technologies (DLTs) (such as blockchains) and embedded smart contracts may also offer the prospect of faster, cheaper trading and settlement. Despite these potential benefits, the road from concept to real-world application of such technologies has so far often been rocky, but are we now reaching an inflection point?

A difficult 2023 for DLT

After more than a decade of fevered excitement around digital assets and the transformative potential of the underlying distributed ledger technology, 2023 marked a return down to earth.

Following the “crypto winter” of 2022 – which saw the prices of well-known cryptocurrencies (such as Bitcoin and Ethereum) more than halve and cryptocurrency exchange FTX collapse amid gross mismanagement and fraud allegations – the sector’s fluctuating fortunes continued through 2023. In March 2023, a Commodity Futures Trading Commission lawsuit charged cryptocurrency exchange Binance with evading US law and breaching derivatives rules. The US Securities and Exchange Commission hit Binance and rival trading platform Coinbase with its own suits in June[1]. Binance subsequently pleaded guilty to federal charges on 21 November 2023, admitting it engaged in money laundering and sanctions violations and would pay USD 4.3 billion in fines[2].

Expectations for DLT projects and their potential ability to revolutionise the way the industry works have also cooled. Australia Securities Exchange’s decision to abandon[3] its anticipated upgrade of the Clearing House Electronic Subregister System (CHESS) with a DLT replacement intended to accelerate settlement times and reduce costs was emblematic of the shift in ambition.

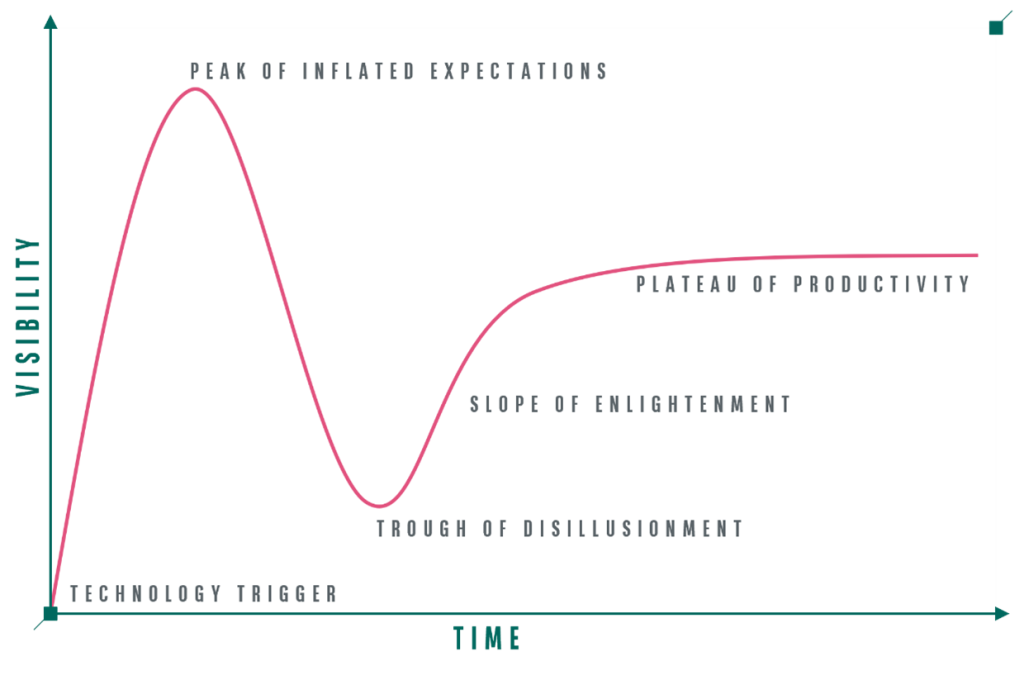

Yet while sentiment has been tempered, last year saw progress on several important tracks through a more measured and step-by-step approach. The trends for the space have shared a resemblance to the Gartner’s Hype Cycle as of late, with the industry likely now reaching a sort of “slope of enlightenment” after having gone through rather disappointing outcomes (even though it doesn’t mean that the trend will continue to follow the course of the Gartner’s Hype Cycle – let’s wait and see).

The Gartner Hype Cycle:

Source: Gartner Hype Cycle Research Methodology | Gartner

One positive to come out of the various bankruptcies, platform woes and initiative collapses is the heightened awareness of the risks involved and need for more regulatory engagement. Many jurisdictions (including, but not limited to, Hong Kong, Japan, Singapore, the United Arab Emirates and the United Kingdom) have published new regulatory and supervisory texts on digital assets related topics, and more are working on them.

In Europe, part of the Markets in Crypto-Assets Regulation (MiCA) entered into force on 30 June 2024 (titles relating to e-money tokens and asset-referenced tokens – so-called stablecoins), with the rest entering into force on 30 December 2024, bringing uniform EU rules for crypto-assets not currently regulated by existing financial services legislation. The EU’s DLT Pilot Regime regulation, which entered into force on 23 March 2023, provides the legal framework for trading and settlement of crypto-assets that qualify as financial instruments under MiFID II, while facilitating the set-up of new types of regulated multilateral trading facility (DLT MTF), settlement system (DLT SS), and trading and settlement system (DLT TSS) infrastructures.

Security tokenisation – the process of issuing a digital representation of a traditional asset such as real estate or equities/bonds on a blockchain to enable asset fractionalisation, and boost liquidity and transparency – has also continued apace.

In January 2023, for example, the European Investment Bank used a combination of private and public blockchains to raise GBP 50 million in its first ever sterling-denominated digital bond, having issued its first digital bond in 2021. Alternatives investment firm Hamilton Lane made a portion of its private markets Equity Opportunities Fund V accessible to individual investors through a tokenised feeder fund, with the minimum investment of USD 20,000 a fraction of the average USD 5 million required to access the traditional version.[4]

Central bank digital currency (CBDC) projects have likewise gathered steam. Some 130 countries are now exploring a CBDC, with half in an advanced phase of development, pilot or launch. The European Central Bank (ECB), in collaboration with Banque de France, Deutsche Bundesbank and the Bank of Italy, is making progress on its exploration of wholesale solutions to settle tokenised instruments between financial intermediaries[5]. Experiments and trials with market participants have taken place throughout 2024.

Looking at 2024 and beyond

During 2024 and beyond, the use and adoption of digital assets may pick up pace, while DLT ambitions may mature as market participants are likely to focus on projects with more limited scope but workable, real-world applications. Many of the use cases and benefits remain relatively theoretical at this stage, so continued exploration and testing will be a priority.

Rather than the ‘Big Bang’ blockchain projects that aimed to reshape the entire transaction chain, emphasis is shifting to progressive, incremental initiatives and experimentations that target defined areas such as primary distribution, secondary markets, repo, collateral and coupon payments. It is anticipated that platform interoperability will eventually expand as organisations work together and link blockchains. Cross-industry collaboration and multi-party consortiums will likely come to the fore to drive larger project experimentations, in place of the discrete, individual programmes that have characterised much of the activity to date. Legal, technical and market practice standardisation may also possibly take root across the market to combat fragmentation and as the regulatory environment takes shape.

CBDC cross-border collaboration

In the digital assets space, existing wholesale CBDC experiments are going to accelerate, while new ones will launch – with almost 70% of central bank respondents to independent think tank OMFIF’s 2023 Future of Payments survey expecting to issue a CBDC within the next decade.[6]

To date, national central banks have primarily explored CBDC use cases within their domestic markets. That is changing. Cross-border payments are critical to capital market efficiency. The onus therefore is shifting to cross-CBDC experimentations as central banks from different regions collaborate to address the lack of harmonisation and interoperability in today’s fragmented digital asset landscape. Pursuing these international collaborations is an opportunity for market participants to create interoperable solutions while the industry is still in its infancy, instead of trying to fix chokepoints down the road.

The Bank for International Settlements (BIS) is spearheading a number of these proof-of-concept initiatives. For example, Project Mariana – a joint project between the BIS Innovation Hub, Bank of France, Swiss National Bank and Monetary Authority of Singapore – has successfully tested the cross-border trading and settlement of hypothetical euro, Singapore dollar and Swiss franc wholesale CBDCs between simulated financial institutions on a public blockchain.[7] Another notable initiative from BIS to watch is project Agorá, which will investigate “how tokenised commercial bank deposits can be seamlessly integrated with tokenised wholesale bank money in a public-private programmable core financial platform”[8]. BNP Paribas has been selected to participate to project Agorá with 40 other private firms and 7 central banks[9].

The ECB’s wholesale Central Bank Money (CeBM) programme has been a particular focus throughout the year, with two waves of experimentation and trials. The aim is for market participants to test the three settlement solutions available at present from the Banque de France, Bank of Italy and Deutsche Bundesbank. Following the programme, the ECB will collect information on the solutions to determine which – in part or whole – would work best for a potential future solution to settle tokenised assets between financial institutions at the European level.

Security token experimentation landscape expansion

The EU’s DLT Pilot Regime regulation will be another focal point for 2024 and beyond. Previous industry efforts have predominantly centred on tokenising unlisted instruments, where blockchains may offer the most immediate benefits. The Pilot Regime sandbox gives market participants and infrastructure providers an opportunity to explore listed security tokens in a regulated framework. The emergence of DLT market infrastructures in the frame of the EU DLT pilot regime would foster broader industry involvement and collaboration, and enable experimentation on a wider scale. It would also allow European regulators to gather information they may be able to use to adapt current regulations in the most appropriate way.

Under the EU Pilot Regime regulation, both existing regulated market infrastructures (such as trading venues, central securities depositories and central counterparties), and entities that are new entrants, can apply for a specific status to operate a DLT market infrastructure. This regime consists of making these DLT market infrastructures exempt from specific requirements under the existing market infrastructures’ Union laws. One innovative feature within the regime is the DLT TSS status, which authorises entities to combine trading and settlement activities on a DLT platform, provided that certain specific conditions are met. Security tokens so far have enabled investors to invest at the primary market level, but without a liquid secondary market it is hard today to transfer them. A DLT TSS infrastructure that the wider market ecosystem can connect to could promote development of a secondary market and unlock additional activity. The UK financial market infrastructures (FMI) sandbox – the Digital Securities Sandbox – has been similarly set up to test and adopt developing technologies and FMI practices, including but not limited to DLTs.[10]

Digital Assets ecosystem interoperability

Past initiatives primarily took place within individual organisations or among small groups to test ideas and gain expertise. The next step would be to create a broader ecosystem, with the sector eventually reaching the critical mass of connected participants that is likely needed to realise the full benefits blockchains offer.

The ECB trials, EU DLT Pilot Regime and other industry wide projects (e.g. Agorá) seem to be part of a shift towards deeper industry collaboration, and the creation of common market practices and standards. Enhancing interoperability to resolve the fragmentation that currently plagues the digital assets space is another area demanding attention.

Tokenised assets at present are managed across a range of blockchains. Initiatives are now making headway on resolving these fragmentation issues, with two examples being the initiatives led by Swift and Digital Asset.

Rather than market participants needing to develop the connectivity to different blockchains individually, the Swift global messaging platform has conducted experiments that use its existing infrastructure – which is already used by a large number of organisations – as a single point of access to multiple networks. By allowing the transfer of tokenised value across multiple public and private blockchains, Swift says it can help “remove significant friction slowing the growth of tokenised asset markets and enable them to scale globally as they mature.”[11]

Digital Asset is similarly exploring how its Canton Network could drive interoperability. The Canton Network is a privacy-enabled, blockchain-based “network of networks” that allows previously siloed financial systems to connect, and for institutional assets, data and cash to synchronise across applications.[12] For example, a digital bond and digital payment on two separate applications can be composed into a single atomic transaction to enable simultaneous delivery versus payment (DvP) exchange. The Canton TestNet environment to test the infrastructure was released last year, with its MainNet version rolling out in 2024.

Interoperability between the traditional and digital assets worlds to create a more integrated, holistic environment is another area requiring investigation. Issuing a financial instrument in tokenised form may bring valuable efficiencies at the primary market level, and may improve investor access to different asset types, including real estate, private equity and private debt. But with subsequent trading opportunities and liquidity availability limited, the ability for tokenised instruments to easily switch back to traditional formats could potentially help promote secondary market activity and broader digital asset take up.

Navigating change with BNP Paribas

The digital assets landscape is evolving, and the coming year promises to bring substantial additional industry- and supervisory-led change. Our Securities Services business will be engaged with these initiatives as we continue to collaborate with market counterparts, industry bodies, authorities and clients. We are for instance a very active participant in the ECB’s CeBM programme, testing the three solutions available across various roles and use cases.

We will continue to support interest from our clients in exploring the possibilities of Blockchain/DLT technology in financial services and engage in live experiments with them, focusing on seamless integration across traditional and digital assets to minimise the complexity and the impacts on our clients’ operating model.

Along with our external collaboration efforts, internally we are partnering closely with entities across the BNP Paribas Group to trial an integrated digital assets model spanning the whole value chain, from origination to distribution to custody. Workstreams include programmes to tokenise fund shares and DvP settlement of digital bonds against digital cash. Our aim going forward is to continue opening these initiatives up to external issuers, investors and industry peers to see how together we can experiment to improve the digital asset ecosystem.

[1] Source: U.S. Securities and Exchange Commission, 6 June 2023

[2] Source: U.S. Department of Justice, Office of Public Affairs, 21 November 2023

[3] Source: ASX, 17 November 2022

[4] Source: Hamilton Lane’s $2.1 Billion Flagship Direct Equity Fund Now Available for Investment on Securitize, Hamilton Lane, 31 January 2023

[5] Source: Exploratory work on new technologies for wholesale central bank money settlement, European Central Bank, 28 June 2023

[6] Source: CBDC success depends on public and private sector collaboration, OMFIF, 2 February 2024

[7] Source: BIS Innovation Hub work on central bank digital currency, Bank for International Settlements

[8] Source: Project Agorá moves to next phase and opens up call for private sector participation, Bank for International Settlements, 14 May 2024

[9] Source: Project Agora: participating private sector institutions, Bank for International Settlements, 09 October 2024

[10] Source: The Digital Securities Sandbox, HM Treasury, July 2023

11] Source: Swift unlocks potential of tokenisation with successful blockchain experiments, Swift, 31 August 2023,

[12] Source: New Global Blockchain Network of Networks for Financial Market Participants and Institutional Assets, Digital Asset, 9 May 2023,