Guiding Light: How leading investors drive sustainable change

Sustainability is not just about the environment, it’s about our collective future.

Ban Ki-moon, former United Nations Secretary-General

The world of sustainable investment is facing both accelerating momentum and challenges to its progress. In this context, the role of more advanced investors in ESG and sustainable investing, named “pacesetters” hereafter, takes on an even greater significance. Understanding how more advanced investors address sustainable investment, in terms of their approaches, priorities and behaviours can offer a blueprint for others setting out on a transition path.

This study shows that for pacesetters, sustainable investment is a strategic advantage, not just a risk mitigation tool. Despite challenges, the pacesetters remain committed to putting ESG and sustainability at the core of their investment approach.

Their appetite is likely driven in part by shifting market dynamics as the competitiveness of renewables increases and the cost of batteries and electric vehicles falls. As a result, investors, especially those on the front lines of sustainability, are focused on how to generate alpha from these growing areas.

The results highlight that investors who want to lead on ESG/sustainability should invest in data, expertise and partnerships to distinguish themselves. We can also see that these leading investors prioritise portfolio decarbonisation and the energy transition, social issues and biodiversity within their investment strategies.

Further, it is worth noting that though larger firms benefit from having deep, fully resourced thematic teams, smaller firms could still emerge as leaders; by focusing deeply on one or two thematics and building a differentiating factor through their specialisation.

In this survey, we will examine what makes a leader in ESG and sustainable investing, exploring their distinguishing characteristics, map their key behaviours and set out a path for other investors to follow in their progress.

1. What makes a pacesetter?

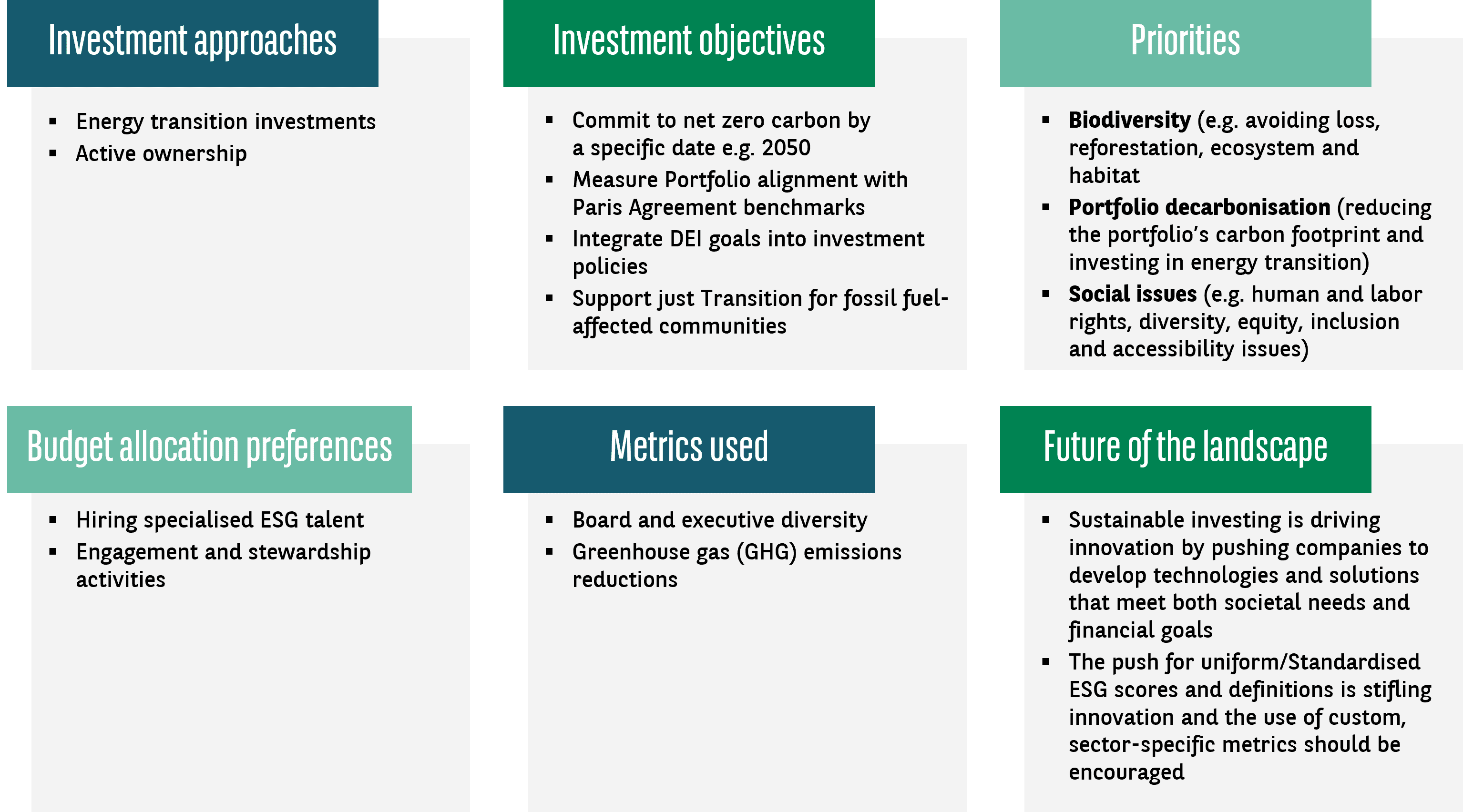

We selected 15 key characteristics, beliefs and behaviours which define pacesetters in ESG. This framework formed the foundation of a scoring system which was then used to classify the investors into three groups – pacesetters, steady performers and followers.

The image above shows the characteristics underlying the investor categorisation, with each one representing a point. Those scoring more than 10 are pacesetters, while the steady performers scored between 7 and 10. Those who score below 7 are Followers.

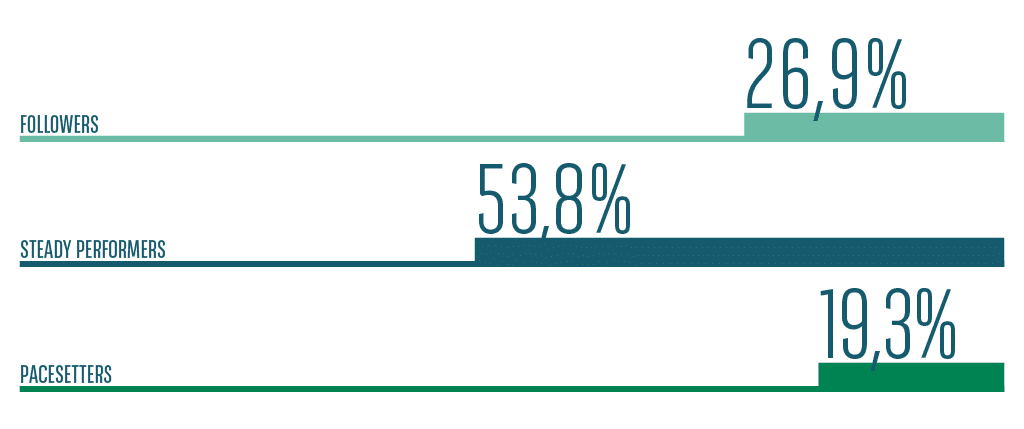

Chart 1: Investors split

2. How are pacesetters different?

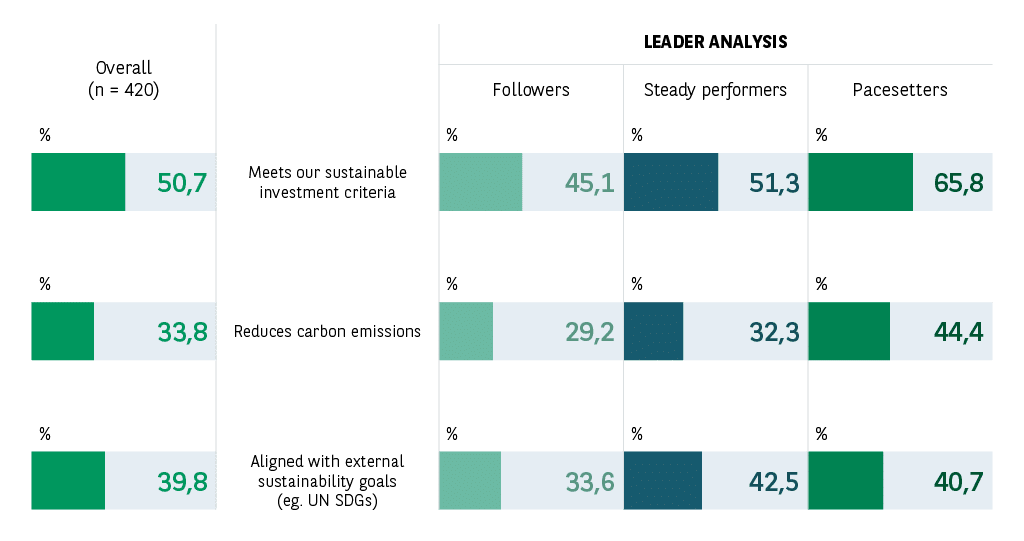

Institutional investors’ definition of what constitutes a sustainable investment remains subjective as, overall, most are concerned with ensuring assets meet their organisations’ investment criteria.

While the majority consider a sustainable investment as one which aligns with their investment criteria, pacesetters strive for their sustainable investments to be backed by quantifiable results and measurable impacts e.g. carbon reduction.

In this, they are unique as this belief is a statistically significant difference between the pacesetters and the other two groups (44% versus 32% and 29%). They show this distinction is not just a preference but signals a broader impetus towards Leadership. This group further reinforces their strategies in sustainability through other demonstrable actions; they are more likely to make use of ‘energy transition investments’ (67% versus 53% and 39%) and to engage in ‘active ownership’ (51% versus 45% and 29%). These behaviours further underscore why they are at the forefront of sustainable investing, pulling ahead of their peers.

Reporting on carbon emissions is also more prevalent among pacesetters (60% versus 44% and 27%), as is promoting social issues (53% versus 42% and 24%) and prioritising biodiversity (95% versus 79% and 50%), portfolio decarbonisation (95% versus 79% and 50%) and social issues (94% versus 77% and 44%).

Having a clear strategy allows you to demonstrate your goals more easily.

Global Head of Sustainability, renewable energy fund manager, Spain

3. Data in the driving seat

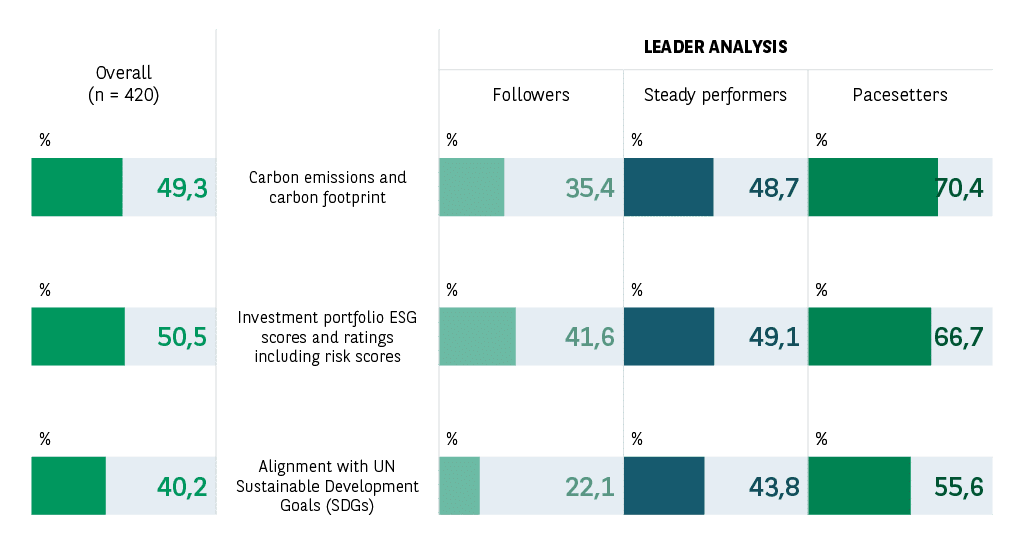

Pacesetters’ 360° approach to sustainability can also be demonstrated by their reliance on a wider set of ESG metrics to monitor and measure progress. The following chart shows how on average, this group makes use of five of the metrics under review, compared to three for the steady performers and two for the followers.

Given their focus on carbon reduction, pacesetters track their investments’ emissions, carbon footprint, energy consumption and efficiency and GHG reductions. These foundational metrics support their increasing focus on energy transition assets. On social aspects, they tend to monitor indicators related to workforce and governance, ensuring equal opportunities and fair representation at different organisational levels.

Furthermore, pacesetters show a higher propensity to conduct their own research methodologies, such as creating benchmarks or in-house ESG scores, to tackle data challenges related to ESG/sustainability (65% versus 50% and 30%).

We tend to call out companies that are not doing the social dimension well. What we need to do is pull out companies, show them the way, and make sure that we follow through with engagement.

Head of ESG Development and Advocacy Special Operation, fund manager, France

Ultimately, pacesetters’ broader approach to tracking ESG metrics equips them to refine sustainable investing strategies, identifying what works and adjusting where necessary.

4. Building and maintaining expertise

For pacesetters in ESG and sustainable investing, it is vital to build and maintain knowledge and expertise. So, it is not surprising that members of the leader group indicate they have increased headcount of ESG/sustainability experts in the past three years in areas such as ‘risk management’ (62%), ‘portfolio management’ (56%) and ‘regulatory and voluntary ESG reporting’ (53%).

The best way to ensure long-term resilience in sustainability is having the right people in the right positions and the right governance structure.

Head of Investment Sustainability Solutions, asset manager, The UK

Continued support of ESG expertise is also seen in their intention to allocate more budget in relation to their sustainable investment strategy to hire specialised ESG talent (63%). In addition, the pacesetters also plan to add resources to ESG data acquisition and analysis and to reporting, impact measurement and disclosure, as part of their sustainable investment strategies.

For asset managers, possessing ESG and sustainability expertise is now expected by most asset owners. The continued investment in this expertise by pacesetters suggests it is now a well-integrated part of their overall approach – even as the topic continues to spark differing views across regions.

Leaders have many distinct ESG teams that deal with different issues, and this distinguishes them as leaders.

Head of ESG investment integration, Insurer, Italy

5. Leveraging strategic partnerships

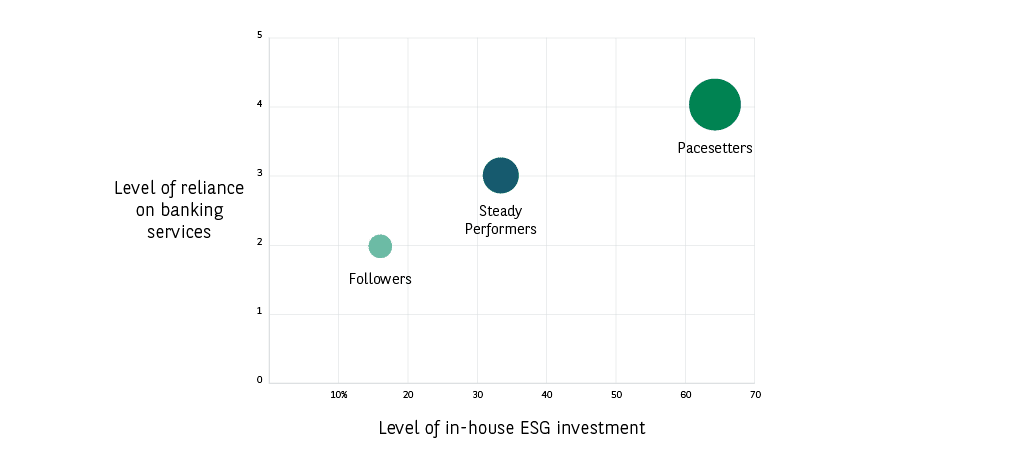

This rise in internal expertise among pacesetters works in tandem with their greater need for external support as they are making broader use of services from banking partners.

While building their in-house talent, these investors are becoming more aware of the gaps in their knowledge, turning to their partners for support on a wider set of issues. When choosing an external banking service partner, the pacesetters are more likely to look at brand reputation on ESG/sustainability and also a collaborative approach. By sharpening their in-house capabilities, the pacesetters are more likely to look at brand reputation on ESG/sustainability and also a collaborative approach.

Chart 4: Support needs rise alongside growing in-house expertise

By sharpening their in-house capabilities, the pacesetters’ approach to sustainability is more integrated and they are highly cognisant of the areas in which they require external support.

The dynamic combination of in-house talent and reliable external support can be said to enhance pacesetters’ ability to make a tangible impact through their sustainable investment strategy.

We have a fully outsourced model, so rely very heavily on external providers. We highly value firms prepared to partner with us, particularly around engagement, data sharing and framework development.

Legal officer, Fund manager, the Netherlands

6. Making Connections: The metrics adoption gap

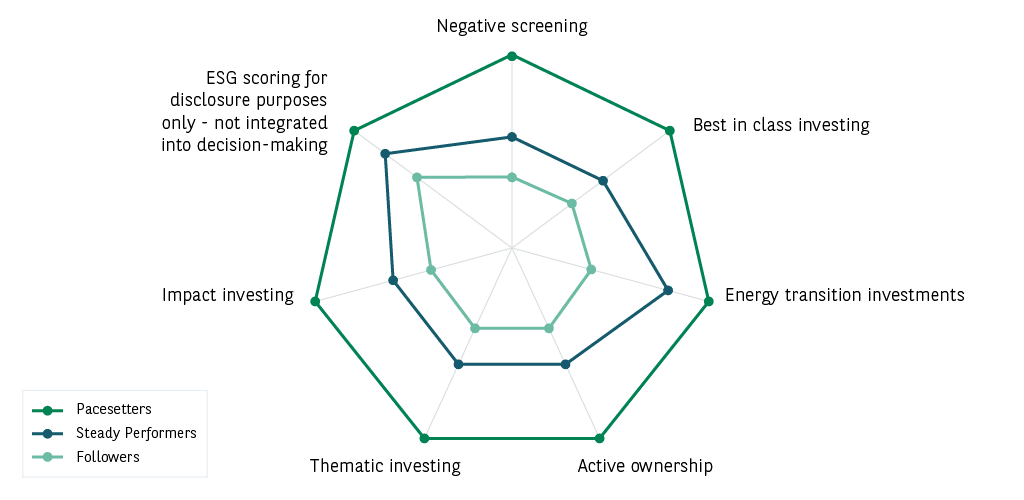

Data shows that pacesetters use a greater number of ESG investing approaches and track a larger number of metrics, a fact which distinguishes them from the other two groups under review.

Biodiversity, equity, and climate perspectives are interconnected…. If you have a narrow lens, you could be invested in a company that has a large negative impact on local communities, on the social side, or on biodiversity, leading to reputational and financial risk.

Head of Investment Sustainability Solutions, asset manager, The UK

Chart 5: Broader use of sustainable investing approaches by pacesetters

These results show the pacesetters are providing evidence of their more in-depth management of ESG and sustainable investing. In conjunction with their other defining characteristics, namely their greater focus on reducing carbon emissions, biodiversity and promoting social issues, we can conclude that having a multi-faceted, interconnected approach to ESG is a marker of Leadership.

In conjunction with their other defining characteristics, namely their greater focus on reducing carbon emissions, biodiversity and promoting social issues, we can conclude that having a multi-faceted, interconnected approach to ESG is a marker of Leadership.

I am seeing a shift away from the pure focus on climate which is telling us we need to think about sustainability more broadly… climate is coming down a little and the social and governance elements are rising.

Legal officer, fund manager, the Netherlands

7. Path to becoming a pacesetter

Followers have a steady base in their approach to sustainable investing. As seen earlier they have foundational beliefs they can build on. Steady performers are closer to the Leader group in terms of their maturity. Given they represent the bulk of institutional investors, they have strong potential for growth and progress.

Progression along the ESG maturity spectrum requires investing in:

- Multi-faceted strategies

- More strategic partnerships

- Greater commitment to impact measurement and data tracking

Followers can:

- Increase the number of ESG/sustainability metrics they use.

- Expand their banking partnerships for ESG expertise.

Steady performers can:

- Incorporate more thematic approaches to broaden their scope of asset allocation, while analysing relative performance and impact.

- Increase reliance on external ESG financial services.