We are proud to share that the leading financial sector publication Euromoney has named BNP Paribas World’s Best Bank for Securities Services, alongside World’s Best Bank for Financial Inclusion and a further 11 regional and countries accolades, in its Awards for Excellence 2024.

For over 30 years, Euromoney has recognised the banks and bankers that have demonstrated their differentiation, pioneering a comprehensive awards programme that today remains the industry benchmark globally. In its editorial below, Euromoney provides some insight into our recognition as a global leader in securities services.

We would like to extend our gratitude to our clients for their continuing trust and partnership, as we remain committed to the development of our offering worldwide.

The world’s best bank for securities services: BNP Paribas

The French bank has made steady progress in this business over the last decade and last year was a strong period of new mandates and client expansion.

Securities services, the stable business that banks love for how it counteracts the volatility of their investment banking units, is even more valuable in a high interest rate environment, particularly for US firms. But for its commitment over the much longer term, BNP Paribas is our pick this year as the world’s best bank for securities services.

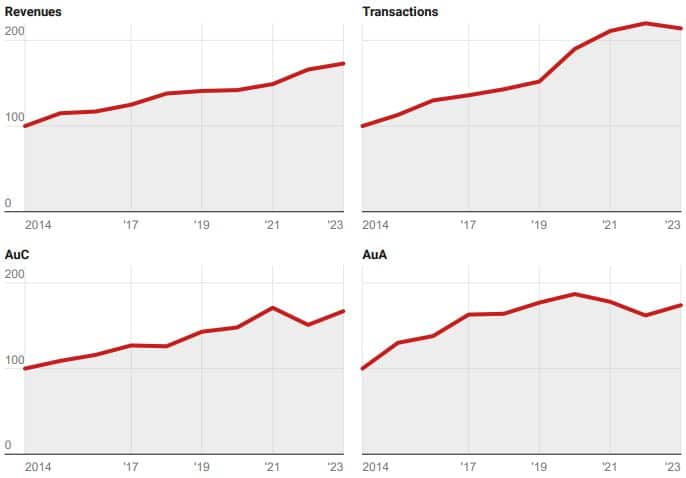

Revenues at BNPP’s securities services division rose 4% in 2023 to €2.7 billion, a new high for the business. It has seen a steady progression over the last 10 years, with revenues nearly doubling over that time. Assets under custody rose 11% in 2023, to €12.4 billion.

Securities services, the stable business that banks love for how it counteracts the volatility of their investment banking units, is even more valuable in a high interest rate environment, particularly for US firms. But for its commitment over the much longer term, BNP Paribas is our pick this year as the world’s best bank for securities services.

BNP Paribas’ Securities Services delegation[1] at Euromoney’s Awards for Excellence 2024 ceremony.

Revenues at BNPP’s securities services division rose 4% in 2023 to €2.7 billion, a new high for the business. It has seen a steady progression over the last 10 years, with revenues nearly doubling over that time. Assets under custody rose 11% in 2023, to €12.4 billion.

For BNPP, it has been a particularly strong period for new mandates. These included triparty collateral management services for the global trading activity of UniSuper, one of the biggest superannuation funds in Australia, building on the bank’s existing custody services work for the fund.

A big selling point for that mandate was the efficiencies possible from using BNPP for other services – UniSuper cited the appeal of combining the roles of custodian, collateral manager and a securities lending agent in one institution, as well as the potential to access trading services and liquidity from the bank if needed.

The bank was also selected by the German government and KfW Capital, the venture capital investing arm of Germany’s state-owned development bank, to provide depositary and global custody services for the €1 billion Growth Fund Germany, a fund of funds that invests in European VC funds. KfW cited BNPP’s special expertise in private capital assets when announcing the mandate.

In Latin America, meanwhile, the bank was appointed as agent lender to the $1.3 billion portfolio of regional development bank Corporación Andina de Fomento (CAF), giving the institution access to more than 100 counterparties through BNPP and increasing the revenues they can generate from the portfolio.

The business mix of BNPPs securities services is a little different to many other players in the industry, with a more diversified spread of client segments across the buy and sell sides. Its annual revenues are split roughly equally between asset managers, asset owners and sell-side firms.

Patrick Colle, head of securities services and chairman of financial institutions coverage at BNPP, notes that in an uncertain environment, clients are increasingly demanding that their securities services bank be a partner rather than simply a provider.

“I see clients asking more and more for combined or integrated solutions, not just custody on a standalone basis, for instance,” says Colle. “And it’s more than the usual bundles of custody and financing. A very relevant example at the moment – because it helps with T+1 settlement – is integrated electronic execution and settlement, where the client trades and then we take care of the whole chain of instructions through to settlement.”

Doing that obviously shortens the processing cycle, very helpful given the T+1 settlement environment that now exists for securities trading in the US market, introduced on May 28, 2024. But the broader trend to bundled solutions and a partnership approach was already coming to the fore in 2023.

“We see clients engaging with this like never before,” says Colle. “But for this to be successful, you need three things. You need a large and diverse global footprint to be able to accompany them across markets. You have to have the right mindset, and the underpinning of everything that we do at BNP Paribas is that we are a relationship bank.

“And the third thing – where I think we are probably better than anyone in the world – is that you need a long-term view and commitment. We are the anti ‘stop-and-go’ firm.”

BNP Paribas Securities Services

10-year metrics, indexed (2014=100)

Chart: Euromoney Source: BNP Paribas earnings reports Created with Datawrapper

This has been a longstanding message in all areas of the bank, which over the years has often celebrated its cautious decision-making, followed by a definitive decades-long commitment once a decision has been reached.

Securities services is one franchise where this is particularly important, particularly since generating a return on investment might well take at least 10 years. Colle, who has been running the unit for 15 years, thinks that kind of commitment is what has allowed it to have double-digit growth every year in the Asia-Pacific securities services business, for instance.

BNPP offers local custody in 27 markets, and the bank’s global custody scope covers 100 markets, so expanding the geographical footprint is not a priority at the moment. But it is trying to add more depth to its solutions for clients, and is pushing strongly with its biggest customers to appoint the bank in additional markets.

I see clients asking more and more for combined or integrated solutions, not just custody on a standalone basis

Patrick Colle, Head of Securities Services & Chairman of Financial Institutions Coverage

Every two years, the bank surveys hundreds of its securities services clients, and in the latest has reached for the first time an average rating of above 4 out of 5.

“We have a very quality-conducive operating model,” adds Colle. “We also always have two primary servicing sites for a client – one of our three international operating centres of excellence, plus a local service centre, so that every client is covered both locally and globally.”

A North American client would be covered out of the bank’s main US service centre outside Philadelphia but also its European hub in Lisbon, giving BNPP a 17-hour service period. Again, the shift to T+1 in the US makes this all the more important.

The client expansion efforts in 2023 and earlier are paying off. At the start of 2024, BNPP was mandated by Indeval, the Mexican Central Securities Depository, to be its local custodian in the US market, for some $60 billion of assets. The appointment followed a competitive process that saw the mandate switch from Citi.

A globally recognised custodian

This esteemed distinction caps off a streak of over 20 awards won by Securities Services so far in 2024 across regions, including Best Provider as Rated by Global Custodians – Emerging Markets (Global Custodian), Best Custodian Bank in Western Europe (Global Finance), and Best ESG Custodian (The Asset). This recognition from far and wide bears witness to the relevance of our multi-local, integrated bank strategy, and long-term approach to trusted relationships.

[1] From left to right:

- Mohamed Charrak, Senior Sales Manager, Securities Services Germany, BNP Paribas

- Lucille Weber, Global Head of Marketing, Communications & Client Insight, Securities Services, BNP Paribas

- Patrick Colle, Global Head of Securities Services and Chairman Financial Institutions Coverage

- Ewa Skała, Head of Private Capital, Securities Services Poland, BNP Paribas

- Laurent Libiszewski, Global Head of Sell-Side Custody Solutions & Debt Solutions, Securities Services, BNP Paribas