Asset managers want more than just today’s services. You need a committed partner that looks beyond current needs and invests in future growth. For over 25 years, asset managers have chosen us as their partner across new asset classes, fund structures and an evolving ecosystem

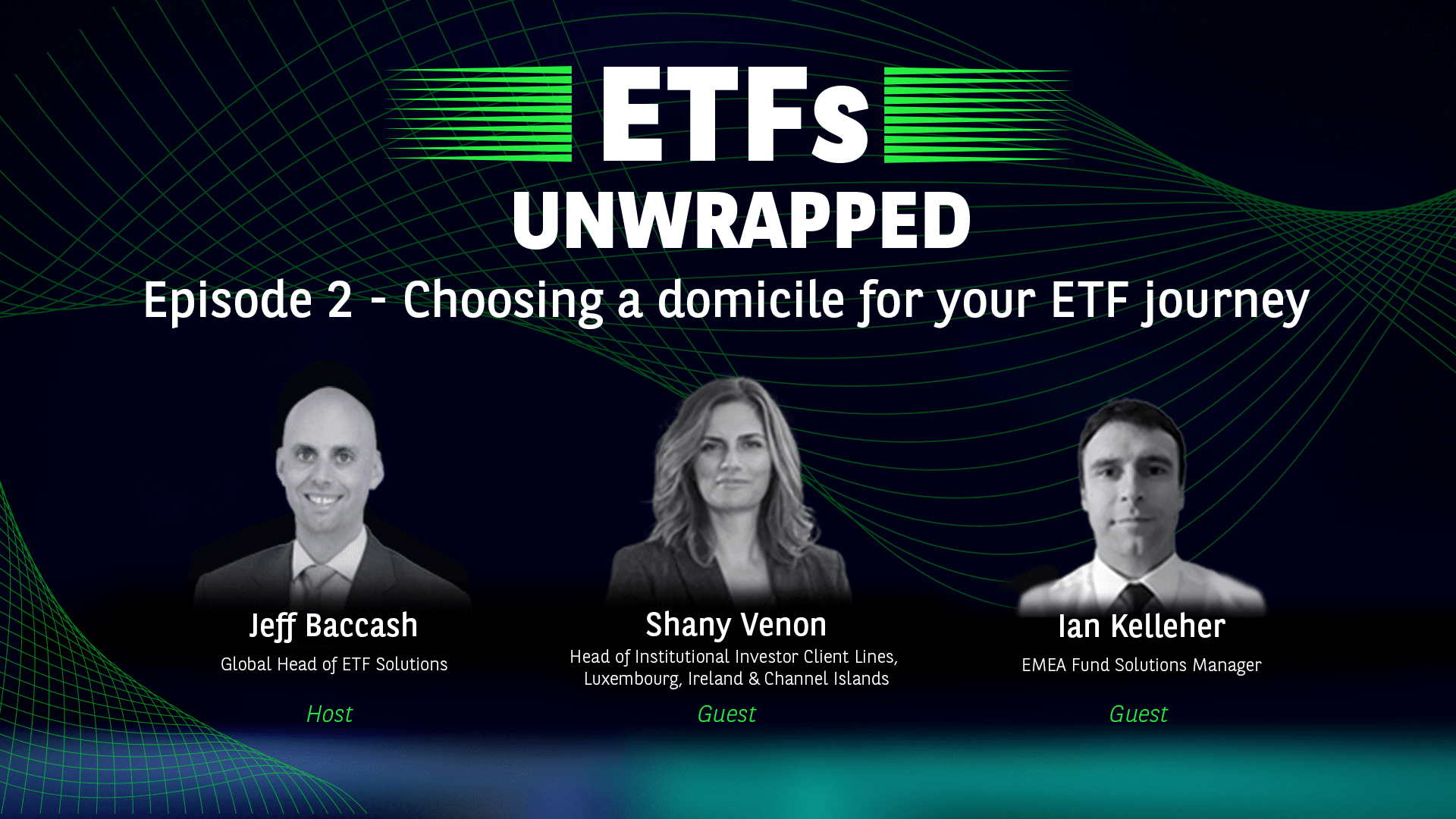

Meet our speakers

Scaling evergreen strategies and ELTIFs: GPs, LPs and platform approaches to private wealth partnerships

How are top GPs, LPs and platforms differentiating their approaches to attract and retain private wealth LPs in the pursuit of building evergreen scale?

Tuesday 24 June | 12pm CET

Global Head of Private Capital

Super session: Sustainable investing in transition

Where is capital flowing, and which sectors and investment vehicles are gaining traction? How are impact investing, biodiversity, and the energy transition shaping the future of sustainable finance.

Wednesday 25 June | 09:30am CET

Head of Sustainable Finance Strategy Client Engagement

Meet our delegates

This year’s key themes and insights

PRIVATE CAPITAL: SCALING STRATEGIES TO UNLEASH GROWTH

As managers scale up their private capital investments distribution, liquidity and operational considerations are key.

SUSTAINABILITY IN TRANSITION: PRIVATE CAPITAL MANAGERS PLAYING A KEY ROLE

Our recent survey shows institutional investors remain committed to sustainable investing. Private capital managers are deepening their impact.

ETFs: A TIPPING POINT FOR EUROPE?

ETFs are becoming an important part of European managers’ distribution strategy. Volumes in Europe have quadrupled in 5 years. But navigating the ecosystem is not easy; BNP Paribas can offer expertise and connectivity to help managers capture this opportunity.