On 13 and 14 May, we were delighted to welcome clients and partners to the 10th edition of the Lisbon Forum. This annual event, designed specifically for financial intermediaries, brings together leading experts from the post-trade industry to explore market trends and collectively assess the opportunities and risks shaping the future.

This year’s theme, “An agenda for growth”, guided two days of engaging panels and workshops. Participants shared insights on the factors influencing growth and discussed what is needed to achieve meaningful growth, together.

Discover more on the key themes and takeaways that shaped this year’s agenda.

Key takeaways:

- Europe’s resilient economy is driving growth amid global market pressures

- Despite challenges, Europe’s capital markets are advancing toward reform, integration, and innovation

- The UK and EU are working closely together to move to T+1 and meet the October 2027 deadline

- There are ongoing initiatives to consolidate European infrastructures, however careful evaluation of cost and time is essential to ensure efficiency

- Tokenised assets are moving toward commercialisation, even though blockchain fragmentation and usability challenges remain

Macroeconomic outlook

The global economy is currently experiencing pressure making macroeconomics more relevant than ever. Our keynote speaker, Isabelle Mateos y Lago, BNP Paribas Group’s Chief Economist, provided an insightful overview of the global context.

Initial optimism for the U.S. economy has moderated, with growth forecasts adjusted and investor interest increasing in the Eurozone, UK, and emerging markets.

BNP Paribas has revised the growth forecast for Europe upwards. Despite political challenges, Europe has shown resilience, supported by infrastructure investment and policy flexibility. The global trading and financial system are likely to undergo significant adjustments over the next decade. Still, globalisation will endure, and Europe appears well positioned to manage the economic impact, if it can rise to the occasion.

Find regular updates on the global economic context here: https://economic-research.bnpparibas.com/Home/en-US

Enhancing European competitiveness

Aligned on the urgent need to enhance Europe’s global competitiveness, our panellists explored several levers for progress: capital markets, T+1, infrastructures, and the growing potential of digital assets.

Capital markets reform remains central to unlocking long-term growth. Initiatives like the Savings and Investment Union (SIU) project are leading the way toward greater efficiency. Key areas for improvement include pension reform, financial education, and modernising operational systems. Favourable tax policies could also boost retail participation while scaling up distributed ledger technology (DLT) and embracing digital assets offer promising opportunities.

The transition to a T+1 settlement cycle, set for 11 October 2027 in both the EU and UK, is another strategic move. Andrew Douglas, Chair of the UK T+1 Taskforce Technical Group and Giovanni Sabatini, Independent Chair of the EU T+1 Industry Committee underlined that success will depend not only on technology, but also on governance, collaboration, and behavioural change. Automation, standardisation, and a thorough impact assessment will be key. The shift is expected to boost efficiency, unlock capital, and ultimately support growth.

Efforts to improve Europe’s market infrastructures are also gaining traction. While proposals such as a single Central Securities Depository (CSD) and a central clearing counterparty (CCP) are under assessment, our experts warn these recommendations could be costly and time-consuming, possibly outweighing benefits or failing to solve fragmentation. Hence, thorough analysis is needed to ensure real savings for the whole market. Developing more competitive, harmonised equity settlement markets seems to be a more promising path.

Finally, Europe’s digital assets landscape is rapidly evolving, yet one significant gap remains: the absence of a widely adopted means of payment mechanism for wholesale blockchain-based securities transactions. The European Central Bank’s (ECB) wholesale Central Bank Money (CeBM) experimentation programme of 2024 marked a significant milestone in developing a solution. Greater coordination and the need to identify high-impact use cases with near-term return on investment will be essential.

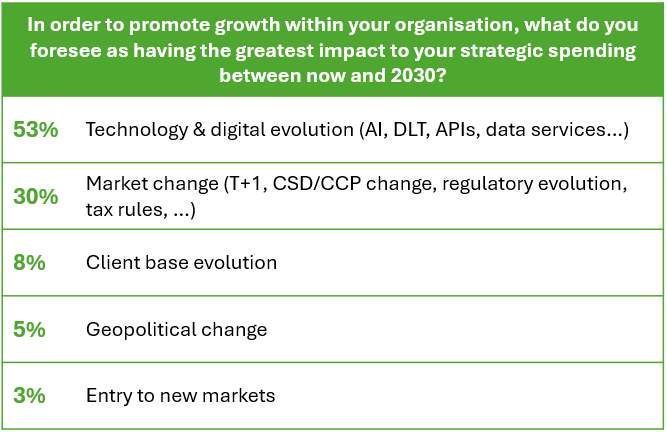

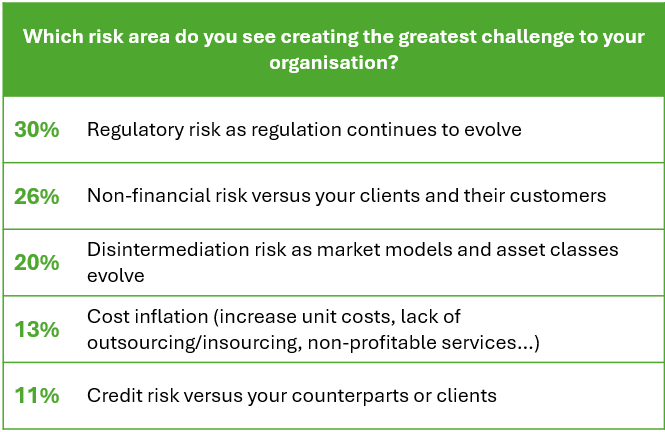

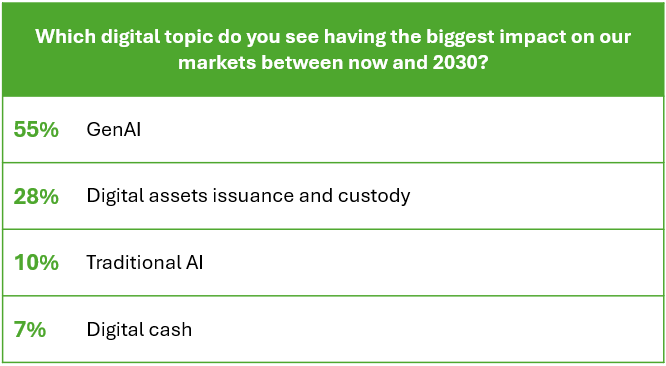

Sell-side barometer: your opinion

This year we conducted our “Sell-side barometer”, a live poll designed to gauge our audience’s sentiment on future market challenges and opportunities. Participants shared their views on key factors influencing their strategy for growth.

See the full results[1] below.

[1] Responses from 60 participants of the Lisbon Forum event