John Fox is the newly appointed US Head of Market and Financing Services at BNP Paribas’ Securities Services business. He shares how securities finance is developing in America, how it helps asset managers and owners generate incremental revenues, and views on capital investment and fintech partners.

John, can you explain your new position and how you plan to shape the US securities finance business?

I was recently appointed Head of Market and Financing Services in the US. I am responsible for strengthening the offering in the country, including securities lending, triparty collateral management and financing. Having spent more than 25 years in the securities finance industry, I have a strong track record in successfully providing solutions to clients’ needs in this area. This includes shaping product development, increasing adoption of securities finance in the region, and assisting clients with finance solutions.

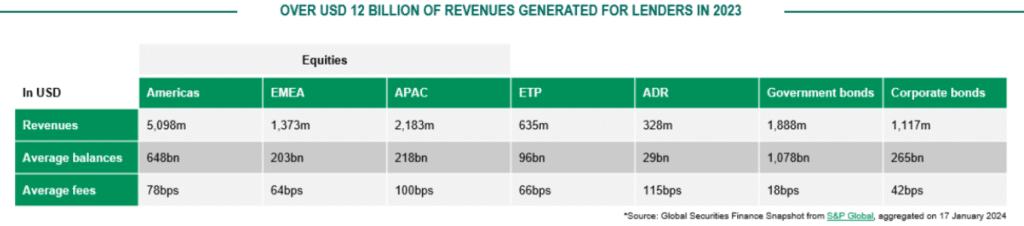

It is truly amazing to see how the borrowing strategies of the securities finance industry have evolved over the course of my career. Particularly their expansion tied to collateral optimisation, hedging, and prime brokerage activity as components of producing over USD 12 billion[1] of revenues generated for lenders in 2023.

This is an exciting time for me to be part of BNP Paribas’ agency lending business. My arrival coincides with substantial capital investment by the Bank. We aim to create even further efficiencies in how we interact with our borrowing counterparties, how traders use information, and improve the client experience. Different clients have different market segment requirements, so it is important to keep that in mind for the flexibility and scope of reporting and data requirements. We have also been strengthening the team and I am excited with the rich skill set and experience that we now have. People are one of our key assets and serve as a foundation to achieve success.

What are the challenges facing securities finance?

There are always new challenges on the horizon, especially as it relates to the regulatory environment. New regulation is a constant, as regulators aim to continue to increase transparency of the activity among participants.

It is important to leverage industry groups and contacts to gain perspective into adapting activity and solutions to these changes. This includes staying updated on US regulatory changes such as the FINRA rulebook to implement SEC 10c-1a. It also covers the challenges and considerations that will work for and against centrally cleared securities lending and repo transactions.

What expectations do you have in the short term for the business?

We offer both custodial and non-custodial agency lending solutions, so we intend to pursue opportunities within all client market segments. Globally we have agency lending desks in London, New York, Hong Kong and Sydney. We will continue to focus on our people, who are vital to our ambitions. Our new dynamic core team, especially in the US, will enrich BNP Paribas agency lending with diverse experience.

Risk management is key for many beneficial owners, and it will remain key for us. A strong and comprehensive indemnification policy acts as a strong risk mitigant. We operate with one of the broadest ranges of acceptable collateral types in the market, allowing our clients to achieve consistent returns while providing solid risk mitigation and diversification. BNP Paribas has a pristine track record in maintaining client capital preservation while providing this activity: no lender has experienced a financial loss since our programme inception.

How are third parties and external partners impacting the market?

One thing that has become very apparent since the start of the year is that agent lenders are more aware than ever that fintechs play a role in connecting participants. Regulatory considerations will impact both beneficial owners and agents, with the upcoming centrally cleared securities lending repo transactions. External partners may play a role in connecting market participants to face these challenges.

We have an ecosystem of trusted fintech partners and will work with them to determine the most appropriate model to meet the ever-changing regulatory, trading and post-trade requirements. Different fintech providers have different capabilities and strengths. Where we feel it makes sense, we partner with providers who can provide value for our clients

How is the US securities lending market performing?

It is a fact that securities financing activity is very much a contrarian one. Often what creates a negative bias in the markets has a positive impact on securities financing returns. This year returns have relatively very positive in the markets overall, for example, the S&P 500 is up almost 15% YTD at the end of June. Since much of demand is created by directional arbitrage, the securities lending revenue environment as a result has been challenging when compared to last year.

As securities finance remains a variable revenue stream, the largest impacts come from the “unknowns”. The issues which are difficult to anticipate but historically shape market conditions for our activity. The overall market conditions that you plan for are not always the market conditions you get, as clearly evidenced in the last four years.

How is your business positioned to respond to the market changes and answer your clients’ needs?

We offer clients a full suite of securities lending services. Our trading activities include securities financing programmes, lending both equity and fixed income via securities lending and repurchase (repo) trade structures.

Our agency lending programme is specifically designed to help clients optimise revenue opportunities within a robust, risk-managed framework. Our securities lending and custody business lines have independent management structures to ensure best operating practice in all divisions.

We have approximately 100 staff supporting our agency securities lending product through operational centres in Paris, New York, London, Lisbon and Chennai. Additionally, we act as the local custodian for the assets of many of our trading counterparties, enhancing efficiency.

We also have a natural end-user demand for European and Asian asset borrowing, making us a leading competitor on pricing, accessing the markets through both securities lending and repo transactions.

In what areas of your business are you prioritising investment?

We have invested heavily over the past few years and will continue to do so to help the growth ambitions of our product globally. One key area has been on improving the level of automation and efficiency across the business. We have made a large effort to move to as little manual intervention as possible across the lifecycle of a loan. This will in turn help ensure the business is well placed for the potential global move to shorten settlement cycles.

In addition, we have built a new application within our client portal NeoLink which features state-of-the-art reporting and functionality. This allows clients to have a more hands on experience in their securities lending programmes if they so wish. This new app will be rolled out at the beginning of 2025 and we expect the functionality to continuously improve each year, adapting to what our clients want to see and do. We want to match the best technology, to enhance automation and efficiency, with the best people, to manage our relationships with clients and borrowers, to improve BNP Paribas’ offering.

[1]Source: Global Securities Finance Snapshot from S&P Global, aggregated on 17 January 2024