This article was first published on 20 September 2024. It was last updated on 6 November 2025.

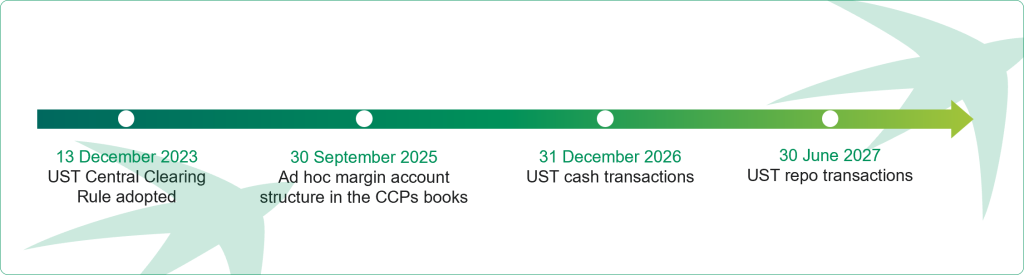

On 13 December 2023, the Securities & Exchange Commission (SEC) adopted a new rule promoting the central clearing of U.S. Treasury securities transactions. The Rule[1] is designed to improve risk management practices, protect investors and reinforce market resiliency. The eligible U.S. Treasury securities cash transactions and U.S. Treasury securities repurchase agreement transactions will be subject to mandatory clearing starting 31December 2026 and 30 June 2027 respectively[2].

U.S. Treasury central clearing: the work continues

In September 2025, the U.S. Treasury market reached a record crossing USD 29.7 trillion[3] in total value of outstanding transactions, which evidences a continuous growth trajectory over the past two decades. A significant portion of the U.S. Treasury transactions are executed on a bilateral basis, are not cleared and can be exposed to counterparty risk. In recent years, the resiliency of this market has been challenged, as market volatility and geopolitical risks became more prominent leading the SEC to introduce the central clearing rule to improve risk management practice and reduce settlement risk.

The U.S. Treasury central clearing rule is a major shift in the current market practice and requires significant efforts. The industry and market participants continue the preparatory work toward full implementation by adapting their technological platforms and operating models. This said, a number of critical issues require further clarification to enable the efficient transition. This includes, but is not limited to, standardization and finalization of “done-away” clearing documentation, assessing the impact of inter-affiliate exemption and double margining issues for registered funds, the extraterritorial scope of the rule, and other clearing houses approvals.

Industry open points pending clarification (not exhaustive)

- Done-away transactions documentation standards

- Inter-affiliate exemption

- Double margining issue for registered funds

- Other Clearing Houses approvals

U.S. Treasury central clearing: a changing landscape

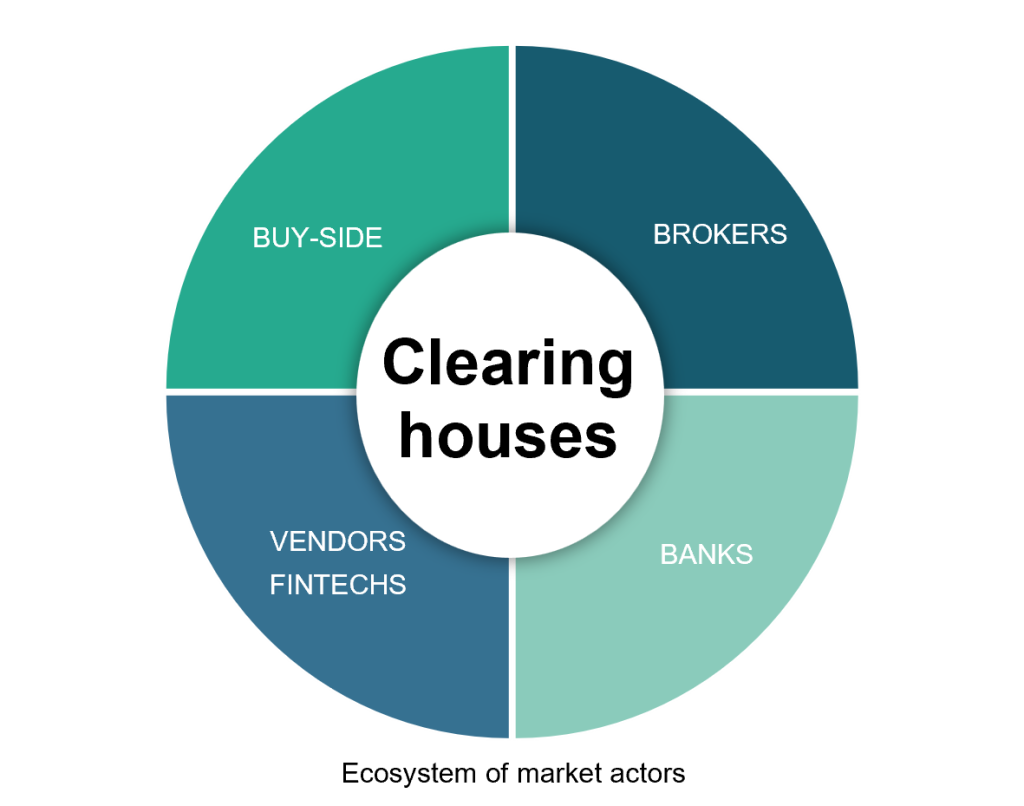

Since the SEC rule was announced, the Fixed Income Clearing Corporation (DTCC subsidiary and the leading clearing house for U.S. Treasury securities transactions) has observed a 56% year-over-year increase in Sponsored Service clearing volumes and a daily average of USD 11.1 trillion in cleared transactions (in total value)[4]. This trend is reinforced by additional clearing houses entering the landscape; earlier this year both CME Securities Clearing and ICE Clear Credit filed with the SEC to be approved as alternative clearing venues for eligible transactions. These firms are also expected to expand their cross-margining capabilities as they open their processes to clear U.S. Treasury securities transactions.

A multiple clearing houses environment is expected to broaden service offerings, improve pricing structure and diversify risk exposure. Nevertheless, the proliferation of clearing houses may also create some drawbacks, such as limited multilateral netting effect as well as increased operating, onboarding and connectivity costs for market participants.

U.S. Treasury securities clearing: next steps

The regulatory bodies, clearing houses and industry working groups continue to collaborate on addressing critical pending points and establishing the path for the best market practice. As the SEC Chairman Paul Atkins states “It is critical that the transition to clearing U.S. Treasury securities goes smoothly”[5].

As a result, clients are encouraged to undertake preparatory work and engage with clearing brokers and service providers as early as possible to assess their trading patterns and determine the best-suited clearing access option. Note that the qualifying standards for sell-side and buy-side firms may vary depending on clearing house terms and conditions, operating models and client requirements.

Preparatory steps (not exhaustive)

- Identify eligible transactions and their nature

- Engage with trading counterparties

- Review margin requirements

- Execute legal documentation

The U.S. Treasury securities clearing regulation is a step toward market integrity and avoidance of systemic events by reduction of the counterparty and settlement risks.

BNP Paribas continues the efforts to implement this regulatory change.

Explore the SEC amendment – Click here to access the Rule 17 CFR Parts 240 (Final rule: Standards for Covered Clearing Agencies for U.S. Treasury Securities and Application of the Broker-Dealer Customer Protection Rule with Respect to U.S. Treasury Securities)

For any further questions, please reach out to your BNP Paribas representative.

[1] Final rule: Standards for Covered Clearing Agencies for U.S. Treasury Securities and Application of the Broker-Dealer Customer Protection Rule with Respect to U.S. Treasury Securities

[2] Final rule; extension of compliance date.

[3] US Treasury Securities Statistics – SIFMA – US Treasury Securities Statistics – SIFMA

[4] U.S. Treasury Clearing | DTCC, as of October 2025