We were delighted to welcome our clients and partners to the Lisbon Forum, which took place on 16 and 17 May. This annual forum brings together participants from the post-trade industry to discuss market trends and collectively reflect on the challenges ahead. Taking place in Lisbon, the event also provides a window into the strategic development of BNP Paribas’ International Operations Centres in Portugal, Poland and India.

Our theme this year was “The platform era: resetting post-trade expectations”. Through panel discussions and expert workshops, participants exchanged views on a range of topics.

Below are some highlights from the event:

What are the strategies for partnership?

2023 marked the eighth edition of the Lisbon Forum. Deepening the dialogue with our clients has always been an important focus of the event. However the question of partnership – not only with clients but also with Fintechs and market infrastructures – has increasingly come to the fore in recent years. The theme of this year’s event reflects the importance of these partnerships as a means of creating value and solving common industry problems. Our panelists, including banks and Fintechs, discussed how their organisations are facing this new reality.

For one bank present, the strategic lever of partnership was central to their philosophy, with the company “building for competitive advantage and partnering for parity”. In the past, many banks capabilities were based around their own home-built proprietary systems. However, this has changed substantially in recent years. While banks continue to build in-house infrastructure in some areas considered as their “secret sauce”, many have moved into an open architecture and partnership approach. As one panelist said, “we need to do what we do with excellence and then we need to fill in the gaps in areas that are either of low value or of high complexity for us to put in place”. Among banks, there is increasing recognition that it is useful to partner with third-parties to enhance key components of their infrastructure. This ultimately makes their client proposition more powerful.

Which way is forward?

Market infrastructures and a BNP Paribas’ expert engaged in a lively discussion on the market infrastructure landscape, covering competition, technology and regulation. With regard to technology, the value of Distributed Ledger Technology (DLT) was debated. Considering the perceived limited uptake of the DLT Pilot Regime and issues faced by market infrastructure modernisation projects based on Blockchain, there have been accusations that DLT is “a solution looking for a problem”. Indeed, a number of years ago, when the topic emerged, there was a clear Fear Of Missing Out (FOMO). Since then, the industry has moved to a more mature view of how we use modern technology, based on Cloud and APIs in addition to Blockchain. As one panelist remarked, “It’s not just Blockchain for the sake of Blockchain… It’s about identifying a problem, looking at the best technology available and deploying that technology to solve it”.

The question of T+1 settlement was also covered. The US will implement T+1 settlement in 2024. Asked whether T+1 should be a priority for the EU, BNP Paribas’ expert indicated that while it was important to consider regulatory alignment, it was also “urgent to wait” and see how the change is implemented in the US market. The European market is much more complex than that of the US in terms of the number of CSDs and CCPs. While market infrastructures in Europe can theoretically handle T+1, the burden of the change may fall on other actors in the chain of custody, such as small brokers and small asset managers. With this in mind, there needs to be an industry-wide approach to the question of T+1 in Europe.

Where do expectations stand?

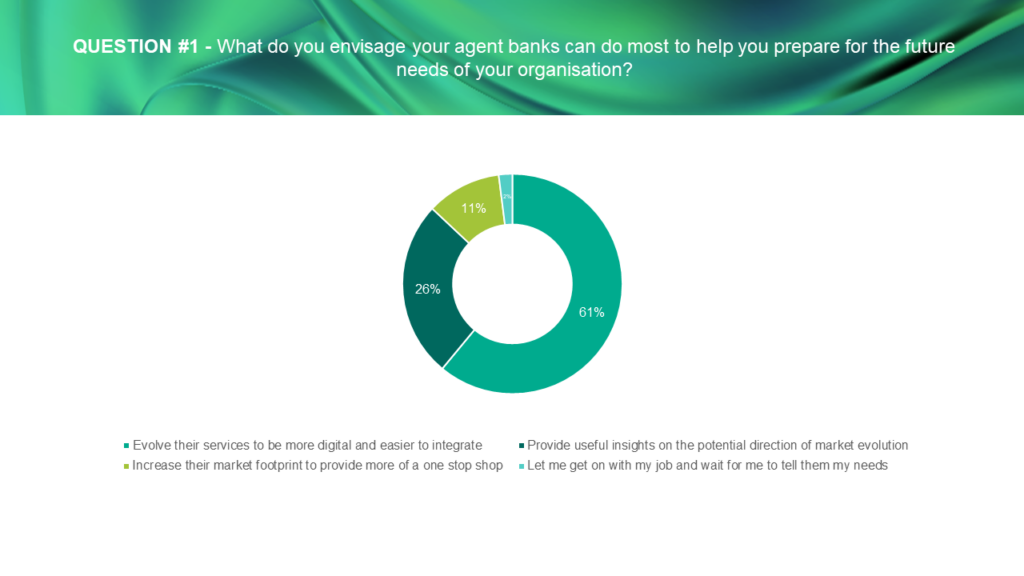

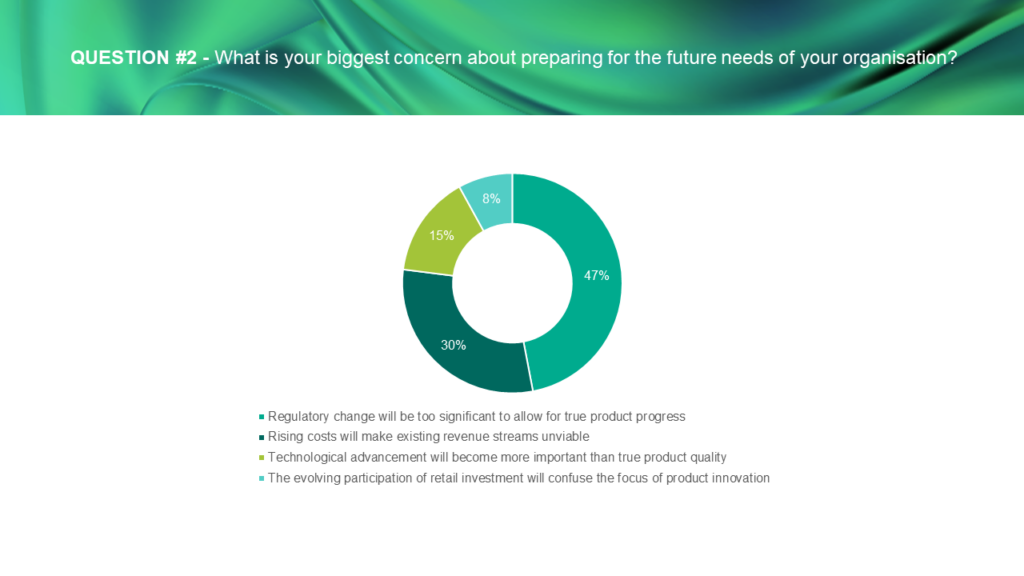

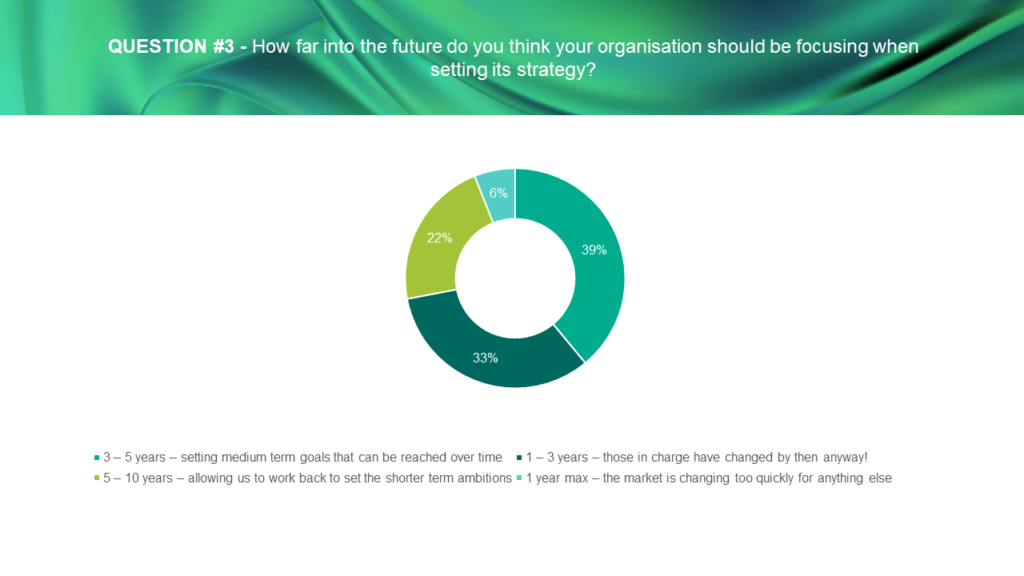

This year’s forum saw the return the “Sell-Side Barometer”, where we gauge the sentiment of our audience on future market challenges through a live poll (see results below*). The Value Exchange, with whom BNP Paribas is undertaking an extensive survey, joined us for this session. The survey will explore the vision of banks and brokers for the next decade, covering strategy, investment and operating models.

Pending the detailed results of the survey, our audience poll provided some interesting results. 61% of respondents highlighted that they require their agent banks to digitalise to prepare for their future needs. When asked about their biggest concerns, regulation was the leading factor cited (by 47% of respondents), far ahead of rising costs and technological advancement.

*Audience poll of 76 participants of the Lisbon Forum event, 16-17 May 2023

We would like to sincerely thank our panelists and participants for the enriching and engaging discussions at this year’s event. By bringing together banks, brokers, market infrastructures and industry experts in the spirit of open dialogue, we aim to address the issues and challenges facing our industry, and contribute to finding common solutions. We look forward to continuing the conversation with the community at the upcoming Network Forum and SIBOS industry events, as well as at future editions of the Lisbon Forum.

Let’s get in touch