Securities lending enables holders of assets to monetise the demand for specific assets and asset classes while retaining the economic benefits of their investments in a risk-controlled, operationally efficient manner.

Our Securities Lending offer

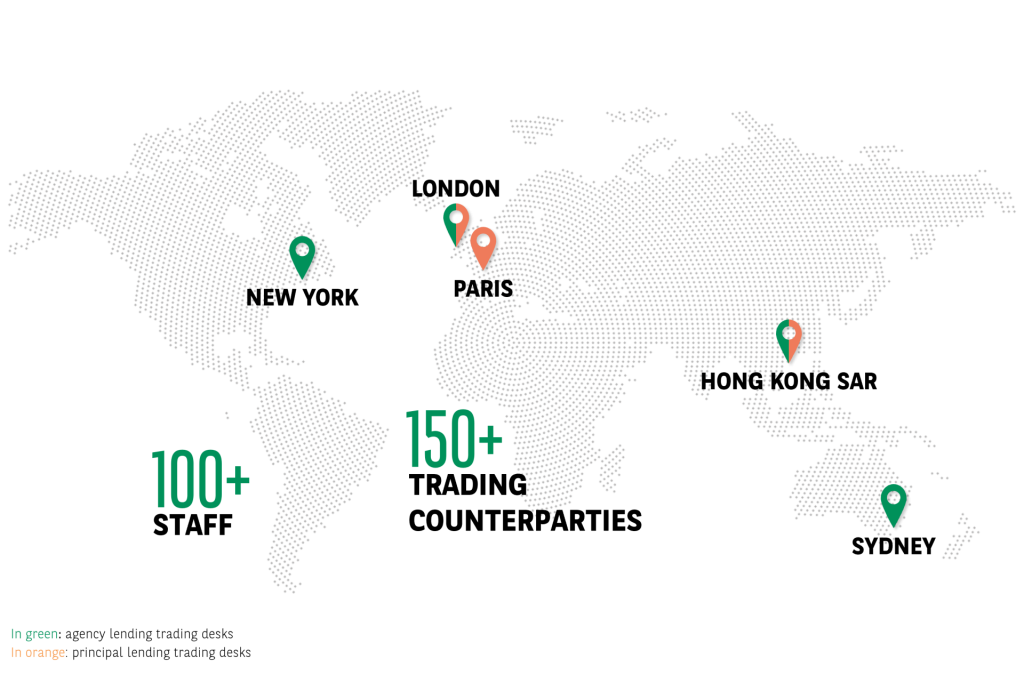

Obtain access to global and local coverage in more than 30 countries for a wide range of asset classes and using different types of collateral (non-cash, cash, client self-managed cash). With our seven desks worldwide, you can benefit from timely trade processing and settlement.

With an in-depth knowledge of local markets, across multiple asset classes and currencies, we can enhance the return on your assets through an efficiently managed, risk-adjusted programme. And you remain in full control of your lending and collateral management programme through customisation.

You can capitalise on our 20+ years of experience in securities finance, as we are here to provide support and product expertise with continuous access to our securities lending trading teams and product specialists.

What is securities lending?

Securities lending is the act of lending various type of assets to a counterparty in exchange for fees, collateral and haircut.

The collateral provided can be in the form of securities or cash, and is generally of a higher value than the lent securities.

This activity features at least two main actors, a lender and a borrower:

- Lenders can be many types of market participants. Their goal is to generate incremental revenue on top of their regular investments by mobilising assets within their portfolios, a strategy most effective in a low rate environment.

- Borrowers, on the other side, are usually Banks and Brokers/Dealers trying to achieve specific strategies. These strategies are numerous and diversified. The objectives behind these also vary from reducing risks, increasing revenues, to respecting investment policies or regulations and more…

As this activity entails some risk, notably counterparty, market and operational risk, it is important to choose the right model and parameters for your programme.

BNP Paribas Securities Services offers two different models: Agency Lending and Principal Lending. Each entails a precise set of documentation that further ensures the security of participants.

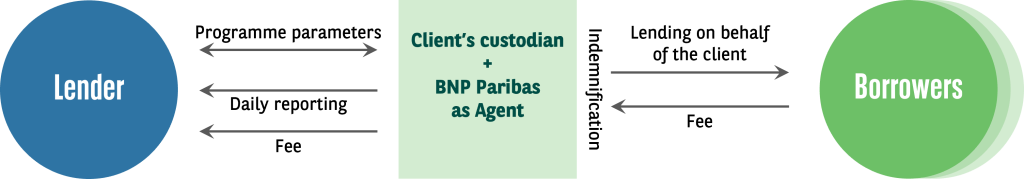

With the first model, Agency Lending, the lender uses the services of an agent to manage its securities lending activities with borrowers. The agent manages the lending process from loan inception and collateral management to settlement and reporting. The fees paid by the borrowers are split between the agent and lender and vary according to the characteristics of the programme.

This model allows the lender to diversify the counterparty risk across a set of pre-approved borrowers and to broaden the distribution of its assets thanks to a wider array of counterparties. And depending on the agent, the lender can also benefit from indemnification in case of borrower default.

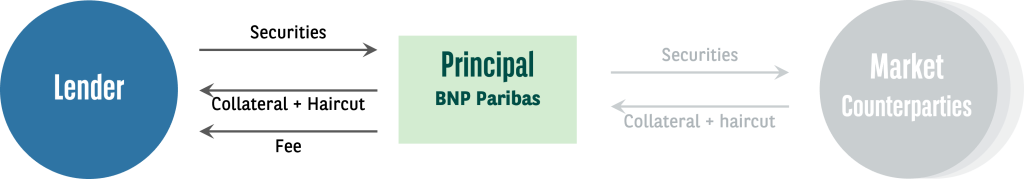

With the second model, Principal Lending, the lender loans its assets directly to BNP Paribas Securities Services, acting as Principal. In this setup the lending revenues are fixed for a defined period, so they are guaranteed irrespective of market events or volatility. This model therefore eliminates any uncertainty over returns, by providing a consistent revenue stream for clients.

With one unique counterparty the associated risk analysis is also simplified. And in the case of BNP Paribas Securities Services, all of the associated processes are managed entirely by us allowing for operational simplicity.

The securities lending market is growing, with new actors and markets on the rise. In parallel, technology is evolving, with developments in artificial intelligence, Distributed Ledger Technology, reporting and more, striving for increased efficiency and transparency.

The activity is full of possibilities as lending programmes can be customised in detail. Programmes can also fit your ESG ambitions with collateral exclusions or recall parameters.

Lending is also widely seen as necessary to ensure efficient capital markets through improved liquidity, reduction of settlement fails and price discovery.

In such a vast market, knowing your needs and having a provider that can answer them is key. With the right partner, you can increase the revenue generated by your dormant assets while facing minimized risks.

Our Securities Lending solutions include:

The Agency Securities Lending model is available to Asset Owners and Asset Managers. With this model BNP Paribas acts as an agent and manage your securities lending activities with borrowers on your behalf. We manage the lending process from loan inception and collateral management to settlement and reporting.

With the Agency Lending model you can benefit from:

- Diversified counterparty risk across a set of preapproved borrowers

- Broad asset distribution with our large network of counterparties

- In-depth customisation for a programme tailored to your risk profile, as well as your ESG policies

- Indemnification in case of borrower default

- Broad collateral acceptability, including cash collateral

The Principal Securities Lending model is available to Asset Owners, Asset Managers and Wealth Managers. With this model you loan your assets directly to BNP Paribas, acting as Principal and managing all of the associated processes. In this setup the revenues are usually fixed for a defined period, so they are guaranteed irrespective of market events or volatility.

With the Principal Lending model you can benefit from:

- A consistent revenue stream

- Simplified risk analysis, facing only one counterparty

- Operational simplicity

- Lending your assets to a sound Global Systemically Important Bank (G-SIB) counterparty

Our Third-Party Securities Lending offer is available to Asset Managers and Asset Owners. It is identical to our traditional custodial Agency Securities Lending offer. It is designed to meet the needs of clients seeking the expertise and commercial benefits of the BNP Paribas offering.

Benefit from:

- Consolidating your lending activity with one provider

- Connections to a wide array of external custodians

- The traditional benefits of our Agency Lending offer (counterparties, indemnification, customisation, collateral acceptance…)

Transparency and expertise

Providing clients with insight into their securities lending programme is paramount. Participants in the BNP Paribas programme can monitor all activity on a daily basis and can receive lending activity in a variety of formats.

The programme utilises advanced proprietary technology to extract maximum value for clients in an efficient manner including trading, settlement and reporting. Additionally, we have the ability to service your regulatory reporting requirements.

The global scale of BNP Paribas also benefits clients through continuous market and regulatory Thought Leadership. Our involvement in industry working groups and trade forums further reinforces our commitment to securities lending.

See below our latest articles on securities lending:

Securities Financing in Asia-Pacific (APAC)

An interview with Benoit Uhlen, BNP Paribas’ Securities Services, sharing how securities finance landscape is developing in the Asia-Pacific region.

Read moreSecurities Finance in the United States of America

An interview of John Fox, US Head of Market and Financing Services at BNP Paribas’ Securities Services business, sharing how securities finance is developing in America.

Read moreSecurities Lending Trends 2025

An overview of the key trends we expect to shape the securities lending markets in 2025 and beyond.

Read more