Your data on-demand with APIs at BNP Paribas

Flexible

Secure

Easy to implement

BNP Paribas has a robust API development programme in place, tackling relevant use cases where APIs are best placed to overcome connectivity challenges.

Our APIs are freely accessible to clients via our API Catalogue. It includes API documentation and information, allowing prospective users to understand the purpose of the API and plan developments for the integration of live APIs.

To further facilitate our clients’ API journey, we also provide a sandbox with generic dataset for them to test the main functionalities of our APIs.

Going a step further, we are implementing a webhook feature notifying clients whenever new data is available, allowing them to pull data at the right time.

Data and connectivity are the cornerstone of the financial industry. As a financial institution, your performance can be influenced by your ability to handle data, including the way you access it.

To unlock new levels of efficiency, you must choose the data sharing channel most suited to your needs.

Among the channels available, APIs are an innovative way for clients to retrieve data.

An API allows two different IT systems to communicate with each other seamlessly and in a secure way. They take shape through the integration of code at both ends, the sender and the receiver.

Their main differentiator is that they allow you to directly pull data from your counterparty, on-demand. This means, you can retrieve the most up-to-date data at any time, as you need it.

As such, APIs are best placed when you need fresh data and to facilitate your decision-making process. With APIs, you won’t need to wait for a scheduled data upload to inform your actions.

APIs also ease the integration of data into your systems by removing layers of data processing found in less standardised methods. Instead, your system can skip straight to aggregation and directly showcase the new data into your visualisation tools, improving your efficiency.

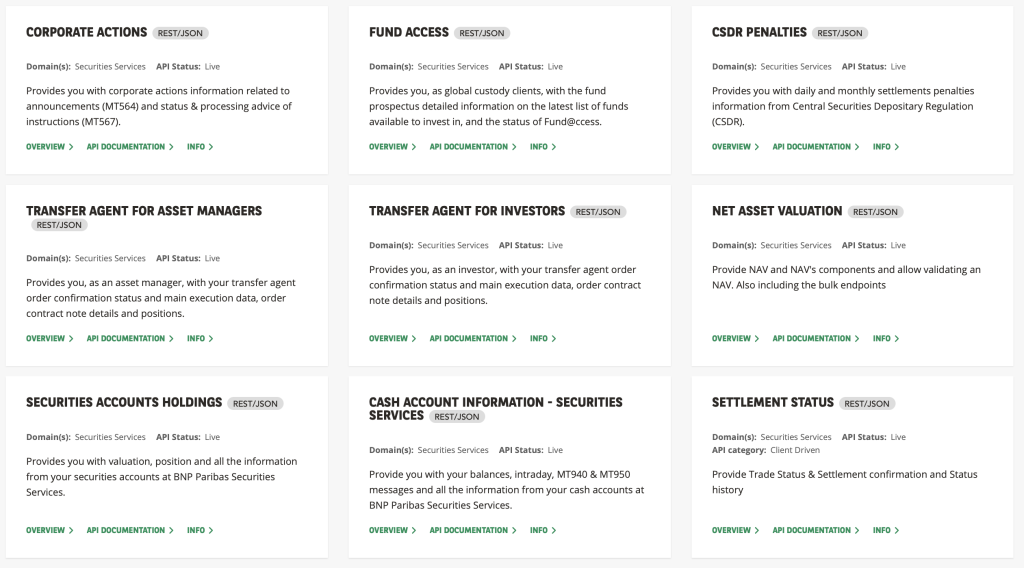

As this technology can help our clients overcome their challenges, BNP Paribas’ Securities Services business has developed a rich catalogue of APIs. It covers a large scope of data from custody positions, cash information, to net asset valuation, and more.

Through them, clients can retrieve a large array of data in near real-time. This can help them avoid overdrafts, quickly check on their trade status, or decide on an investment with more agility.

Pushing a step closer to real-time access to data, we are integrating a webhook to our APIs. Through this feature, clients are notified as soon as new data is available for consumption, allowing them to pull data through the API at the right time.

And leveraging state of the art solutions, we have built APIs with secured mechanisms for authentication and encryption, complying with the Open API Specification and local jurisdictions. Want to get fast and safe access to your data?

Check our API catalogue today or contact your relationship manager to learn more

A WIDE RANGE OF DATA

AVAILABLE TO YOU, AT ANY TIME

FLEXIBLE

Clients can retrieve up-to-date data on-demand and in near real-time. They can do so however they want, with precision, for a dedicated set of data.

SECURE

Our APIs are built with secured mechanisms for authentication and encryption, complying with the Open API Specification (OAS) and local jurisdictions.

EASY TO IMPLEMENT

APIs are often seen as faster to test and implement compared to other system-to-system channels. A process we are further facilitating by adopting market standards.

As an asset manager or institutional investor, our suite of APIs can provide you with on-demand and near real-time access to the data that matter most to you, from information on your positions, to Net Asset Valuations (NAVs) and beyond. By integrating our APIs into your ecosystem, you can improve your efficiency, data accuracy and gain greater agility in managing your mandates.

Check our catalogue to see the use cases supported by APIs.

As a broker, bank or market intermediary, your edge relies on speed, integration, and reliability. Our suite of APIs can provide you with on-demand and near real-time access to essential post-trade data including settlement statuses, custody positions, cash account information and more. APIs could help you automate flows, minimise risks and deliver faster execution.

Check our catalogue to see the use cases supported by APIs.

See below our latest content related to APIs:

Application Programming Interfaces (APIs) in the finance industry

In this article we document what APIs are before delving into how relevant they are for the finance industry.

Read moreBNP Paribas’ Securities Services business further expands its Application Programming Interface (API) capabilities

BNP Paribas’ Securities Services business has a robust development programme tackling relevant use cases where APIs are best placed to overcome connectivity challenges.

Read more

For more information, reach out to your BNP Paribas representative or click here: