From definition to deployment: turning ESG intentions into action

1. A nuanced approach to sustainable investment

Sustainable investing is evolving as investors continue to prioritise a personalised and diversified approach. Their subjective interpretation of what defines a sustainable investment is translating into a growing focus on thematic approaches as their ability to identify specific opportunities progresses.

The most important element in defining “what is a sustainable investment?” remains consistent. Mirroring the BNP Paribas’s ESG Survey 2023 results, investors say the asset needs to meet their own sustainable investment criteria: 51%, of investors selected this definition. The second most popular definition, as it also was in 2023, is ‘alignment with external sustainability goals’ (40%). This differed in the Asia-Pacific region, where reducing carbon emissions and ‘excluding investments with negative ESG impacts’ (both 41%) both surpass it.

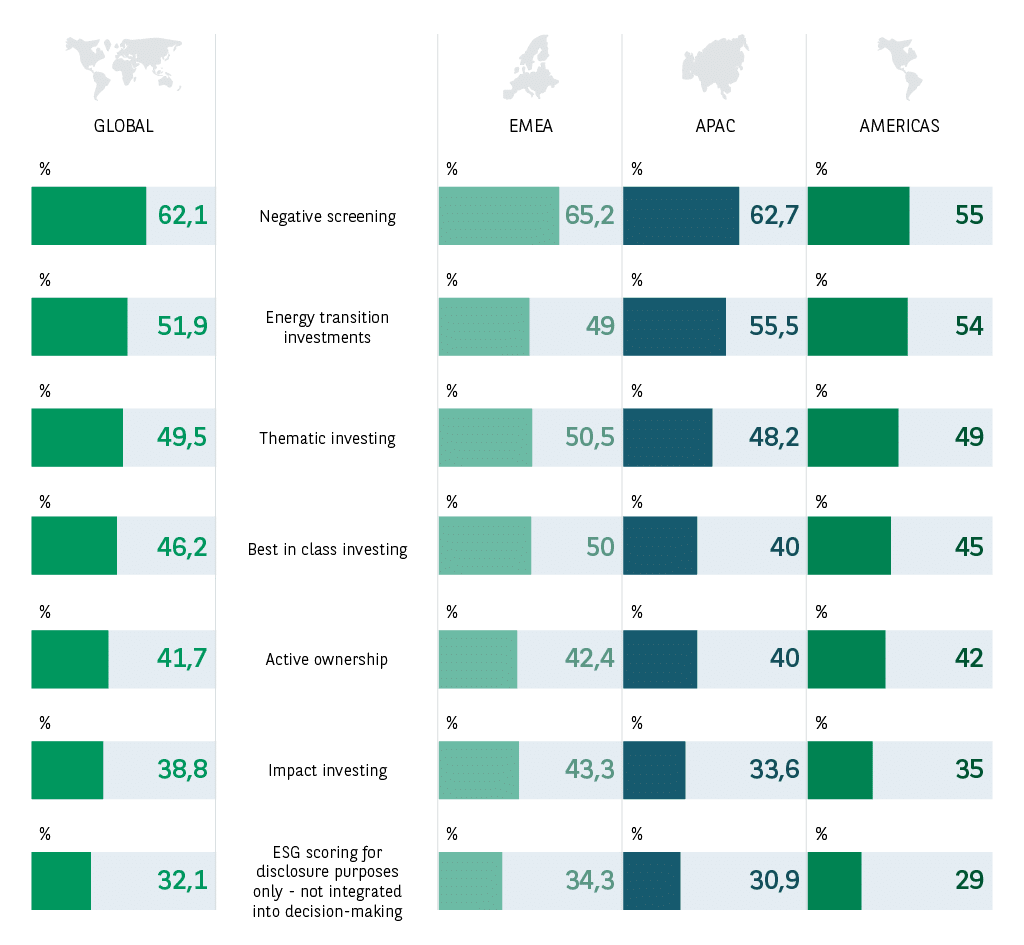

There are common themes that investors share in their approaches to sustainable investing. For example, ‘negative screening’ (62%), ‘energy transition investments’ (52%) and ‘thematic investing’ (50%) are the three leading ESG or sustainable investment strategies used on a global basis. Their dominance is strongest in Asia-Pacific and The Americas, while in EMEA, ‘best in class investing’ is one of the top three approaches, slightly ahead of ‘energy transition investments’ (50% vs. 49%).

We’ve been incorporating ESG since 2007 in an active manner. In recent years, we have professionalised our approach in a very tailored manner.

Legal officer, fund manager, The Netherlands

This convergence in investing approaches provides a sense of cohesion in an often-fragmented landscape. Within this consistency, however, some changes in the appeal of different approaches can be identified. Since 2023, thematic investing has increased in importance as investors try to find more nuanced opportunities for impact and alpha generation.

This shows the approach to sustainable investing is becoming more focused, with investors increasingly allocating to specific themes or regions to help concentrate their expertise on generating better outcomes.

With growing investment opportunities in ranging from energy to biodiversity, to adaptation activities, to transition, we can expect investors to continue to focus on thematics for the rest of this decade, and to reduce exposure to generalist ESG strategies.

2. Investors driving capital to high impact areas

Beyond the definition of sustainable investments are the actions investors take in terms of their allocations. This is where theory meets practice, highlighting their true priorities.

In the next five years we will see an increased focus on transition financing. The reality is that markets, both financial and broader economies, are realising that the transition has to be implemented and it will cost.

Global Head of ESG, fund manager, the UK

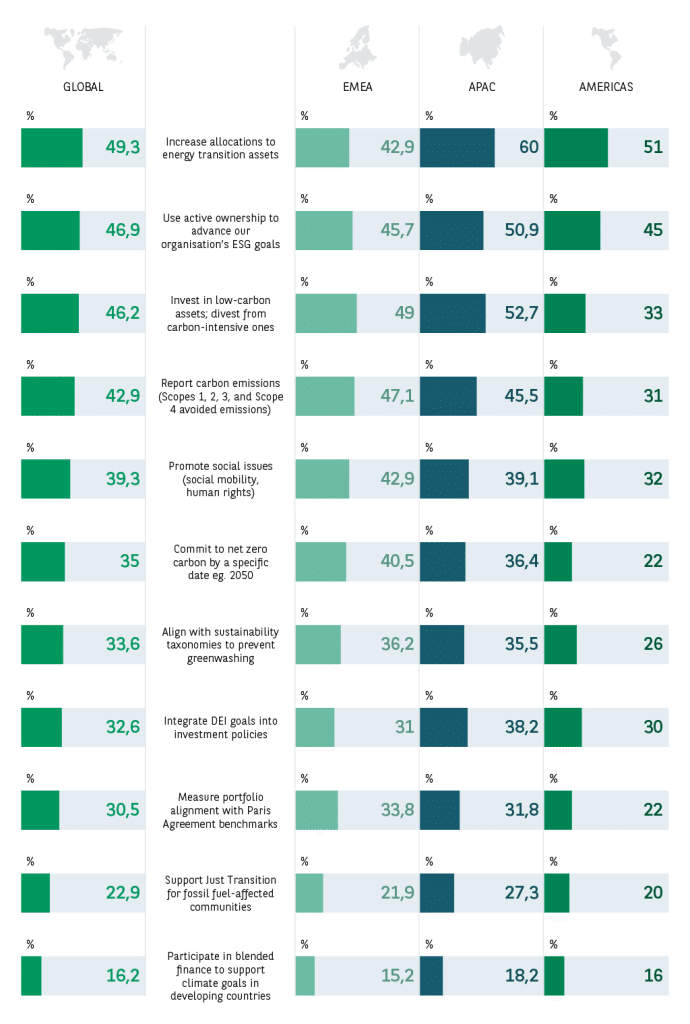

Globally, institutional investors’ primary sustainability/ESG objectives in the next two years are:- ‘Increasing allocations to energy transition assets’ (49%), ‘using active ownership to advance their own organisation’s ESG goals’ (47%), ‘investing in low-carbon assets while divesting from carbon-intensive assets’ (46%), ‘reporting carbon emissions’ (43%) and ‘promoting social issues’ (39%).

These priorities signal shifts in allocations which are a strong indicator of the direction of travel within the sustainable investment landscape. Investors are aiming to drive capital towards areas of high impact while being in a strong position to influence investee company behaviour and manage emerging ESG risks.

There are some regional differences worth noting; regional nuances will drive the way sustainability strategies are applied at a local level.

In North America, 51% of investors cite energy transition assets as a ‘short-term priority’ and 33% focus on ‘low-carbon investments or divestment’. Compared to 2023 results, this points to a gradual shift toward more proactive involvement in the transition.

Compared to 2023, ‘integrating DEI goals into investment policies’ is a key objective for fewer investors (41% in 2023 to 29% this year), in line with broader shifts in focus observed across different markets. These differences can be said to reflect the investors’ geographical context, energy dependencies and social climate.

The importance of sustainability objectives around the energy transition and the shift towards low-carbon assets, as well as social issues, is reinforced when considering investors’ priorities for their investment strategy.

The two biggest priorities for investors on a global basis are ‘portfolio decarbonisation’ (74%) and ‘social issues’ (71%), ahead of a ‘just transition’ (52%) and ‘biodiversity’ (55%). As seen in the analysis of the leaders in ESG and sustainability, prioritising portfolio decarbonisation and social issues are key characteristics for investors who are ahead of the curve.

The support for a just transition shows that many investors understand that the move away from fossil fuels by decarbonisation must be supported by a broader set of considerations when dealing with regions and communities currently dependent on carbon-intensive activities. Alongside this, many investors also believe biodiversity is now part of supporting key ESG and sustainability objectives and priorities. When asked about the most appealing attributes of biodiversity-oriented or nature-based solutions, 51% of investors cited making a measurable positive impact on ESG/sustainability investing goals, followed by ‘providing climate solutions to man-made climate change’ (40%), ‘generating uncorrelated returns from a sustainable source’ (37%), ‘protecting ecosystems in their own country or region’ (36%) and, ‘aligning with the social values of their stakeholders’ (33%) and ‘offsetting carbon emissions from other portfolio investments’ (32%).

3. An unwavering commitment amid broader uncertainties

The current context has created new challenges for investors, not just in terms of capital flow but also in how their commitment is communicated publicly.

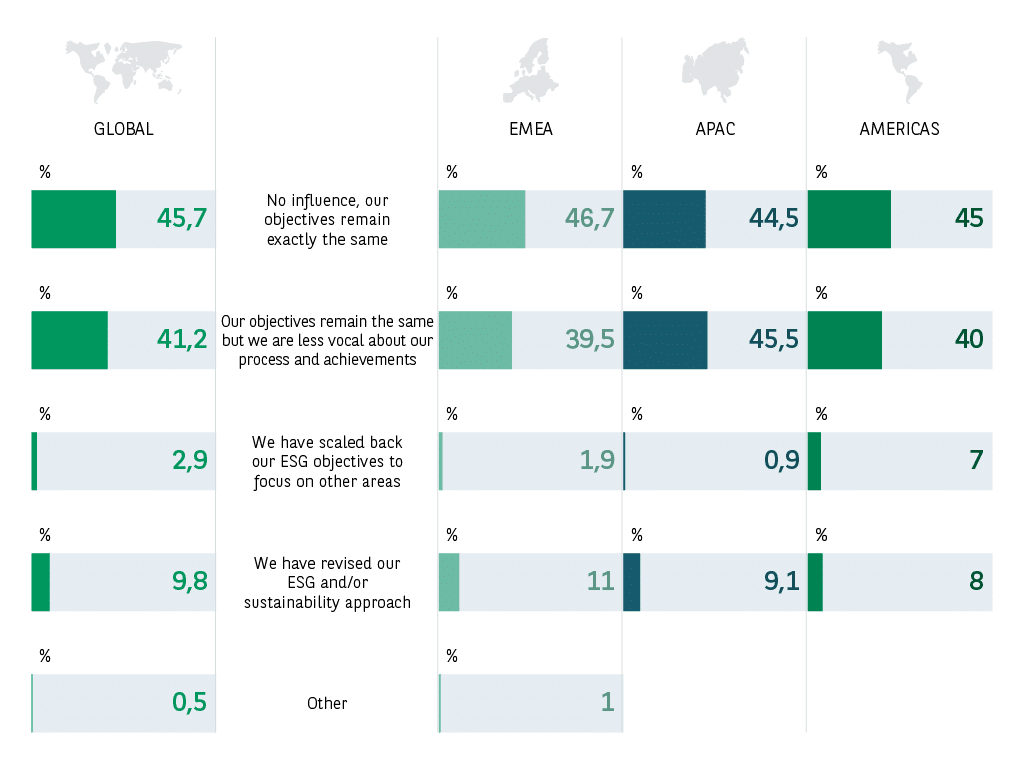

Overall, the survey data shows that investors’ commitment remains very strong, with 87% say that their ‘ESG and sustainability objectives remain the same’, which indicates that investment strategies remain long term.

However, just over four-in-ten investors (42%) see ‘geopolitical risks as causing a re-think of ESG and sustainable investing’ as a significant challenge. This probably explains why some investors intend to become less vocal about their sustainable action, 41% say they are ‘less vocal about their process and achievements’.

The continued allocation to sustainable assets can help avoid potential misalignment between asset managers and asset owners which some have been heralding.

It is critical to note that almost three-quarters (74%) of investors ‘expect the pace of progress towards sustainability to continue at the same pace between now and 2030’. This is consistent across regions and organisation types, and this is reinforced by pacesetters where nearly 2 out 3 respondents expect to use more thematic investment opportunities going forward, which is considered as a key path to help ensure this momentum. However, 23% think it will ‘continue with less publicity’, while 22% think it will ‘continue with enhanced publicity’. While 16% think it will slow down, 11% think the ‘pace of progress will accelerate’.

This expectation translates well into the way investors are maintaining their ESG and sustainability objectives.

4. A maturing approach to the data challenge

It is widely accepted that data is a key challenge for sustainable investing and critical to helping them meet and deliver on their ESG ambitions. As they shift to more precise tracking and measurement techniques, investors are maturing in how they approach this topic.

Institutional investors are employing a more critical lens to identify opportunities for alpha generation and impact, as well as analysing risks, both in terms of environment and resource stress. This growth has created the necessity to consume more specialist data, to better clean and organise the data, and compare more datasets, marking a distinct shift towards more quantitative analysis.

The scale of the difficulty with data is shown when investors are asked about their significant challenges when allocating to ESG and sustainability investments. Here, ‘ESG/sustainability data and research challenges’ (58%) are just ahead of the ‘conflict between short-term financial performance versus long-term sustainability goals’ (56%), followed by ‘risks of greenwashing by investee companies or product providers’ (54%).

Until recently, data estimates were acceptable. Now, we need precise ESG ratings and stricter reporting requirements like CSRD metrics.

Head of ESG investment integration, insurer, Italy

In order to manage the data challenges relating to ESG/sustainability, over half (54%) of investors ‘use and compare multiple sources of data’, while 48% ‘conduct their own research methodologies, such as creating benchmarks or in-house ESG scores’. Another approach used is ‘implementing data management techniques to customise ESG data’, with 39% of investors doing this, while 38% seek to ‘ensure the transparency of the source of raw data’.

These findings show that investors want to take a robust approach to data and ensure they have reliable information at their disposal. In fact, they show a reluctance to rely on sources such as ratings agencies, with 70% agreeing that a focus on ESG ratings could see companies favour reputation management over real impact and this risks ESG becoming simply a “check box” exercise.

To support their aim to access and generate reliable ESG data, nearly half of investors (48%) anticipate ‘allocating more budget to their sustainable investment strategy on ESG data acquisition and analysis’, while 38% plan to ‘add funding to reporting, impact measurement and disclosure’, and 37% pledge to ‘hire specialised ESG talent’.

5. Partnering to support investors’ ESG journey

As sustainable investment evolves in different ways, strategic partners are emerging as a crucial element in supporting investors on their journey. They are increasingly looking for banking partners to help them navigate their development and growth.

When asked about the areas where they would use, or consider using, a banking services partner, 33% of investors cite ‘research-driven trade ideas’, followed by ‘data management services to integrate, process, clean and aggregate ESG data’ (31%) and ‘risk managing portfolio with market benchmarks’ (30%). Regionally, Asia-Pacific investors stand out, with 41% using, or considering using a partner, for research-driven ideas, and 39% for data management services around ESG data.

These findings further underline the importance of tackling the data challenges outlined earlier. Though investors have their strategies to manage these risks, they are clearly looking for specific services from external banking partners to help them overcome these hurdles.

Investors believe the strongest partners will be those who excel in terms of their ‘brand reputation on ESG/sustainability’ (51%). This is the topmost priority for investors when selecting an external banking services partner.

They also value a partner’s ‘availability of ESG aligned products and expertise’ (40%) and they want these firms to show a ‘commitment to long-term client relationship’ and have ‘strong/shared sustainability commitments, strategy and track record’ (both 33%).