How investors are tackling the ESG data challenge

- Foreword

- Background

- The ESG data challenge – The main findings

- Data is the biggest barrier to ESG investing

- The data challenges for ESG and sustainability issues

- How investors apply data management techniques to ESG data

- Using a range of data vendors for ESG data

- Reporting on ESG investing and sustainability

- Conclusion

- ESG Global Survey 2023

- ESG Global Survey 2023

- How investors are tackling the ESG data challenge

- Key take-aways

- Foreword

- Background

- The ESG data challenge – The main findings

- Data is the biggest barrier to ESG investing

- Focus on ESG investing and North America

- The data challenges for ESG and sustainability issues

- How investors apply data management techniques to ESG data

- Using a range of data vendors for ESG data

- Reporting on ESG investing and sustainability

- Conclusion

- Institutional investors progress on the path to sustainability

- Foreword

- Background

- How investors define sustainable investments – The main findings

- Key ESG objectives among investors

- How investors apply sustainability in their portfolios

- Methods used for sustainable investing

- Sustainable or ESG investing approaches explained

- ESG investing priorities for active ownership

- Other steps investors are taking towards a low-carbon economic model

- Setting carbon reduction targets

- Conclusion

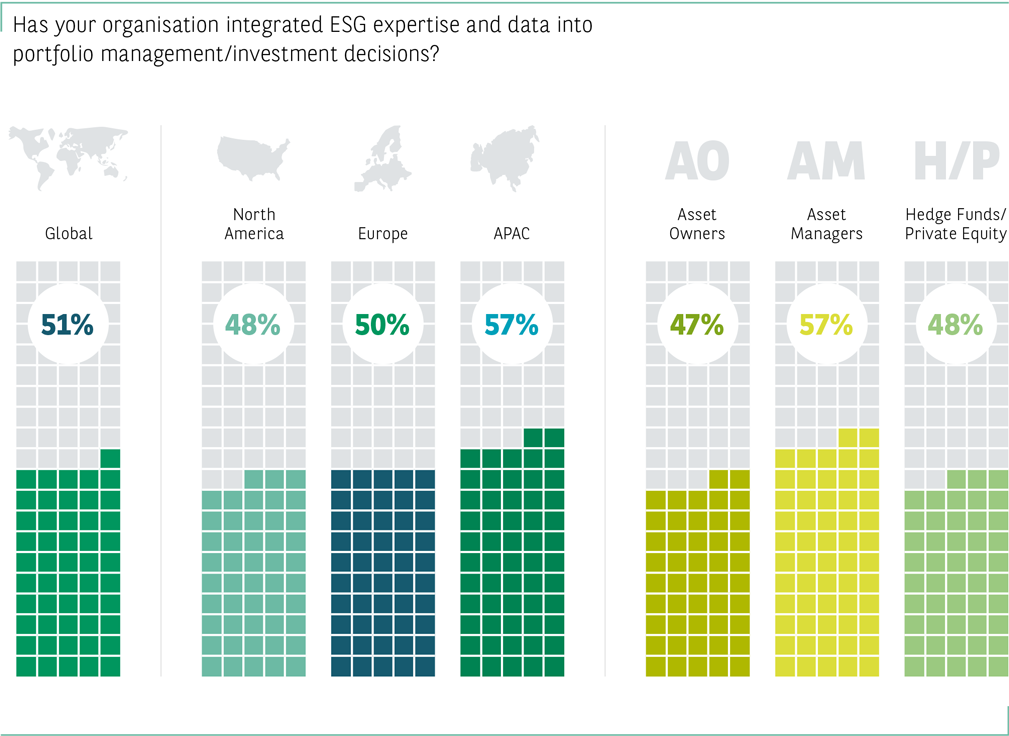

- Integrating ESG Expertise into Operations

- Foreword

- Background – Nurturing integration

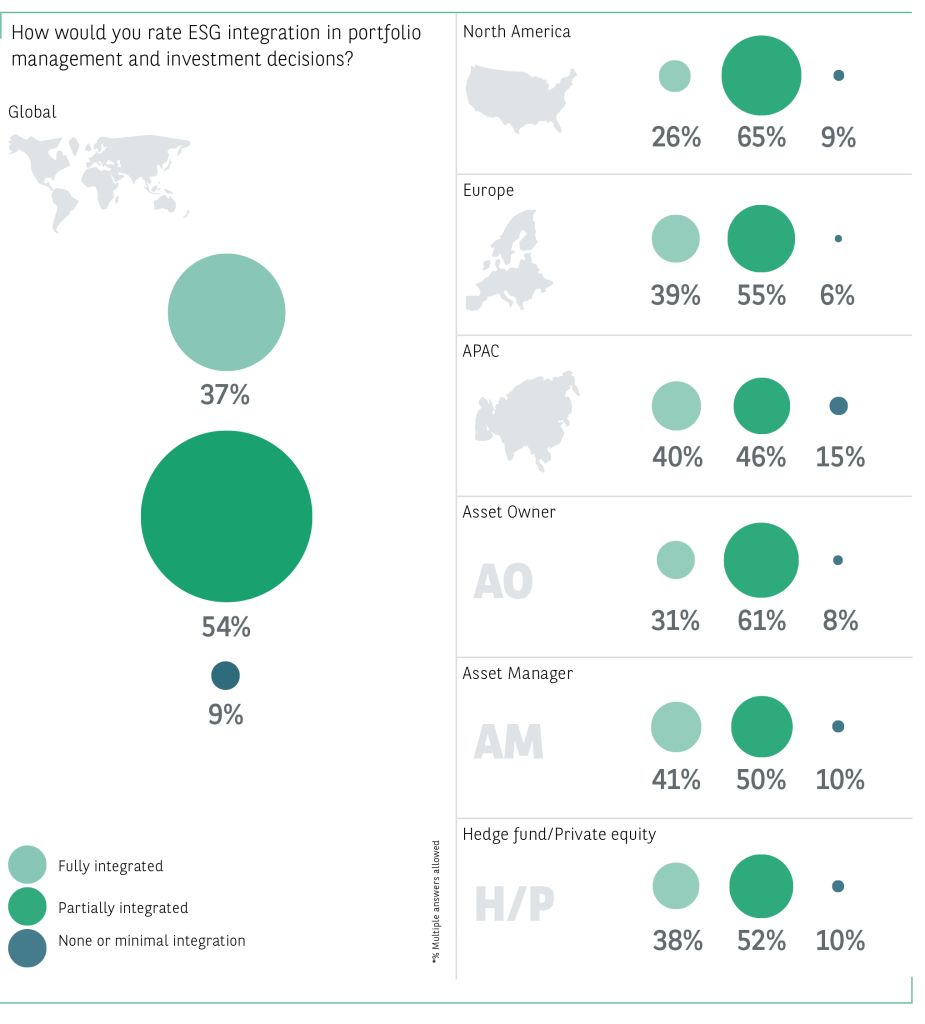

- Driving decisions – Portfolio management integration

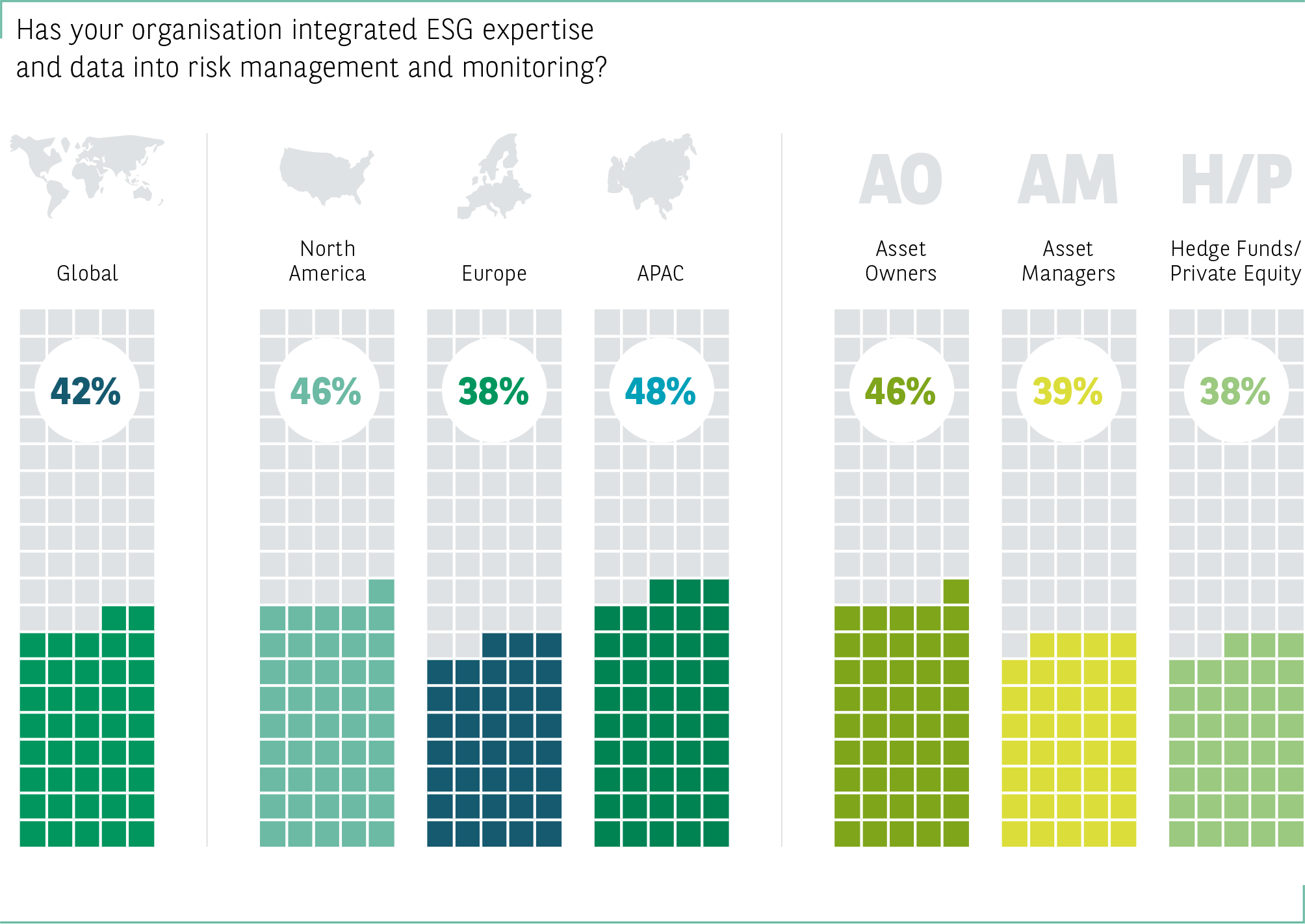

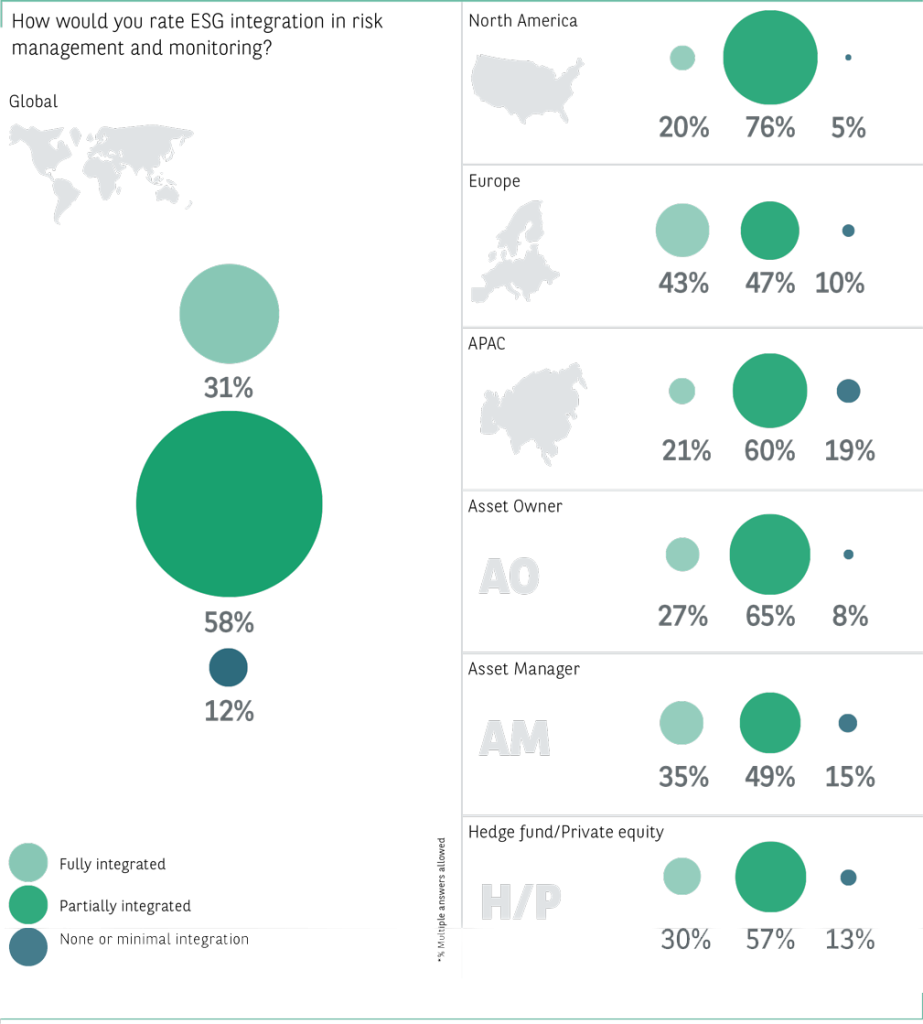

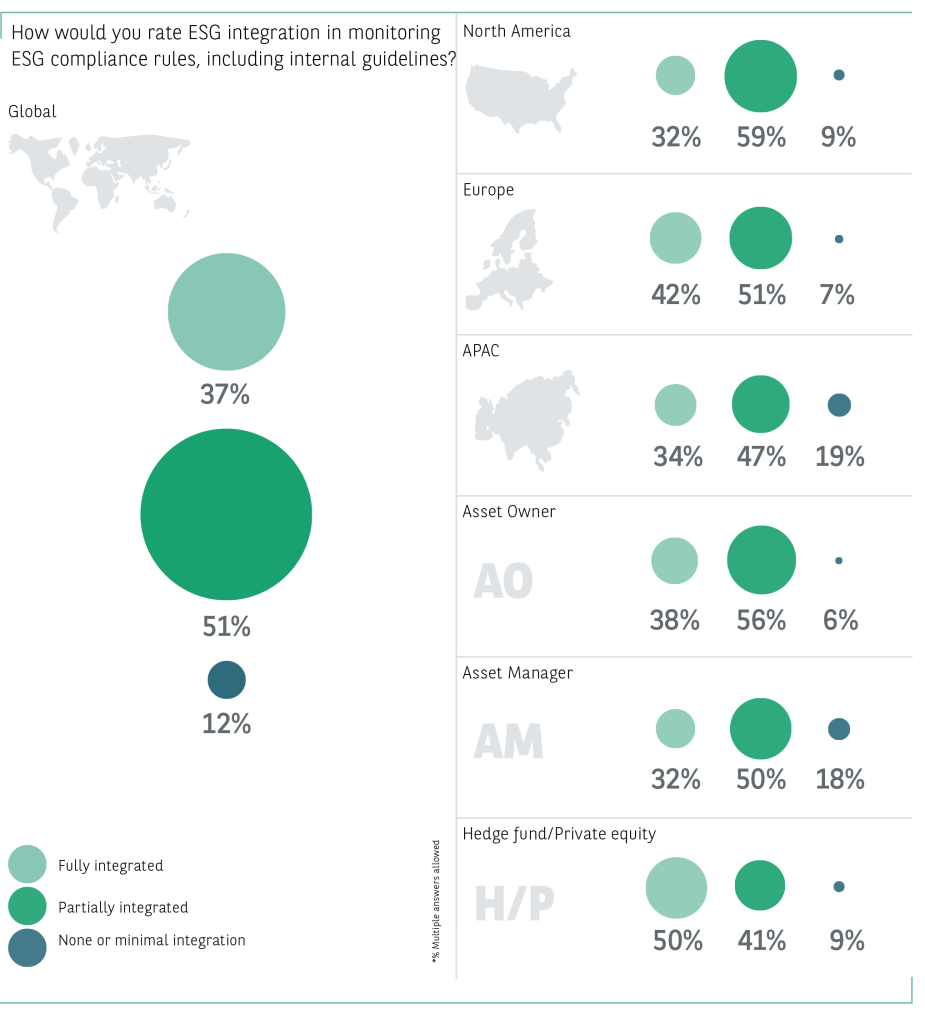

- Multi-faceted risk management

- Close scrutiny – Monitoring ESG compliance rules

- External experts for execution

- A careful choice

- Using a range of data vendors for ESG data

- Reporting on ESG investing and sustainability

- Conclusion

Key take-aways

The following points stand out from the findings and form the basis of this report.

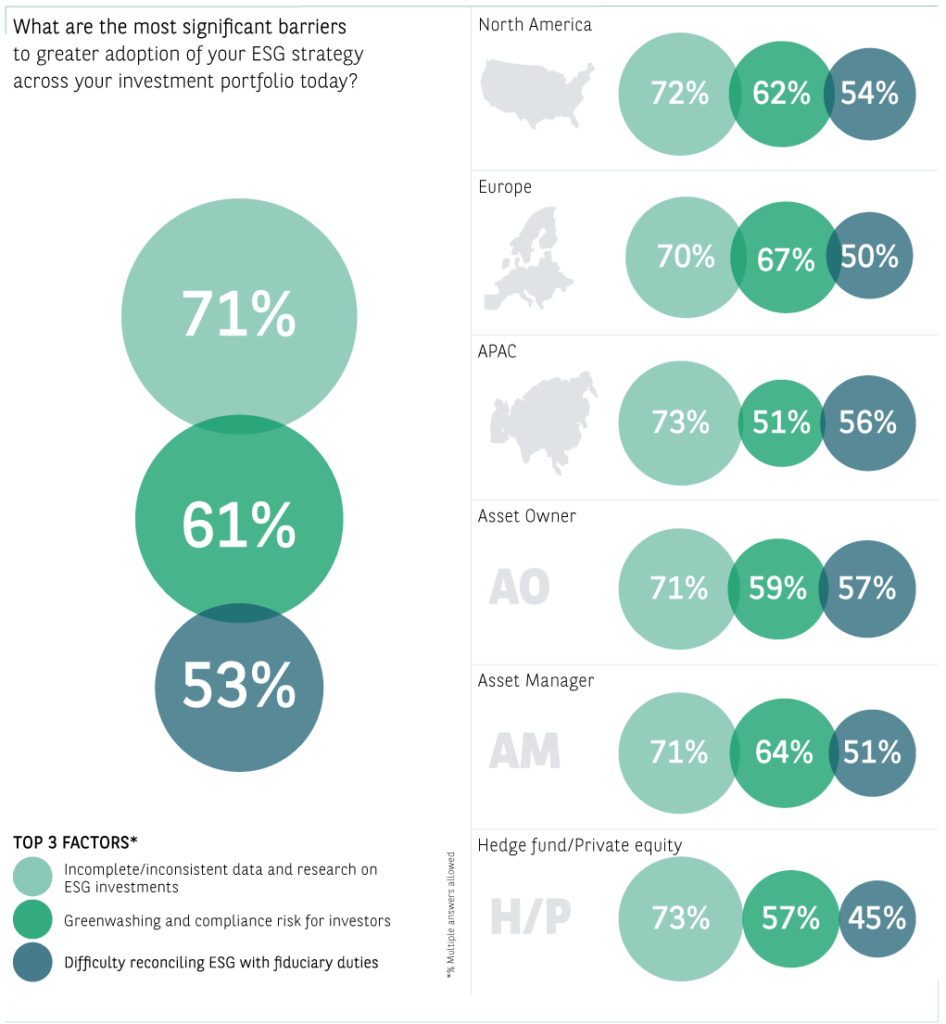

- ESG data remains a major issue for investors. For example, incomplete and inconsistent data and research is most likely to be cited as one of the most significant barriers to greater adoption of ESG investing, by 71% of investors, ahead of greenwashing (61%) or difficulties reconciling ESG with fiduciary duties (53%).

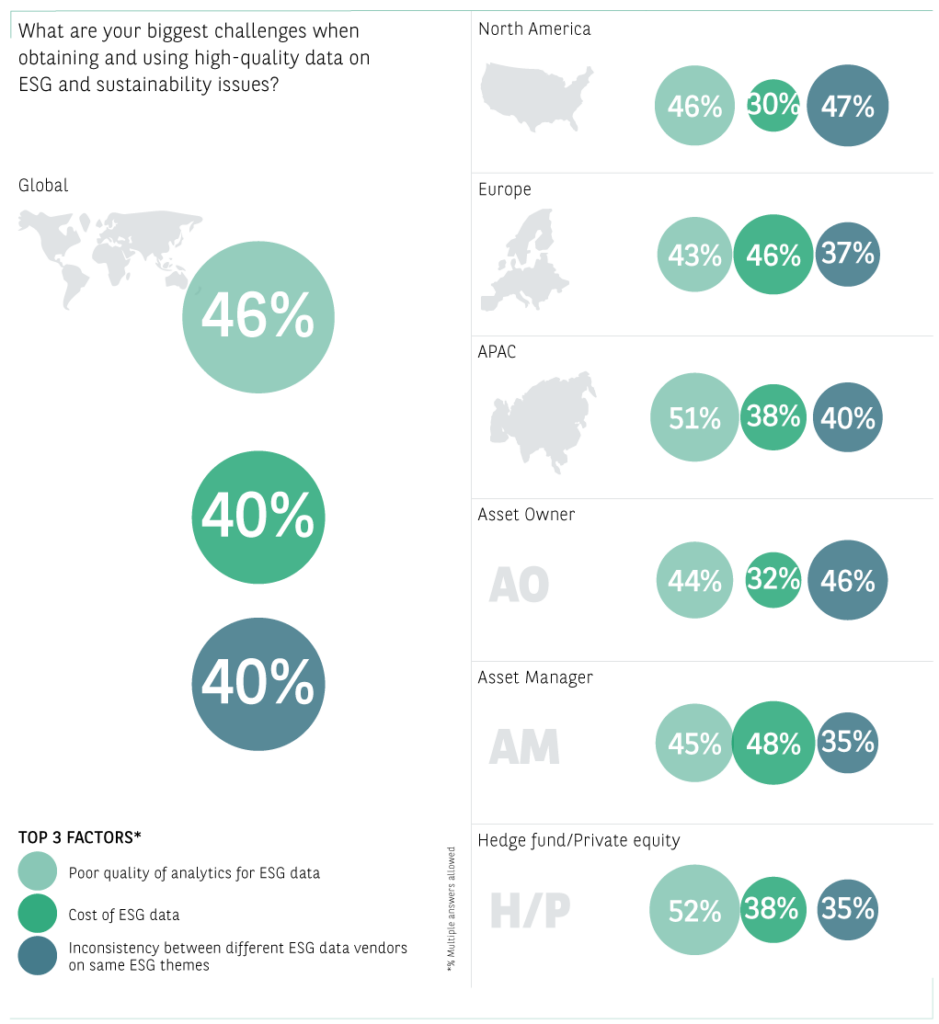

- The biggest ESG data challenges for investors are the poor quality of analytics for ESG data, its costs and inconsistency between different data vendors on the same ESG themes.

- To overcome data challenges, investors are using multiple sources of data, ensuring the transparency of raw data and conducting their own research methodologies, rather than relying solely on external providers. And a quarter of investors use data management techniques as part of their response to ESG data challenges.

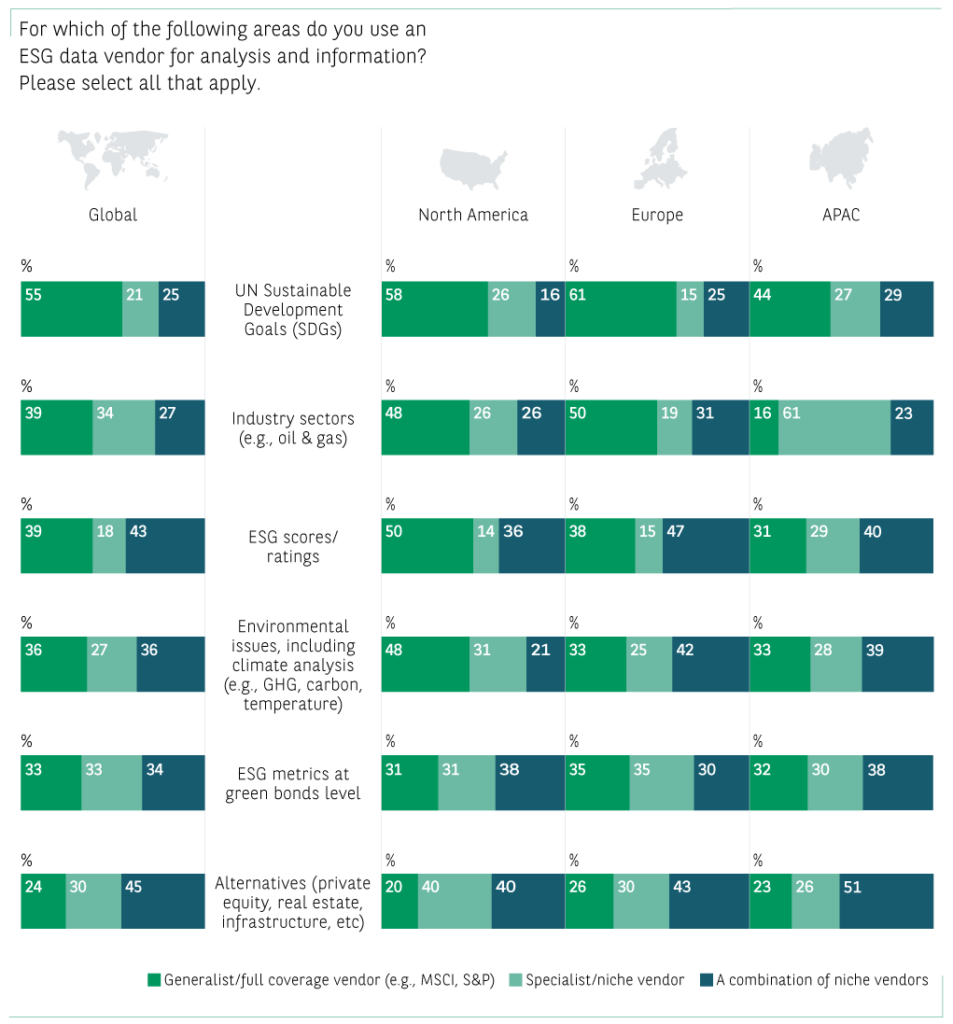

- The most common use of ESG data vendors is for ESG scores and ratings, followed by green bond metrics, environmental issues and for alternative assets. Investors also use both generalist data vendors, where ESG data is part of the overall data offering, and specialist data vendors, who focus on certain aspects of ESG data, such as environmental data. In addition, investors often use a combination of generalists and specialist vendors.

- In terms of reporting on ESG issues, by far the most common approach among investors is to integrate data into existing financial reporting. Other approaches, such as providing raw ESG data, or dynamic data visualisations, or static reporting, are less widely used. New regulations, such as the EU’s Sustainable Financial Disclosure Regulations (SFDR), and adoption of net zero carbon emissions goals will increase the importance of reporting on ESG investing and sustainability.

Foreword

Every two years since 2017, BNP Paribas has conducted a detailed survey on how institutional investors are addressing some of the key issues in environmental, social and governance (ESG) investing. To produce the fourth survey in this series, CoreData Research, working on behalf of BNP Paribas, gathered the views of 420 institutional investors around the world on a range of issues and topics related to ESG investing.

As well as the quantitative survey, a small number of qualitative interviews were undertaken to follow up on some of key issues covered in the survey. Quotes from these interviews have been used in this report to illustrate the survey findings where appropriate.

This is the first of three reports giving key findings and analysis from the 2023 survey and it covers the topic of ESG data for investors. The need for timely and reliable ESG investing data has increased since 2017. Through this paper, we aim to shed some light on the main problems for investors with ESG data and how they are tackling these challenges.

Background

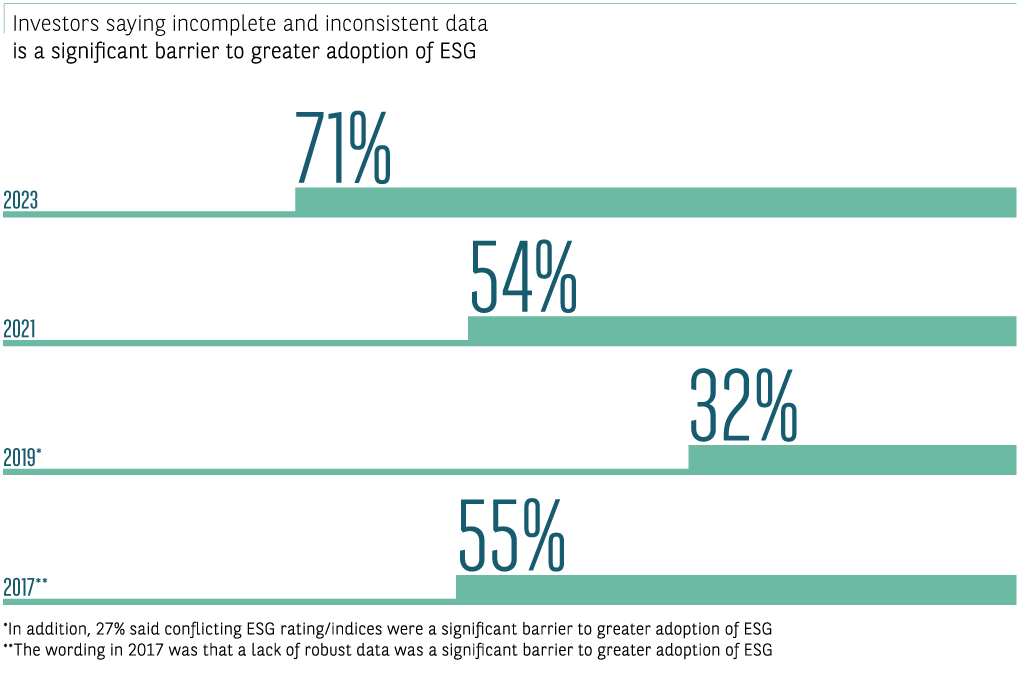

In its 2017 survey on ESG investing, BNP Paribas looked at the changing obstacles to ESG investing for asset owners and asset managers. The 2017 survey flagged up that a lack of robust data was a significant barrier to the adoption of ESG investing to 55% of all respondents, but this was expected to fall to 15% by 2019. Sadly, this expectation was not met; in the 2019 survey, 32% of investors gave the inconsistent quality of ESG data as one of the most significant barriers to greater adoption of ESG, with 27% citing conflicting ESG ratings and indices as a significant barrier. By 2021, over half (54%) of investors agreed that the inconsistent quality of data across asset classes was one of their top three most significant barriers to greater adoption of ESG investing, while 44% said that conflicting ESG ratings and indices were in their top three most significant barriers. These findings show that data has been a major obstacle for investors looking to increase their adoption and integration of ESG investing for some time.

The need for timely and reliable ESG investing data has increased since 2017 for a number of reasons. One is the increased emphasis on tackling climate change by many institutional investors, through decarbonising portfolios and engaging with investee companies, particularly with heavy emitters of greenhouse gases, to push for positive changes. And new regulatory requirements, such as the European Union’s Sustainable Finance Disclosure Regulation (SFDR), require greater transparency on the disclosure of information related to sustainability. Another driver for more and better ESG data is the growing use of impact investing, where investors seek to make a measurable, positive contribution to their ESG goals. Now in 2023, as we see above, ESG data is even more of an issue for investors, with 71% citing it as a significant barrier to the greater adoption of ESG investing. Why is this the case, given the growth of ESG investing since 2017? What are the main problems for investors with ESG data and how are investors tackling the challenges they face? This report looks at these issues and attempts to provide some illuminating answers.

The ESG data challenge – The main findings

Obtaining accurate and reliable data is a vital requirement for investors for a range of reasons, including performance measurement, risk management, assessing competing investment opportunities and disclosing on the progress of their ESG commitments. Indeed, investment success in public equities or bonds is partly driven by the ability to gather and analyse the constant flow of market data, to find and exploit overlooked anomalies, or to manage assets in the most efficient way.

The rise of ESG investing has added further layers of complexity to the use of data by investors. Increasingly, investors using ESG investing strategies want data that is forward-looking and covers emerging topics and approaches, such as decarbonisation, biodiversity or impact investing. ESG investing data can be quite different to the traditional data tools used to assess assets, as it may involve more subjective judgements or data which is hard to find and record. As a result, the lack of reliable and accurate data is often cited as a hindrance for ESG investing. To address these ESG data challenges, investors must find ways to cope with poor quality, incomplete or inconsistent data, including internal data management techniques and working with others to improve the quality of data available to them.

INVESTORS USING

ESG INVESTING

STRATEGIES WANT

DATA THAT IS

FORWARD-LOOKING

AND COVERS EMERGING TOPICS

Data is the biggest barrier to ESG investing

When respondents were asked about the biggest barriers to greater adoption of ESG across their portfolios, over seven-in-ten (71%) named incomplete and inconsistent data. This was generally a consistent result, across regions and investor types. One discrepancy was that only 58% of corporate pension funds gave this as a significant barrier, but they were more likely to cite lack of internal and external support and difficulties reconciling ESG with fiduciary duties as significant barriers. An ESG investment specialist at a US corporate pension fund said the lack of top-level commitment at his organisation was the biggest barrier to its adoption of ESG strategies. “It’s just not a priority for the key decision-makers, which is a struggle. We are an USD18 billion company with a team of two people for ESG”, he said.

Incomplete and inconsistent data was followed by greenwashing (61%) and the difficulty of reconciling ESG investing with fiduciary duties (53%), as significant barriers. On this question, there is a relatively high degree of consensus among the regions.

The significance of inconsistent and incomplete ESG data as a barrier to the greater adoption of ESG

For hedge fund and private equity managers, fewer cite difficulties reconciling ESG with fiduciary duties as a significant barrier (45% vs. 53% overall). One reason for this could be that some in this group have embraced ESG investing as enhancing risk management and see sustainability as a positive factor, perhaps on the back of investor demand for hedge funds and private equity funds with positive ESG credentials. Hedge funds and private equity investing could also, through a higher degree of control of the private assets, make use of impact investing, where making a positive contribution to ESG criteria is a key goal.

CORPORATE PENSION FUNDS CITE LACK OF INTERNAL AND EXTERNAL SUPPORT AND DIFFICULTIES RECONCILING ESG WITH FIDUCIARY DUTIES AS SIGNIFICANT BARRIERS

Alongside the findings above, two-thirds (66%) of respondents agreed that undertaking climate analysis is becoming more important to their investment approach. Many investors have now committed to a net zero target with their investment portfolios, and this requires data on carbon emissions to decarbonise their portfolios. A sustainability expert at one Dutch wealth manager commented: “We were only able to commit to targets on climate and carbon footprints in 2020 because before that there was not reliable data on carbon footprints and aligned definitions from around the world”. He said that while scope 1 and 2 data is improving, scope 3 data is still a problem[1] . He added: “On other topics, such as biodiversity, it is still very early days to come up with clear KPIs, targets and goals, because it is very difficult to get that data”.

And where ESG data is provided, inconsistency and incompleteness can be an issue, as the findings show. Views on how to deal with this vary among investors. Some see data inconsistency and incompleteness as inevitable but manageable. For example, an ESG investment specialist at a US pension fund said: “I understand that different data providers have different processes. The way to get around inconsistent data is to engage. As a very large asset owner, we are not doing our job if we cannot get company X on the phone to give us some more clarity on an issue”. And an investment manager at a European asset manager specialising in impact investing commented: “We are an active investor and data is one thing, but really understanding an investment is even more important”.

However, ESG data issues can make it harder for an organisation to use bespoke benchmarks that reflect its ESG policies. An investment committee member at a European pension provider explained that it wanted customised benchmarks for its equity and fixed income portfolios, taking into account its adoption of three UN Sustainable Development Goals (SDGs) and its carbon reduction target. “The barrier here is the lack of knowledge and the unwillingness of some providers that are trying to push us to use standardised benchmarks”, he said. Views like this, along with other findings in the survey, show that ESG data is not yet fully meeting the needs of investors.

Focus on ESG investing and North America

The results in this survey show that North American investors often differ to their peers elsewhere when it comes to ESG investing. For example, North American investors are less likely to have made a commitment to net zero by a certain date, such as 2050, (28% vs. 41% globally). On the other hand, the integration of diversity, equity and inclusion (DEI) goals into investment policies is more likely to be a key ESG objective for the North American respondents (54% vs. 41% globally).

INVESTORS OVERALL HAVE CONCERNS OVER POLITICAL OPPOSITION TO ESG INVESTING, THIS RISES TO 48% OF RESPONDENTS IN THE UNITED STATES

One reason for this divergence between North American investors and other regions is that while 40% of investors overall have concerns over political opposition to ESG investing, this rises to 48% of respondents in the United States. However, the level of concern over political opposition to ESG investing is also high in a number of other countries, namely the Netherlands, Sweden, Denmark, Spain and Singapore. A US asset owner said the political backlash against ESG provided a convenient excuse for some: “If you were truly committed and your ESG commitments were not dictated by signal or noise, you will continue. But if you had one foot in and one foot out, then it’s a reason to quit”.

The data challenges for ESG and sustainability issues

Investors have several issues when working with ESG data, with their top three challenges being poor quality analytics for ESG data (46%), the cost of ESG data (40%) and inconsistency between different data vendors on the same ESG themes (40%). Other challenges mentioned include a lack of transparency in non-financial data (31%), aggregation at portfolio level (34%) and data being too backward-looking (25%).

In terms of variation by region or investor type, European respondents (46%) and asset managers (48%) were more likely to give the cost of ESG data as being a top three challenge. Hedge funds and private equity managers (52%) and APAC respondents (51%) were the most likely to give the poor quality of analytics for ESG data as a top three challenge. Within the APAC region, respondents in China are most likely to cite poor quality of analytics for ESG data as a challenge (67%). The chief investment officer at a Chinese asset owner said: “It is very difficult to find sufficient, reliable data in our domestic market. For listed companies, it is possible, but below that, it is very difficult”. For European respondents, the cost of ESG data could be more of an issue than in North America and APAC because Europeans are more likely to use multiple vendors to meet their data needs on issues such as environmental data, or for ESG scores and ratings, raising their data costs.

The biggest challenges when obtaining and using high-quality data on ESG and sustainability issues

Another nuance here is that the cost of ESG data is less of an issue for asset owners (32%) compared to asset managers (48%). This is likely to be because asset managers may need to purchase more data, to ensure the ESG credentials of their investment products and strategies, or risk regulatory issues and greenwashing accusations.

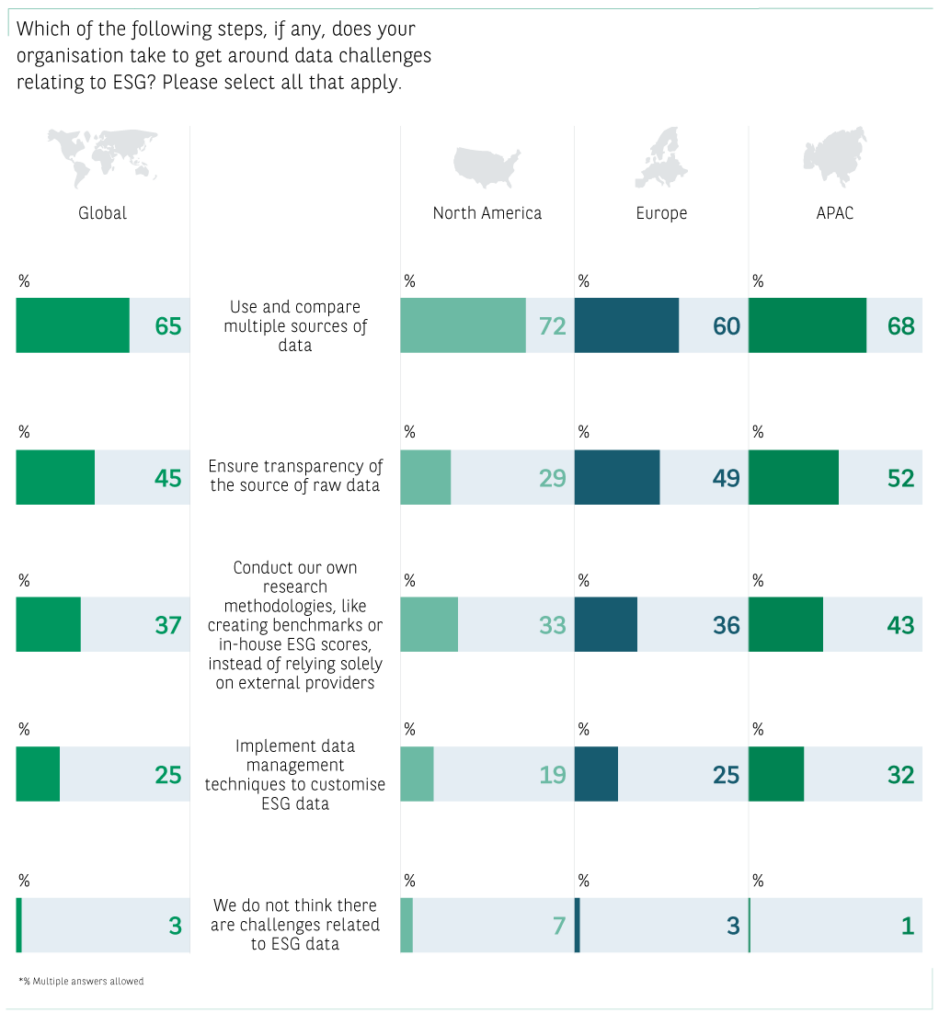

In response to the challenges of ESG data, investors are taking several steps. Almost two-thirds (65%) say that they are using and comparing multiple data sources, while 45% are ensuring the transparency of the source of raw data and 37% are conducting their own research methodologies, such as creating benchmarks or in-house ESG scores, instead of relying solely on external providers.

Each of the regions have their own preferences here: North American respondents are more likely to use and compare multiple sources of data (72% vs. 65% overall), Europeans are slightly more inclined to ensure the transparency of the source of raw data (49% vs. 45% overall) and APAC respondents are more likely to both conduct their own research methodologies (43% vs. 37% overall) and to ensure the transparency of the source of raw data (52% vs. 45% overall).

Looking at investor types, hedge funds and private equity firms (60%) are the most likely to ensure the transparency of the source of raw data, followed by asset managers (47%) and then corporate pension funds (45%) and insurance companies (42%).

THE COST OF ESG DATA IS LESS OF AN ISSUE FOR ASSET

OWNERS (32%) COMPARED TO ASSET MANAGERS (48%)

When investors find discrepancies between data providers, they may dig deeper into the data and how it is generated. A European asset manager explained that it cross-checked data with its portfolio managers, who often know the companies involved well. It also engages with companies if there are differences between their reporting and a data provider’s metrics. He added: “We engage with our three data providers and the companies”. At a Canadian sovereign wealth fund, an investment director said it conducted an in-depth reconciliation process between data vendors, a process he called “data scrubbing”. And an Australian investment manager at a superannuation fund said it sought to verify ESG data. “We have our own ideas around how companies should be scored under different metrics. If we see inconsistencies, we will go and validate the data”. He added that this could involve looking at the providers’ underlying philosophies. “We want the closest alignment between our own philosophies and the provider’s philosophy”.

HEDGE FUNDS AND PRIVATE EQUITY FIRMS ARE THE MOST LIKELY TO ENSURE THE TRANSPARENCY OF THE SOURCE OF RAW DATA 60%

Steps taken to get around data challenges relating to ESG

How investors apply data management techniques to ESG data

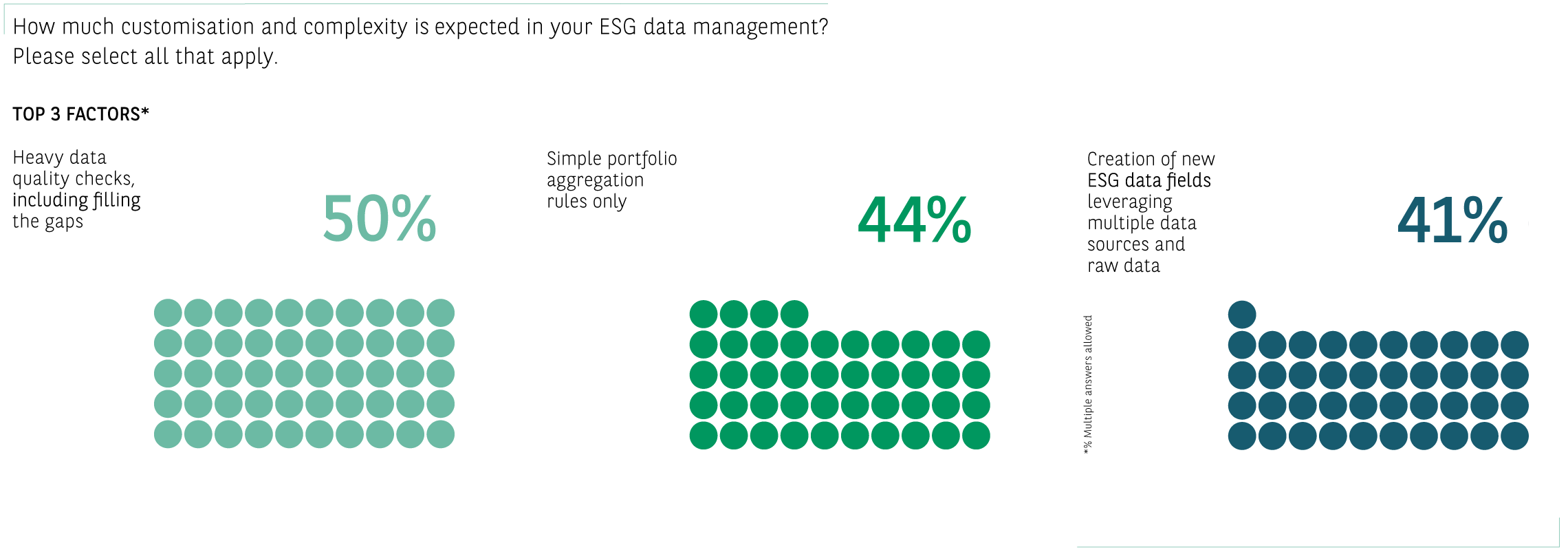

A quarter of the respondents said they implemented data management techniques to customise ESG data. This figure rose to 38% of hedge fund and private equity providers and fell to 21% of asset owners. By region, it is highest in the APAC region (32%), compared to 25% of European respondents and 19% of North Americans. The 25% of all respondents who implement data management techniques were asked about their ESG data management methods used. Half said they use heavy data quality checks, including filling the gaps, 44% use simple portfolio aggregation rules only, while just over four-in-ten (41%) create new ESG data fields by leveraging multiple data sources and raw data.

ESG data management methods used by investors

Data management techniques can involve using assumptions or estimates to fill data gaps. One respondent, at a large Danish pension provider, commented: “We sometimes have had to use the law of big numbers; sometimes it is about averaging out or trying to make guesstimates. We are trying to do the best we can, given the circumstances and given that data can be patchy, or misleading, or point in many directions”. However, data management techniques like this can also be a challenge to investors if they find them in use at their providers. An APAC region portfolio manager said: “If a provider is not covering particular stocks, we found it is quite common that they will apply some kind of machine learning algorithm. Then you really start to get into this world of estimation, as it is assuming two companies in the same industry broadly look the same. The degree of estimation that some of the providers use is a challenge for us”.

But data management techniques can be innovative in their scope. An example of the creation of new ESG data was brought up by a Dutch asset manager which specialises in real estate. It wanted to stress-test physical risks so has formed a partnership with a large insurance company. “We are the real estate specialists, and they are experts in how to price climate risk. We have combined our databases into one, a really big data approach. Every commercial real estate building in the world is in our database. We price specific flooding risk, earthquake risk, or tornado risk, whatever it is, into our systems”. At a North American pension fund, an ESG investment specialist said it was conducting a research project with a respected academic expert on how stocks perform based on labour management standards. “I hope that within a year, we will start to understand that level of financial risk on an asset level basis”, he commented.

25%

OF THE RESPONDENTS SAID

THEY IMPLEMENTED DATA MANAGEMENT TECHNIQUES TO CUSTOMISE ESG DATA

Using a range of data vendors for ESG data

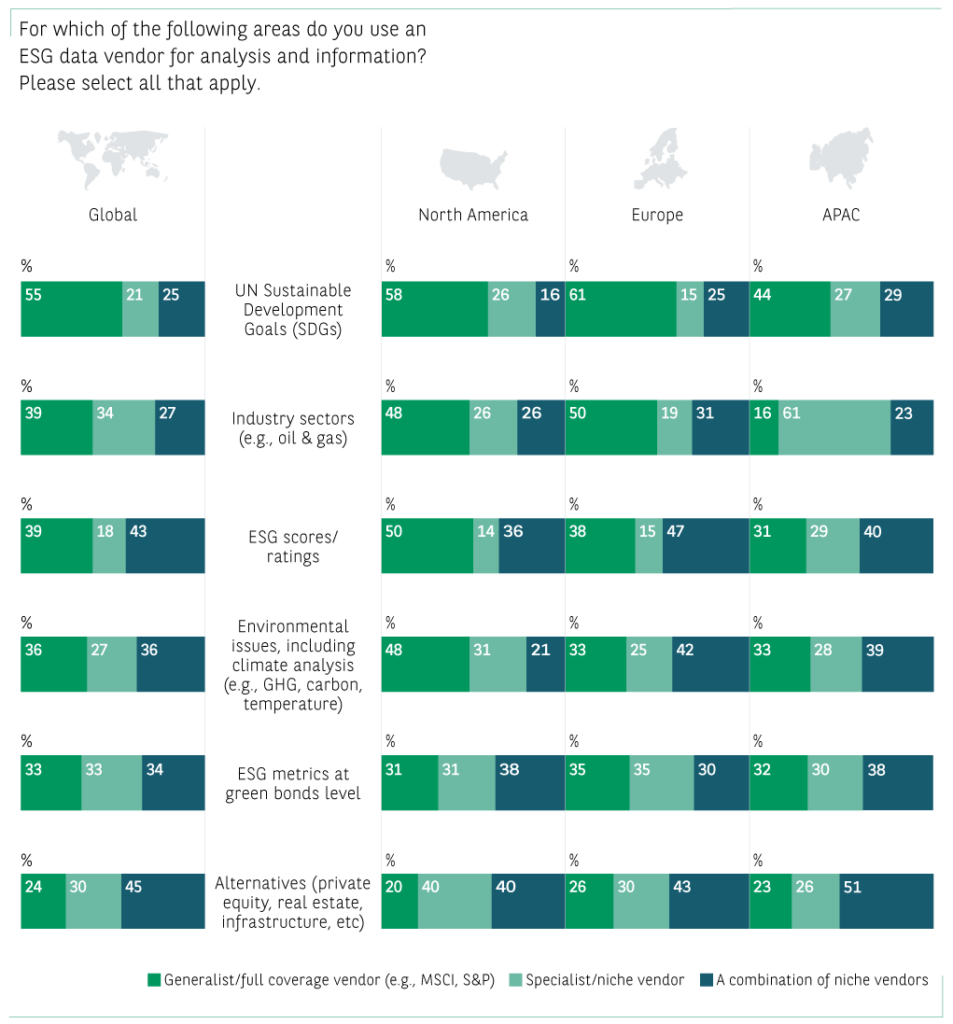

Investors use a range of ESG data vendors to help them understand ESG factors across different asset classes and with different functions, from calculating carbon footprints to proxy voting. They use both generalist and specialist data vendors and a combination of multiple vendors. For example, for UN SDGs, 55% of investors use a generalist or full coverage vendor, which offers a broad range of investment data, such as fixed income credit ratings, as well as ESG data. Overall, looking across the use of generalist vendors, specialist vendors or a combination of multiple vendors for a wide range of scenarios for ESG investing, generalist vendors are used by 40% of respondents, 24% use specialist vendors and 35% use a combination of multiple vendors. For some scenarios, such as for ESG scores/ratings, a combination of multiple vendors is the most popular option (43%), ahead of generalist vendors (39%) and specialist vendors (18%). The UN SDGs have been in existence since 2015, so generalist vendors have had some time to adapt to them. However, when using ESG investing in alternative assets, such as private equity, real estate and infrastructure, investors are more likely to use a variety of vendors to obtain ESG data. Here, 45% use a combination of multiple vendors and 30% use specialist or niche vendors. For alternatives, asset managers are more likely to use both specialist data vendors (34% vs. 30%) overall and combination of multiple vendors (54% vs. 45% overall).

Areas where generalist, specialist or multiple data vendors are used

At a European asset manager, the chief sustainability officer commented on the issues with ESG data for different asset classes: “Our ESG policies in public markets are relatively well-developed because we have the data. On private equity, private debt, real estate, infrastructure and farmland, the ESG policies will be developed in the next few years because the data is lagging, but the potential impact is much bigger. For example, we have had a sustainable farmland fund for two years, but you need to collect the data yourself because there are no data providers in that area”. This comment indicates why the use of multiple data vendors is higher for alternative asset classes.

Investors use a range of ESG data vendors to help them understand ESG factors across different asset classes

In some countries, there is still a limited supply of third-party data on ESG. A Chinese asset owner commented: “In general, in the Chinese market, the data sources are less complete than in the US with Bloomberg and other vendors like that. But the supply of ESG data is improving and I expect it to grow rapidly in the future.”

Larger investors may use more than one of the major data vendors to create a bigger data set. A European investor commented here: “We now use MSCI ESG data, but we also use ISS and Sustainalytics. To complement the data, we bring it all into one database. And if we miss data, we start engaging with those three first”. The importance of data and the use of multiple vendors was described by an investment director at a large Canadian sovereign wealth fund: “We do not have one data vendor, we have dozens. Data is one of our biggest cost drivers”.

One positive development here was flagged up by BNP Paribas Global Head of Sustainability for Financial Institutions Coverage (FIC), Marie-Gwenhaëlle Geffroy, who said: “We are part of a number of industry initiatives on ESG data and we believe that it should be as comparable as possible. In order to do that, we need to work together to define the raw data that we want to access and put it in a common repository. We are working with number of other banks and financial institutions on an accessible open platform for climate data”.

Reporting on ESG investing and sustainability

In terms of their preferences for report formats and approaches, when producing ESG reports, the most popular approach is to integrate this into existing financial reporting, with 72% of respondents ranking this in their top three reporting formats and approaches, ahead of static reports (54%), dynamic data visualisation (53%), data sets and extractions (49%) and raw ESG data (48%). These results are fairly consistent across regions and by investor types. One variation is that asset managers are more likely to use dynamic data visualisation (58%) and less likely to use static reports (49%). This is likely due to a desire for more up-to-date reporting formats among asset managers. In contrast, hedge funds and private equity firms are less likely to use dynamic data visualisation (38%) and more likely to use static reports (62%), possibly because they are smaller organisations with less resources available in IT or reporting.

One reason for the popularity of integrated ESG reporting is that regulators are now starting to require greater disclosure of ESG and sustainability factors. A European pension fund board member commented: “According to European legislation, we have to put more and more information in our annual report, which is currently being audited by our external auditor”. As a result, investors need to ensure that the ESG data used for their annual report is accurate and can be justified. And having raw ESG data could be useful as an input for reporting and to help make investment decisions.

INVESTORS NEED TO ENSURE THAT THE ESG DATA USED FOR THEIR ANNUAL REPORT IS ACCURATE AND CAN BE JUSTIFIED

Conclusion

The ultimate goal for investors is to obtain high-quality data on the widest possible range of asset classes, as they increasingly seek to incorporate ESG and sustainable investing into private markets, real estate, infrastructure and other asset classes.

BNP Paribas’s Marie-Gwenhaëlle Geffroy summed up what is needed: “ESG data must help investors assess portfolios, manage risk, and take into consideration the current and historic impact of the ESG components on performance and strategy. It is more important than ever, if we want to turn sustainability into an opportunity, that ESG data is embedded in investment strategies”. In this sense, ESG data can be compared to a compass, helping investors chart their course and identify the best pathways to profit and impact. In order to act as a compass that can guide investors on the path to investing sustainably and responsibly, ESG data needs to be accurate, available and presented in a way that can be embedded effectively into investors’ overall approach.

[1] Scope 1, 2 and 3 emissions are different categories of greenhouse gas emissions. Scope 1 emissions are directly due to an organisation’s activities and operations, while scope 2 emissions are indirect emissions created by the production of energy that an organisation buys. Scope 3 emissions are harder for an organisation to control, as they are indirect emissions from across a company’s value chain, from customers using a company’s products, or suppliers making products used by a company.

Institutional investors progress on the path to sustainability

- How investors define sustainable investments – The main findings

- Key ESG objectives among investors

- How investors apply sustainability in their portfolios

- Methods used for sustainable investing

- ESG investing priorities for active ownership

- Other steps investors are taking towards a low-carbon economic model

- Setting carbon reduction targets

- Conclusion

- ESG Global Survey 2023

- ESG Global Survey 2023

- How investors are tackling the ESG data challenge

- Key take-aways

- Foreword

- Background

- The ESG data challenge – The main findings

- Data is the biggest barrier to ESG investing

- Focus on ESG investing and North America

- The data challenges for ESG and sustainability issues

- How investors apply data management techniques to ESG data

- Using a range of data vendors for ESG data

- Reporting on ESG investing and sustainability

- Conclusion

- Institutional investors progress on the path to sustainability

- Foreword

- Background

- How investors define sustainable investments – The main findings

- Key ESG objectives among investors

- How investors apply sustainability in their portfolios

- Methods used for sustainable investing

- Sustainable or ESG investing approaches explained

- ESG investing priorities for active ownership

- Other steps investors are taking towards a low-carbon economic model

- Setting carbon reduction targets

- Conclusion

- Integrating ESG Expertise into Operations

- Foreword

- Background – Nurturing integration

- Driving decisions – Portfolio management integration

- Multi-faceted risk management

- Close scrutiny – Monitoring ESG compliance rules

- External experts for execution

- A careful choice

- Using a range of data vendors for ESG data

- Reporting on ESG investing and sustainability

- Conclusion

Foreword

Sustainable investing is adapting to the requirements of investors at a brisk pace. This is hardly surprising, given that it encompasses the three pillars of environmental, social and governance (ESG) issues, all of which are subject to new thinking and innovations. For example, the environmental side of sustainable investing now takes account of emerging issues such as biodiversity loss, as well as climate change, while the debate around diversity, equality and inclusion issues has fed into the social agenda. In addition, investors increasingly want to engage with investee companies as active owners in areas they are prioritising, as part of their governance agenda.

Sustainable investing also uses a wide range of investment approaches, from negative screening and exclusion to ESG integration and the increasingly popular approaches of impact and thematic investing. These approaches are now being applied to most asset classes, including private markets and alternative assets. At the same time, macro-economic issues, such as rising interest rates and the return of inflation, or geopolitical risks, must be considered. And within ESG investing, the emphasis on different aspects varies between regions. For example, North American investors are currently less likely to have made a commitment to net zero than investors in Europe or the APAC region, but they are more likely to have integrated diversity, equity and inclusion (DEI) goals into investment policies. As a consequence of all these issues, sustainable investing is now complex and multi-faceted, while increasingly central to the investment objectives of many investors.

Background

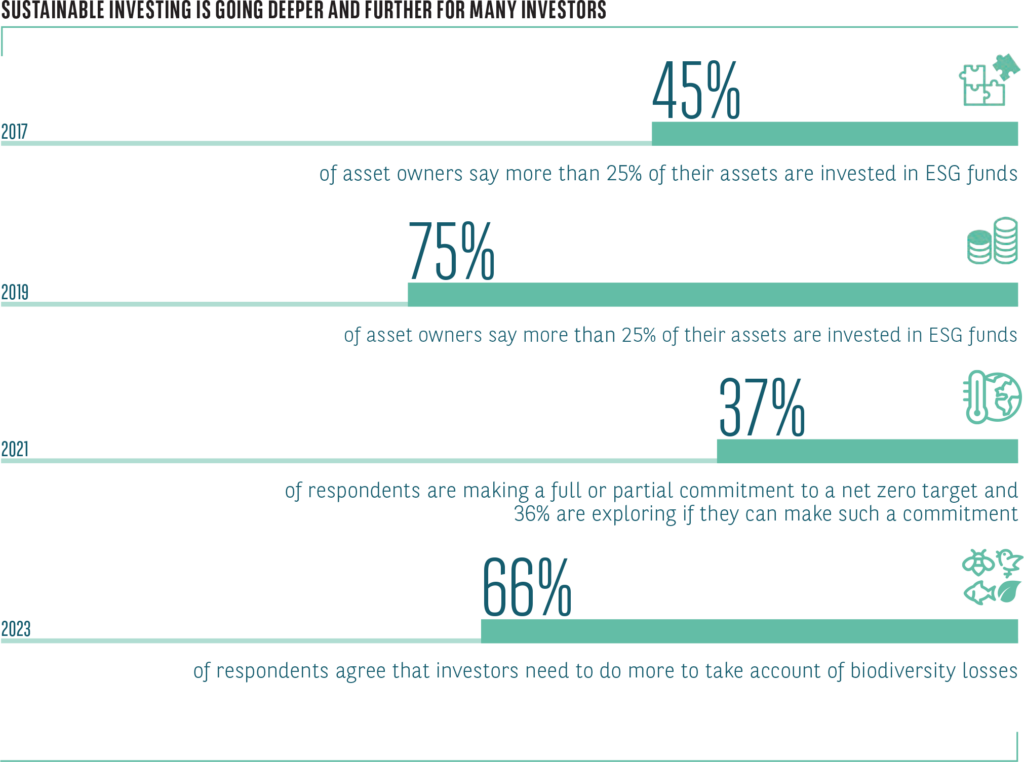

BNP Paribas’s previous ESG Global Surveys show how ESG investing has advanced among institutional investors over the last six years. In 2017, the first ESG Global Survey found that ESG investing was widely used, with 79% of respondents incorporating ESG in how they invested. But while the use of ESG investing was broad in scope, it was also relatively shallow; just under half (48%) of asset owners invested more than 25% of their assets in specific ESG strategies, with a similar result for asset managers. However, ESG usage was on an upward trend, with both asset managers and asset owners saying that ESG strategies or funds would take a growing share of their investments over time.

And the 2019 ESG Global Survey found that ESG investing was becoming more entrenched, with 75% of asset owners saying that more than 25% of their funds are invested in ESG funds. The use of the United Nations Sustainable Development Goals (UN SDGs) was also on the rise, with almost two-thirds (65%) of investors using them to align their investment approach. In terms of the biggest drivers for ESG investing, just over half (52%) of investors cited improved long-term returns and slightly fewer (47%) gave brand and reputation.

Sustainable investing is going deeper and further for many investors

By 2021, commitment to a net zero carbon emissions target was growing among institutional investors, with 37% of respondents making a full or partial commitment to achieve a net zero target through their investments, and another 36% exploring if they can make such a commitment. These findings reflected the importance of tackling climate change for investors, following in the wake of the Paris Agreement of 2015, which aims to limit global warming to 1.5 degrees Celsius above pre-industrial levels. Investors were also responding to new regulations, such as the EU’s Sustainable Finance Disclosure Regulation (SFDR), and to the demands of their internal and external stakeholders. Other key findings included the fact that the S in ESG continued to be seen as the most difficult pillar of ESG to analyse and integrate, while brand and reputation (59%) overtook improved long-term returns (45%) as the biggest motivation for ESG investing among investors.

In 2023, as issues such as climate change become urgent for many, is there now a consensus on what a sustainable investment means for investors? And how does this translate into investment strategies? For investors committed to a net zero target, how is it being implemented? And what differences and similarities are there between investors in different regions on investing sustainably? This report looks at these and other aspects of how investors are seeking to invest sustainably.

IS THERE NOW A CONSENSUS ON WHAT A SUSTAINABLE INVESTMENT MEANS FOR INVESTORS?

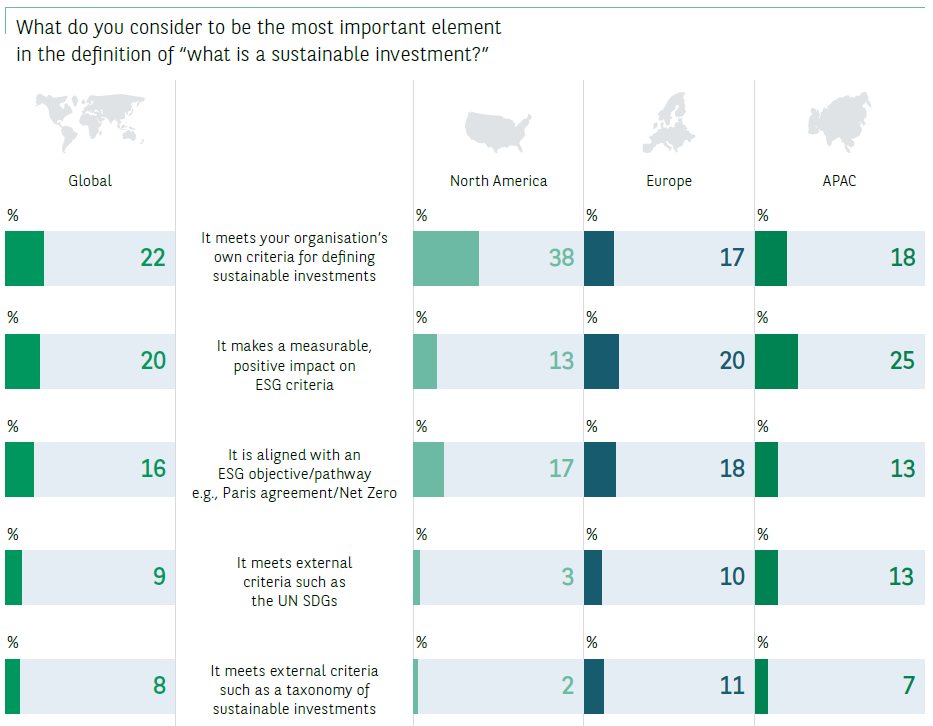

How investors define sustainable investments – The main findings

As part of this year’s ESG Global Survey, respondents were asked for the most important element in their definitions of a sustainable investment. A key point here is that the lack of consensus on the most important element, with only three elements getting more than 10% and none more than 22% on a global basis. This indicates how much each investor’s circumstances are a factor into how they view sustainable investing and their priorities.

The most popular element, for 22% of respondents, is that it meets their organisation’s own criteria for defining sustainable investments. This is by far the most popular element for North American investors, with 42% of US investors selecting it and 30% of Canadian investors. In contrast, only 18% of APAC region investors and 17% of European investors think that the most important element in defining a sustainable investment is that it meets their organisation’s own criteria. These regional differences highlight the difference in regulatory oversight. In North America, investors make their own priority judgements on what is impactful. But in the relatively higher regulatory oversight regions of Europe and Asia, there is less ambiguity for the market to emphasise specific sustainability issues.

IN NORTH AMERICA, INVESTORS MAKE THEIR OWN PRIORITY JUDGEMENTS ON WHAT IS IMPACTFUL. BUT IN THE RELATIVELY HIGHER REGULATORY OVERSIGHT REGIONS OF EUROPE AND ASIA, THERE IS LESS AMBIGUITY FOR THE MARKET TO EMPHASISE SPECIFIC SUSTAINABILITY ISSUES

While organisations will have their own views in Europe and the APAC region, they are more likely to be influenced by policy makers and regulatory bodies, as well as governments, or influential investors. The CIO of a Chinese insurance company said it wanted to start to allocate capital to ESG products, “because in China, the government and the regulator are pushing for companies to accelerate ESG progress”. For some European investors, the equivalent driver is the adoption of Paris-aligned climate goals. In turn, this is leading investors to make a net zero commitment and to reduce their carbon footprint. These are two examples of how investors in the APAC region and Europe are often guided by top-down policies and regulation, whereas North American investors tend to take a bottom-up approach.

ASSET OWNERS ARE MORE LIKELY TO AGREE THAT THE MOST IMPORTANT ELEMENT OF A SUSTAINABLE INVESTMENT IS THAT IT MEETS THEIR OWN CRITERIA FOR DEFINING A SUSTAINABLE INVESTMENT

Asset owners (27%) are also more likely than asset managers (18%) or hedge funds and private equity firms (18%) to agree that the most important element of a sustainable investment is that it meets their own criteria for defining a sustainable investment. In this case, asset managers, hedge funds and private equity firms are likely to be influenced by what their clients want in terms of how they define a sustainable investment.

Investors on the most important elements in a sustainable investment

Overall, the second most popular element in defining a sustainable investment is that it makes a measurable, positive impact on ESG criteria, with a fifth (20%) selecting this. However, this falls to 13% in North America, compared to 20% in Europe and 25% in the APAC region. The overall finding here helps explain why impact investing is becoming an important ESG approach. For example, when asked to define sustainable investing, an Australian super fund investment manager said: “A sustainable investment would be a company or assets that can deliver returns first and foremost, but without compromising on our sustainability goals, around decarbonisation or labour standards, for example”. Elsewhere, impact investing can be even more fundamental. A senior manager at a Dutch asset manager specialising in impact investing said: “The Brundtland Report[1], and how it defined sustainable development, is still the basis of everything we do. We want no negative impacts from our investments for future generations, or for vulnerable societies now”.

While these first two elements in defining a sustainable investment could be quite subjective, the third most popular element is more objective. This is in alignment with an ESG objective or pathway, such as the Paris Agreement or a net zero target, with 16% overall selecting this, although this falls to 13% in the APAC region. This element was less popular among asset owners (13%), than with asset managers (17%) and hedge funds and private equity firms (22%). For the latter, its objectivity is likely to be an advantage in transparently demonstrating the sustainability of a fund or strategy to potential investors and other fund selectors.

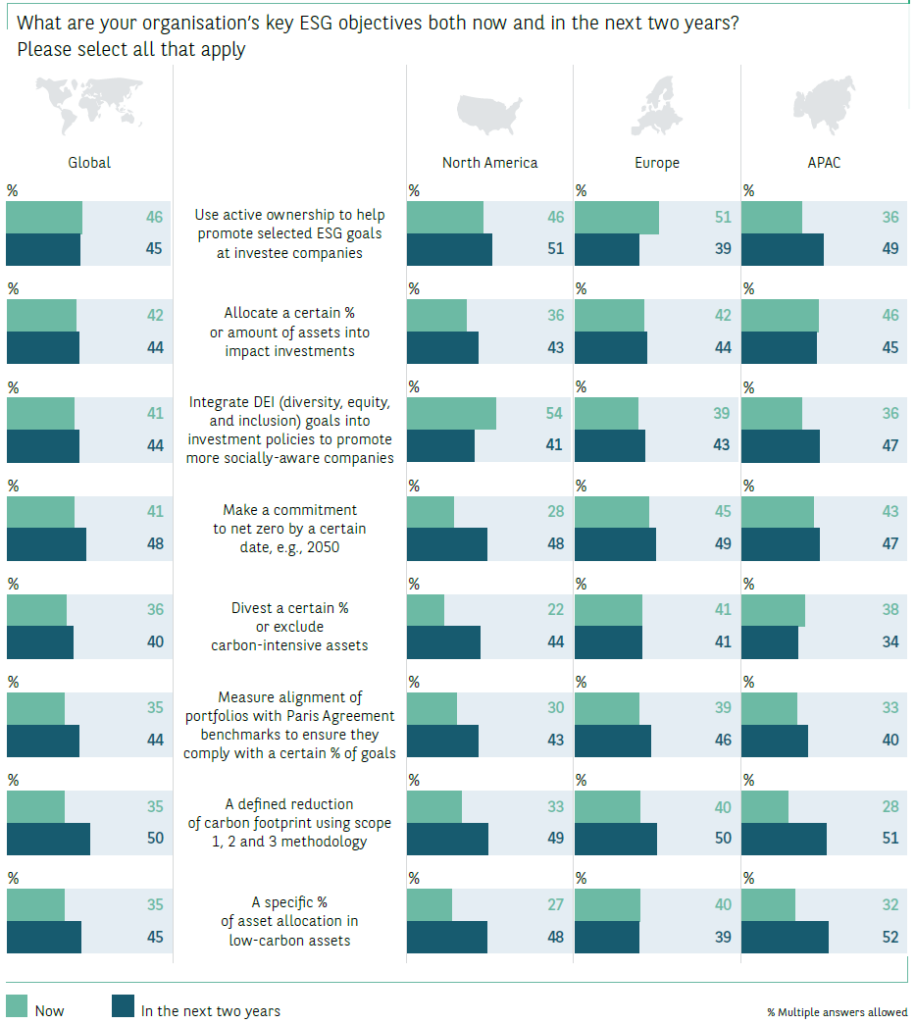

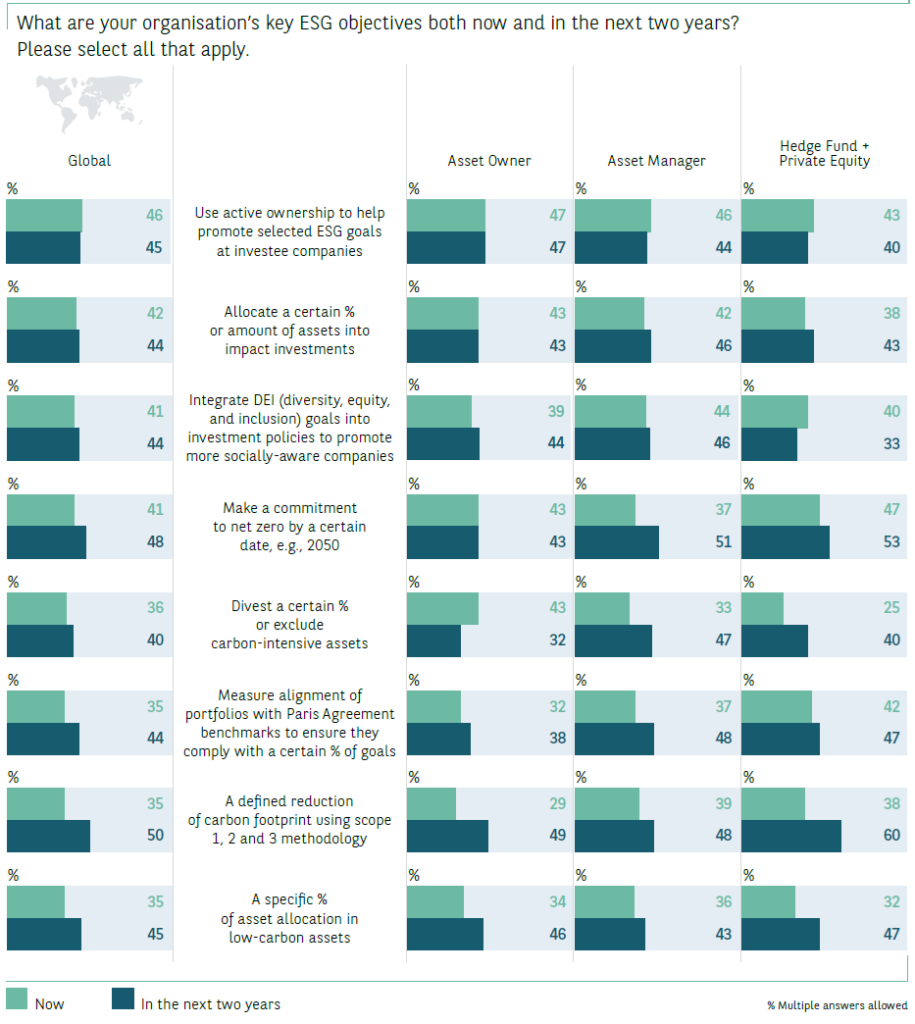

Key ESG objectives among investors

For investors, their key ESG objectives will be a major determinant of how they apply ESG investing to their investment portfolio. On a global basis, the results show that the most popular key ESG objective is to use active ownership to help promote selected ESG goals at investee companies (46%), ahead of allocating a certain amount or percentage to impact investments (42%), integrating DEI goals into investment policies (41%), making a commitment to net zero by a certain date (41%), and divesting a certain percentage from, or excluding, carbon-intensive assets (36%).

These results are all for key objectives now; in the next two years, a defined reduction of an investor’s carbon footprint using scope 1, 2 and 3 methodologies[2] (50%) is the most widely chosen key objective, ahead of making a commitment to net zero (48%), investing in low-carbon assets and the use of active ownership (45%). Looking at these results, it is apparent that there is a trend for investor key ESG objectives to become more focussed on the transition to a low-carbon economy and decarbonisation over the next two years and that this applies across all three regions.

ON A GLOBAL BASIS, THE RESULTS SHOW THAT THE MOST POPULAR KEY ESG OBJECTIVE IS TO USE ACTIVE OWNERSHIP TO HELP PROMOTE SELECTED ESG GOALS

Investor comments in a series of qualitative interviews back up the mix of key ESG objectives and the importance of objectives related to decarbonisation. For instance, an ESG investment specialist at a US pension fund in the healthcare sector said: “We have built out a carbon roadmap, as we have a net zero goal. And then we have five pillars of ESG strategy centred around health equity, climate change, DEI, the circular economy, and data patient safety”. And a Dutch asset manager commented: “We have Paris-aligned climate goals, which were set in 2020. Since then, we have been progressing quite well on decreasing our carbon footprint.”

On a regional basis, there are some large increases in key ESG objectives related to decarbonisation among North American investors and this applies to both Canadian and US investors. For example, the percentage of investors making a commitment to net zero in Canada is rising from 37% now to 57% in the next two years, while the equivalent figures for the USA are 23% now and 43% in the next two years.

Key ESG objectives among investors by region

In a similar vein, the objective of a defined reduction of the carbon footprint using scope 1, 2 and 3 methodology rises among Canadian investors from 43% now to 53% in two years, with a rise from 28% to 47% among US investors. And on divesting or excluding carbon-intensive assets as a key objective, US investors are set to overtake their Canadian peers; the number of US investors divesting from, or excluding, carbon-intensive assets as a key ESG objective will rise from 20% now to 48% in the next two years, ahead of the equivalent results for Canadian investors (from 27% now to 37% in the next two years).

These findings challenge the perception that US investors are less interested than their peers elsewhere in sustainable investing. For US investors, a possible new driver here could be the investment opportunities in green energy and clean tech. A North American asset owner highlighted this approach, saying: “Our sustainability objectives revolve around what we are doing to reduce greenhouse gases, such as investing in electrical vehicles, renewable energy and so on and so forth”.

Key ESG objectives among investors by organisation type

Looking at other findings for key ESG objectives now and in the next two years, there are some intriguing trends. For instance, in Europe, active ownership is set to slip from being the leading key ESG objective now (51%) to the fifth (39%) in the next two years. At the same time, making a commitment to net zero and integrating the DEI goals into investment policy will become more important to European investors. Here, it is possible that when asked about key ESG objectives in the next two years, investors naturally focus more on areas where they plan to increase their activity. So European investors may intend to maintain their use of active ownership and when looking ahead, are focussed on areas where they want to do more, such as the integration of DEI goals into investment policies. The future increase in this in Europe and Asia Pacific could be the significant finding here, while North American investors, where 54% already have it as a key ESG objective at present, move into a ‘use and maintain’ approach, as they step up activity elsewhere.

At the same time, it is also possible that key ESG objectives could fall in importance, if investors feel that they have reached their limit. For example, divesting from carbon-intensive assets is set to fall as a key ESG objective among APAC region investors, from 38% now to 34% in the next two years. This likely reflects that divesting assets becomes more difficult over time. Once the low-hanging fruit is removed, investors need to consider diversification, sector exposure and overall portfolio construction, making it more difficult to jettison investments as the pool of carbon-intensive assets becomes smaller.

In support of this approach by APAC investors, the findings also show that more APAC investors will set key ESG objectives on reducing their carbon footprint and making a specific allocation to low-carbon assets in the next two years, with increases from 28% to 51% for the former and 32% to 52% on the latter.

These findings show that, overall, investors in the APAC region are tackling climate change. They also indicate that making a commitment to net zero will increase as a key objective for APAC investors. At the same time, investors in North America, who plan to increase divestment or exclusion of carbon-intensive assets, may feel that they can do more here, while for European investors, where there is no change in the use of divestment or exclusions, they are seen as a valid option for investors as part of an engagement approach.

There are some common trends for all three investor types, particularly the greater use of a defined reduction of carbon footprint using scope 1, 2 and 3 measures (from 35% now to 50% in the next two years on an overall basis), and of a specific allocation to low-carbon assets (from 35% now to 45% in the next two years on an overall basis). In both cases, all three investor types plan to increase these activities as key ESG objectives. It is likely that these objectives are related, with the aim of a reduced carbon footprint leading to an allocation to low-carbon assets. And these objectives are almost certainly linked to the objective of making a net zero commitment, which is increasing quite sharply at asset managers and to a lesser extent at hedge funds and private equity firms. This shows a strong impetus for action on decarbonisation among investors, with the use of scope 1, 2 and 3 to measure a carbon footprint adding clarity and transparency to this.

By investor type, one key difference is that more asset owners (43%) cite divesting from carbon-intensive assets as a key objective now, compared to asset managers (33%), hedge funds and private equity firms (25%). But this is set to flip in the next two years, falling as a key objective for asset owners (32%), and rising for asset managers (47%), hedge funds and private equity firms (40%). One possible reason here is that asset owners feel that they have tackled this issue, so do not plan to do more in future, while asset managers, hedge funds and private equity firms are further back on divestment and exclusion and are aware that they should do more in the future.

Another possible factor here is that asset owners, such as large pension funds and insurance companies, have been under greater pressure to divest from carbon-intensive assets to reduce exposure and better align to their investor demands. Delphine Queniart, Head of Sustainable Finance Client Engagement, Global Markets, BNP Paribas commented: “Financial institutions are increasingly incorporating sustainability into their investment strategies in a systematic manner, progressively integrating sustainable investing in mainstream asset classes typically from equities to other asset classes. The approaches and focuses of these institutions are closely linked to their stakeholders and the framework they set. We see that while climate (decarbonisation and pathways) is a key priority at present, topics such as DEI, social issues, environmental and biodiversity loss and governance are set to increase in importance as key topics for active ownership”.

How investors apply sustainability in their portfolios

23%

NEARLY A QUARTER OF RESPONDENTS SAID THAT 50% OR MORE OF THEIR EQUITY INVESTMENTS INCORPORATE ESG

Among institutional investors, ESG investing is normally first used in mainstream asset classes, typically equities, and then extended over time to other asset classes, such as fixed income, private markets, real estate, and other asset classes.

This trend can be seen when investors are asked what percentage of their allocations to different asset classes use ESG investing. Nearly a quarter (23%) of respondents said that 50% or more of their equity investments incorporate ESG. For fixed income, 15% of respondents say 50% or more of their fixed income investments incorporate ESG. ESG is also being incorporated into private debt and equity, with 17% of respondents having 50% or more of their private debt/equity investments incorporating ESG.

Use of ESG by asset class (% of respondents with 50% of more of investments incorporating ESG)

In general, European investors are more likely than North American and APAC investors to have 50% or more of their investments in the asset classes above incorporating ESG. The exception to this is Canada, as the countries with the highest percentages of respondents with more than 50% of their equity investment incorporating ESG are Canada (43%), France (40%), Sweden (33%), Denmark (45%), Spain (30%) and the UK (33%). In contrast, only 5% of US respondents have 50% or more of their equity investments incorporating ESG. For US investors, a higher percentage of respondents, 57%, compared to 37% overall, have between 1% and 25% of their equity investments incorporating ESG. A similar pattern can be seen for the use of ESG in fixed income investments, with more European investors with 50% or more of their fixed income investments incorporating ESG, than APAC or North American investors.

For investors, increasing the range of asset classes used for ESG investing poses various challenges. A European pension fund investment manager said: “On the credit side, the issue, especially for leveraged loans, is that less than 10% of the companies are public and data is sporadic. Often you must use the sector or industry average for a company when you don’t use real numbers”. The same challenge can apply to private market assets, as a European asset manager said: “On private equity, private debt, real estate, infrastructure and farmland, our ESG policies are to be developed in the next few years, because the data is lagging, but the potential impact is much greater”.

IN GENERAL, EUROPEAN INVESTORS ARE MORE LIKELY THAN NORTH AMERICAN AND APAC INVESTORS TO HAVE 50% OR MORE OF THEIR INVESTMENTS IN THE ASSET CLASSES ABOVE INCORPORATING ESG

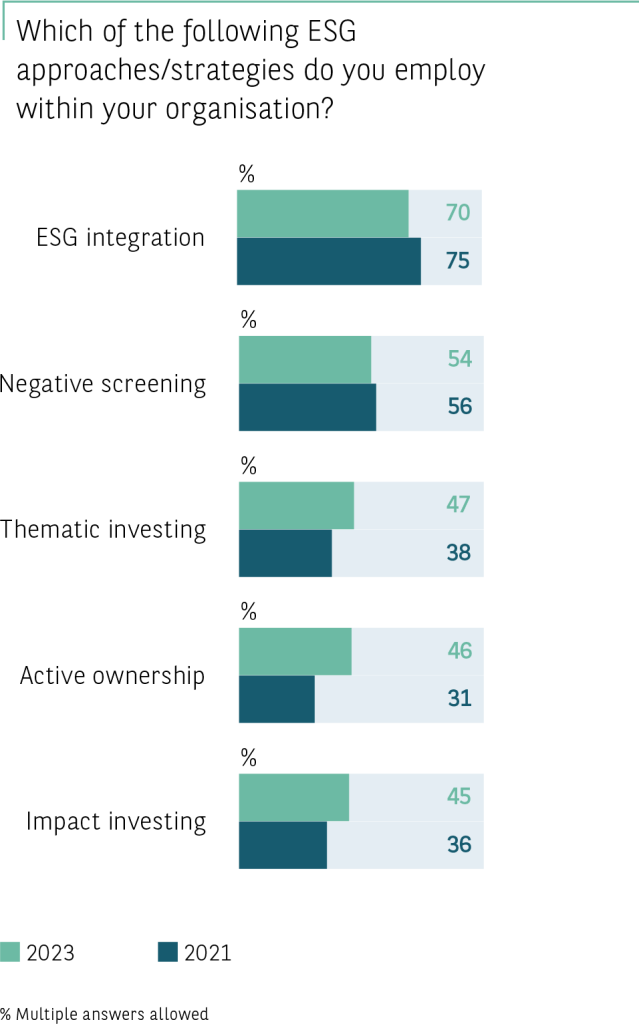

Methods used for sustainable investing

Investors use a wide range of approaches to ESG investing and this is evolving over time. At present, ESG integration is the most widely used approach, by 70% of investors globally, followed by negative screening (54%), thematic investing (47%) and impact investing (45%).

European investors are the biggest users of these techniques; 75% of European investors use ESG integration, 54% use negative screening, 53% seek to invest in the best in class in a particular sector and 52% use impact investing. APAC investors are keen on negative screening (62% vs. 54% overall). While North American investors have lower usage rates for these ESG approaches, ESG integration and negative screening are two approaches they favour now. By organisation type, asset owners stand out here for their use of active ownership (51% vs. 46% overall), while asset managers make more use of negative screening and impact investing than most respondents. Hedge funds and private equity firms use ESG integration more than the average score for respondents but make less use of active ownership and impact investing.

ESG INTEGRATION IS THE MOST WIDELY USED APPROACH, BY 70% OF INVESTORS GLOBALLY

Sustainable or ESG investing approaches explained

ESG integration means taking financially material ESG considerations into account in the investment decision-making process. By doing this, investors believe that they can enhance risk management and may improve future returns.

Negative screening is the use of a screen, or filter, to exclude certain investments, such as companies with negative ESG characteristics, or activities or sectors that an investor wants to avoid.

Best in class investing means investors focus on finding companies which are highly rated on ESG criteria. It can be used when investors allocate to sectors where many companies are poor performers on ESG criteria, but some exposure to the sector is considered important.

Thematic investing is investing with a focus on activities seen as benefiting from long-term trends, such as a shift to renewable energy and clean tech.

Impact investing is the process of investing with the objective of making a positive, measurable impact on ESG criteria while also generating a financial return.

Active ownership refers to engaging with an investee company by shareholders, through a dialogue, voting and other steps, with the aim of positively influencing the company’s approach to environmental, social and governance matters. Ultimately, if shareholders believe active ownership is not working, they may decide to divest, or sell their shares in a company.

ESG approaches used now and within the next 2 years by region

Asking respondents about the methods they expect to play a part in the next two years shows some interesting changes from the approaches in use now. The focus on ESG integration (70% to 52%) and negative screening (54% to 44%) is expected to fall, while the use of impact investing increases from 45% to 54%. Active ownership also rises from 46% to 50%, while there is a small increase in the use of best in class, where investors select the best stocks on an ESG scorecard in a particular sector, from 43% to 46%.

The point to note here is that impact investing and active ownership are approaches to ESG investing which aim to bring about positive changes through how assets are invested and how investors fulfil their ownership responsibilities. It can also be argued that best in class investing is similar, as it involves selecting the best investments from an ESG perspective in a sector. Greater use of these approaches then ties into investors’ plans to reduce their carbon footprint and work towards net zero targets.

It is also noticeable that this trend applies to all three regions. For impact investing, its use is set to rise from 39% of North American investors and 38% of APAC investors now, to 46% and 58% of investors respectively. For Europe, the rise is from 52% of investors now to 56% within the next two years for impact investing and from 50% to 53% for active ownership. The increase in the use of impact investing is also seen at asset owners (41% to 51%), asset managers (52% to 58%), hedge funds and private equity firms (38% to 53%). The latter group, hedge funds and private equity firms, also expect to see a large increase in their use of active ownership, from 35% to 53%.

IMPACT INVESTING, USE IS SET TO RISE FROM 39% OF NORTH AMERICAN INVESTORS AND 38% OF APAC INVESTORS NOW, TO 46% AND 58% OF INVESTORS RESPECTIVELY

ESG approaches used now and within the next 2 years by investor type

ESG investing priorities for active ownership

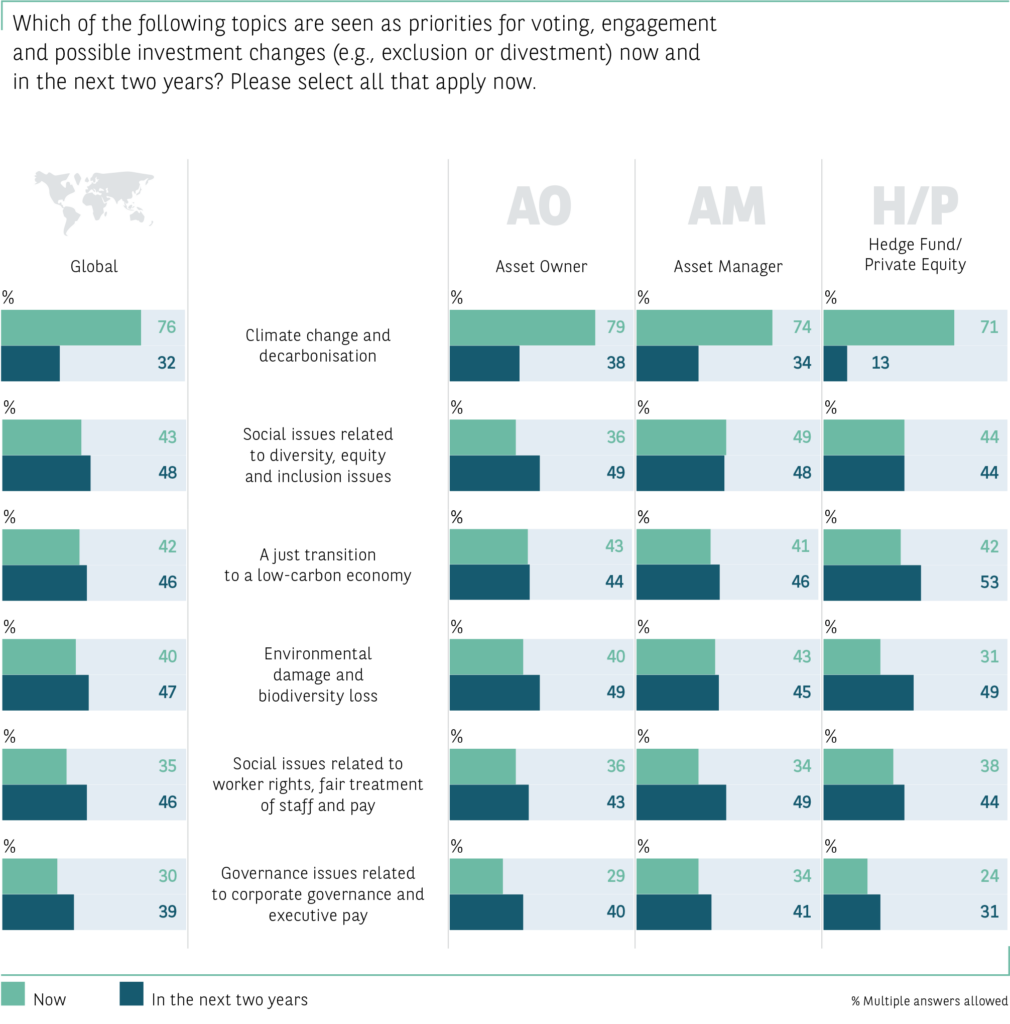

Given that interest in active ownership is rising, it is interesting to note the topics that investors see as priorities now and in the next two years. By a considerable margin, climate change and decarbonisation are the key priorities now, with 76% selecting this ahead of social issues related to diversity, equity, and inclusion (43%), a just transition to a low-carbon economy[3] (42%), environmental damage and biodiversity loss (40%) and social issues related to worker rights, fair treatment of staff and pay (35%). The high priority given to climate change and decarbonisation applies across the three regions and across asset owners, asset managers, hedge funds and private equity firms. This finding ties into other outcomes, such as the increases in net zero commitments and in divesting or excluding carbon-intensive assets, as key ESG objectives.

Active engagement with companies over carbon emissions is seen as crucial to the transition to a low-carbon economy.

Topics seen as key priorities for voting, engagement, and possible investment changes now and in the next two years

This is illustrated by a European asset owner, who spoke about how investors can work with energy companies to help them move away from using fossil fuels towards renewable energy sources, such as offshore windfarms. “It’s about changing a company from A to Z, rather than just investing in it once the change has been made”, he said. As such, active ownership can mean, as a US asset owner explained, engaging with companies that are struggling to become more sustainable. “When we engage with laggards, it’s not that they think climate change is an immaterial factor. They want to work on it, but they don’t have the buy-in, or the resources to make that change.”

Over the next two years, investors plan to increase their voting, engagement, and possible investment changes, such as divestment and exclusion, to a broad spread of ESG issues and there are some distinct regional variations. On an overall basis, climate change and decarbonisation are priority topics for only 32% of investors in the next two years, a big change from 76% now. Given the overall investor interest in decarbonisation, as shown by investors’ key ESG objectives, this finding can be interpreted as showing how investors want to increase the attention given to a range of topics, rather than abandoning the issues of climate change and decarbonisation. As part of this, investors may also have set up processes to deal with companies on decarbonisation, which should lead to more targeted engagement on climate issues. For example, a European asset manager said: “In general, the majority of our investee companies have a set of science-based targets that are aligned with what we expect from them. Where that’s not the case, there is an engagement trajectory.” Another European asset manager explained that, through the increased ESG data provided by the SFDR, it is now in the process of using the implied temperature rise (ITR), which calculates how many degrees temperature rise a company is aiming at through its climate action plan. “We are trying to get a grip on that and are planning to use that in our engagement, probably with companies that are most at risk”, she commented.

In Europe and the APAC region, environmental damage and biodiversity loss will be a key topic for more investors in the next two years than now, while for North American investors, a just transition to a low-carbon economy will become a more important topic. We can also see those social issues, both around DEI issues and worker rights, are increasing as priorities in Europe and the APAC region, but not in North America, where they are decreasing as priority topics. Again, this could be because North American investors are downplaying future action on DEI issues, as this has been a focus for some time, whereas APAC and European investors see it as an area where they plan to do more. However, the US was the only region where a majority of investors see the just transition becoming a key priority for in their strategies over the next 2 years. One possible reason for this is that because of the importance of the oil and gas sector in the US economy, investors are aware that if it is to be replaced by greener energy, then a just transition is needed to support communities and workers currently dependent on the oil and gas sector.

For asset owners, environmental damage and biodiversity loss (40% to 49%), social issues around DEI issues (36% to 49%), social issues around worker rights (36% to 43%) and governance issues (from 29% to 40%) are all set to increase in importance as key topics for active ownership. For asset managers, the biggest increases are on social issues around worker rights (34% to 49%) and governance issues (34% to 41%), followed by a just transition to a low-carbon economy (41% to 46%). And for hedge funds and private equity firms, there are increases for environmental damage and biodiversity loss (31% to 49%), a just transition to a low-carbon economy (42% to 53%), social issues related to worker rights (38% to 44%) and governance issues (24% to 31%).

THE US WAS THE ONLY REGION WHERE A MAJORITY OF INVESTORS SEE THE JUST TRANSITION BECOMING A KEY PRIORITY FOR IN THEIR STRATEGIES OVER THE NEXT 2 YEARS

Key priorities for voting, engagement and possible investment changes

Overall, the survey results show that over the next two years, for the 50% of respondents who plan to use active ownership as part of their ESG investing approach, they intend to prioritise several topics. While climate change and decarbonisation are a key priority at present, other topics will also become important in the minds of investors soon. Asked about how their active ownership approach will evolve, a European asset manager said: “Health will be a topic going forward, which will translate into the food transition and that is also connected with biodiversity. Another theme for us is the circular economy and that will translate into the materials transition”.

WHILE CLIMATE CHANGE AND DECARBONISATION ARE A KEY PRIORITY AT PRESENT, OTHER TOPICS WILL ALSO BECOME IMPORTANT IN THE MINDS OF INVESTORS SOON

Other steps investors are taking towards a low-carbon economic model

41%

THIS YEAR’S FINDINGS SHOW THAT JUST OVER FOUR-IN-TEN INVESTORS HAVE A KEY OBJECTIVE OF MAKING A COMMITMENT TO NET ZERO BY A CERTAIN DATE

In 2021, the ESG Global Survey found that net zero was an important component of ESG investing, as institutional investors started to adopt the goal of net zero carbon emissions by a certain date, usually 2050, to support the Paris agreement on limiting climate change. In 2021, 37% of investors had made a public commitment to a net zero goal, while 36% were actively investigating the feasibility of implementing a net zero policy at their organisation.

This year’s findings show that just over four-in-ten (41%) investors have a key objective of making a commitment to net zero by a certain date, such as 2050. This rises to nearly half (48%) of all investors in the next two years, with little difference between the three regions.

Looking at the data, there is, as would be expected, a strong relationship between investors with a commitment to net zero which is one of their key ESG objectives and the number of decarbonisation activities they are undertaking. While 41% of investors overall have a commitment to net zero as a key ESG objective now, this rises to 48% for investors using three or more decarbonisation activities. In addition, while 44% of investors say that portfolio decarbonisation is either a high priority or a top priority now or in the next two years, this rises to 61% for investors undertaking three or more decarbonisation activities.

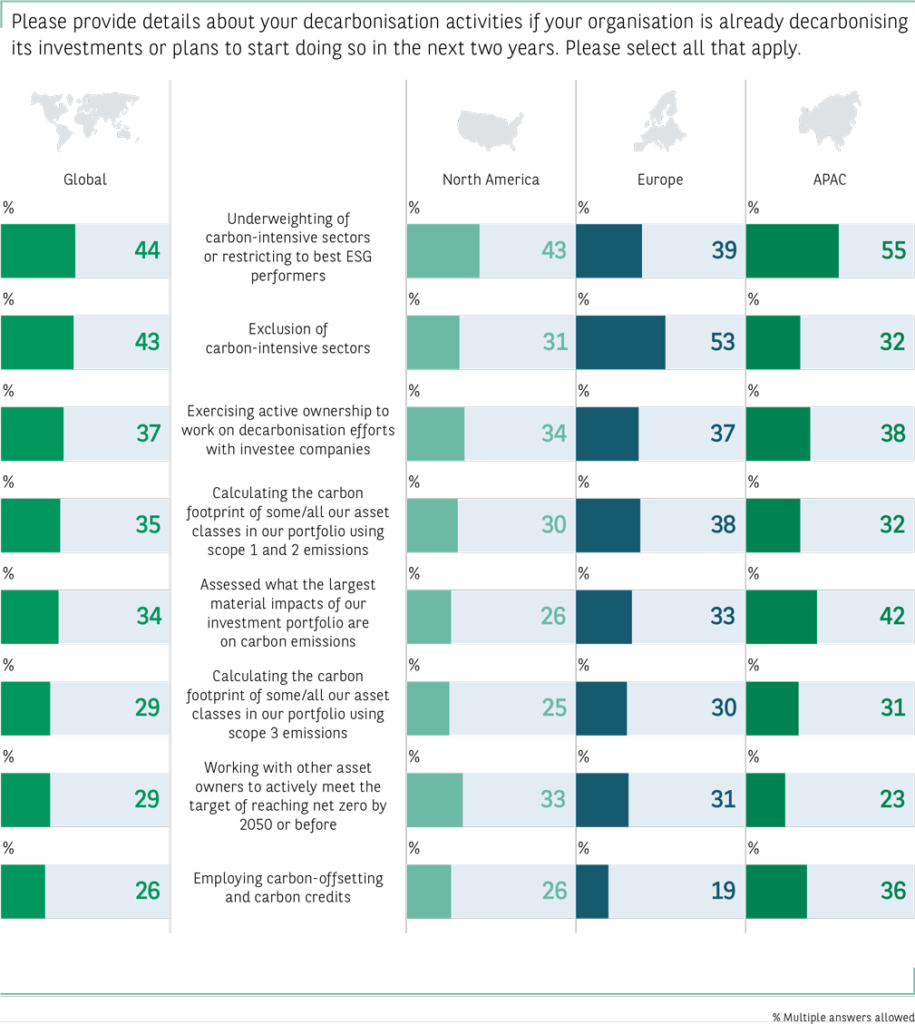

In terms of how they will decarbonise their portfolios, as they have already shown, investors are making use of underweighting carbon-intensive sectors or investing in only the best ESG performers (44%), excluding carbon-intensive sectors (43%), and exercising active ownership (37%). This is followed by steps around measuring their carbon footprint using scope 1 and 2 emissions (35%) and the biggest material impacts of their portfolios on carbon emissions (34%), then other steps, such as working with other asset owners (29%) and undertaking carbon credits and carbon-offsetting (26%).

Among investors who are undertaking three or more decarbonisation activities, the most widely used here are underweighting carbon-intensive sectors or restricting investments to the best ESG performers (53%), excluding carbon-intensive sectors (52%) and calculating the carbon footprint of some, or all, or their assets (49%).

HEDGE FUNDS AND PRIVATE EQUITY FIRMS ARE MORE LIKELY TO USE ACTIVE OWNERSHIP TO WORK ON DECARBONISATION EFFORTS WITH INVESTEE COMPANIES

On a regional basis, APAC investors are more likely to employ underweighting of carbon-intensive sectors, while Europeans are more inclined to use exclusion and less likely to use carbon-offsetting and carbon credits. North American investors are slightly less likely to calculate their carbon footprint and to assess their portfolio’s impact on carbon emissions.

Decarbonisation activities by region

Among organisation types, one point of difference on decarbonisation stands out, which is that hedge funds and private equity firms are more likely to use active ownership to work on decarbonisation efforts with investee companies (53% vs. 39% for asset owners and 30% for asset managers). This finding makes sense, as private equity firms, with board representation and often sizeable stakes in investee companies, have a good opportunity to make active ownership work.

On decarbonisation, investors are very much aware that they are in the early stages of a journey, according to some of their comments. For example, a US asset owner said: “We are still in the process of building out a 2050 net zero plan. We’ve worked with a lot of big pension plans, who might have engagement strategies for 200 to 300 companies. That’s what we hope to do. We want to make renewable energy about 30% of our portfolio in 2040”. And a CIO at an insurance company in China explained how its decarbonisation efforts are in line with Chinese government policy. “Our overall decarbonisation strategy, because of the government requirement for this, is to follow companies that can reach the government’s decarbonisation goals. And we will avoid or divest from companies that are not capable of following the government’s decarbonisation goals”. Investors that have embraced impact investing, such as a European asset owner with a focus on impact investing, often have more ambitious decarbonisation goals:

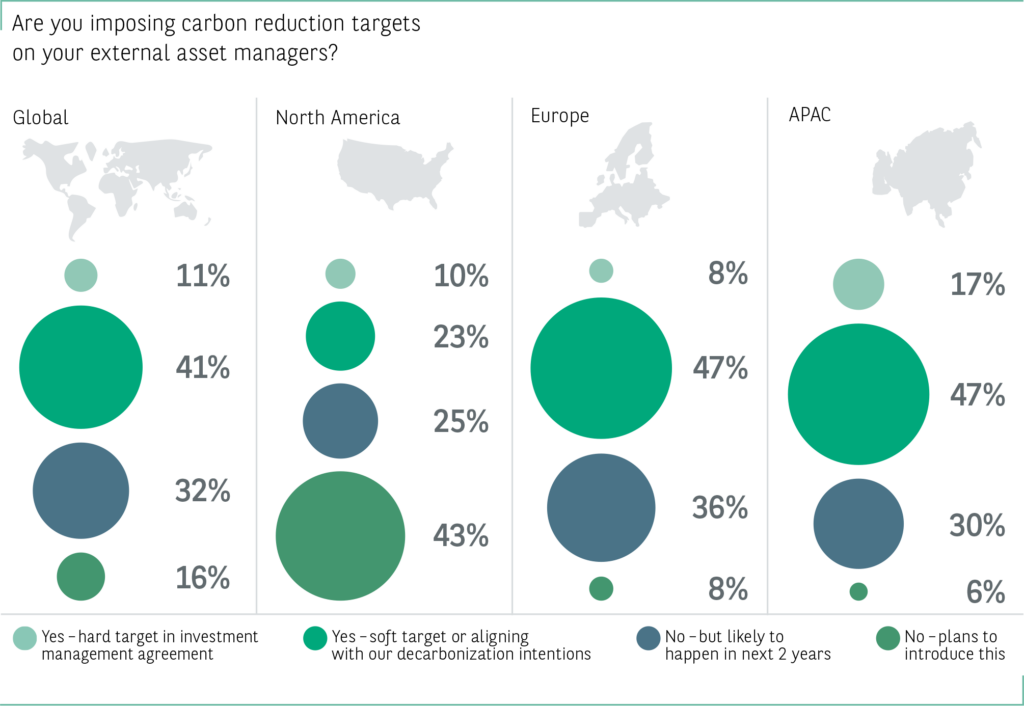

Setting carbon reduction targets

As part of their decarbonisation work, investors must work with other parties, from other investors to their external asset managers. One way of working with asset managers is to set, or impose, carbon reduction targets. Overall, just over half (52%) of investors are doing this. Most investors, 41%, are setting a soft target or working with an asset manager aligned with their decarbonisation goal. But 11% are setting a hard target in the investment management agreement. A further 32% of investors say that although they are not setting a carbon reduction target at present, it is likely to happen in the next two years. Only a minority, 16%, have no plans to introduce carbon reduction targets for their asset managers.

ONLY A MINORITY, 16%, HAVE NO PLANS TO INTRODUCE CARBON REDUCTION TARGETS FOR THEIR ASSET MANAGERS

APAC investors are leading the way here, as 17% have set hard targets, while 47% are using soft targets or an alignment on decarbonisation. European investors are not far behind, with 8% using hard targets and 47% soft targets. And in both regions, more investors plan to start using targets in the next two years; 36% in the APAC region and 30% in Europe. North American investors are some way behind their peers when it comes to carbon reduction targets, with 43% having no plans to introduce then and only a third using them at present.

Investors on their use of carbon reduction targets

One APAC asset owner explained how they use both soft and hard carbon reduction targets for their asset managers. “Some have a hard target to be 40% lower than the market. Others have a risk-based target, for example, for 25 basis points of tracking error, we want the manager to use that tracking error to maximise the carbon reduction”. And a European asset owner, which uses fiduciary management, said it has an ESG dashboard which shows its carbon reduction against a benchmark. This investor also said it wanted to be aligned with its asset managers on sustainability. “We want to be sure that their responsible investing thinking is integrated into all processes. That is checked on a quarterly basis by the fiduciary manager, if there is still the right responsible investing attitude at the asset manager”.

Conclusion

One of the most striking findings in this research is the diversity of views on the most important elements in defining a sustainable investment. This highlights the potential growing gap between having a globally consistent approach to sustainable investing versus individual investor views. This is clearly reflected in the data from our study where we saw a difference between North America and other regions, with investors in the former focussing on what is important to their organisation as sustainable investors, while investors in Europe and the APAC region are more aligned to external criteria, primarily regulation and policy signals.

Contrasting this, the research also shows how investors around the world are now taking action on climate change. Global agreements, such as the Paris Agreement of 2015, have led to many investors to set targets for net zero emissions. The adoption of net zero targets is a good example of how ESG investing evolves over time, and how investors have become more sophisticated in their analysis, requiring data to become more nuanced. While ESG investing is driven often by values, which can shift the focus among organisations and individuals, sustainable investing recognises that a common goal, in this case producing a sustainable economic and social model in an era of global warming, requires united action if it is to work. So, investors in, say, China and the USA can find harmony in defining net zero as a goal, while their views on other aspects of ESG investing might differ considerably.

The importance of sustainable investing, with decarbonisation as the objective, also explains why investors are moving from more passive approaches, such as excluding certain investments, to more active approaches, such as exercising active ownership and the use of impact investing. This is because approaches such as active ownership and impact investing enable investors to make more effective use of their assets under management, by bringing positive changes at investee companies. If investors can scale this approach, then the chances of effective action to support decarbonisation and a transition to a low-carbon economy also increase.

Looking at the range of investor responses in this survey, and from their own comments, we can see a wide dispersion of investor attitudes and actions on sustainable investing. But this, and previous research from the BNP Paribas ESG Global Surveys, show that there is a general trend towards an increased take-up of sustainable investing. Within this, we can see some encouraging developments, such as the fact that many in the APAC and North American regions are moving ahead on sustainable investing. Another positive sign is that sustainable investing is now often applied to asset classes such as private equity and private debt. Delphine Queniart concluded: “The survey shows investors are moving from more passive approaches, such as excluding certain investments, to more active approaches, such as exercising active ownership and the use of impact investing. As institutional investors prepare to scale up their efforts, private markets are becoming progressively more important for investors’ ESG strategies. However, investing in private markets for sustainability and impact is not always easy to do. Despite the challenges, the impact can be very effective, and the findings show that hedge funds and private equity firms are becoming supporters of sustainable investing.” There is a huge amount still to do, and erratic severe weather events are an unsettling reminder, but this research shows that many investors are making definitive progress on investing more sustainably.

[1] The Brundtland Report was published by the World Commission on Environment and Development (WCED) in 1987 and introduced the concept of sustainable development as a response to the problems of reconciling environmental issues with economic growth and social equity. It is named at former Norwegian prime minister Gro Harlem Brundtland, who chaired the WCED, which was also called the Brundtland Commission.

[2] Scope 1, 2 and 3 emissions are different categories of greenhouse gas emissions. Scope 1 emissions are directly due to an organisation’s activities and operations, while scope 2 emissions are indirect emissions created by the production of energy that an organisation buys. Scope 3 emissions are harder for an organisation to control, as they are indirect emissions from across a company’s value chain, from customers using a company’s products, to suppliers making products used by a company.

[3] A just transition to a low-carbon economy refers to the need to support workers and communities affected by the transition away from fossil fuel use and to a more sustainable, low-carbon economy. It recognises that this will be a complex process, with millions of jobs in carbon-intensive industries around the world disappearing and being replaced by jobs in low-carbon activities, which will need different skills. For this transition to happen in a socially and economically just manner, it will require planning, dialogue and support for entire communities on a large-scale.

Integrating ESG Expertise into Operations

- ESG Global Survey 2023

- ESG Global Survey 2023

- How investors are tackling the ESG data challenge

- Key take-aways

- Foreword

- Background

- The ESG data challenge – The main findings

- Data is the biggest barrier to ESG investing

- Focus on ESG investing and North America

- The data challenges for ESG and sustainability issues

- How investors apply data management techniques to ESG data

- Using a range of data vendors for ESG data

- Reporting on ESG investing and sustainability

- Conclusion

- Institutional investors progress on the path to sustainability

- Foreword

- Background

- How investors define sustainable investments – The main findings

- Key ESG objectives among investors

- How investors apply sustainability in their portfolios

- Methods used for sustainable investing

- Sustainable or ESG investing approaches explained

- ESG investing priorities for active ownership

- Other steps investors are taking towards a low-carbon economic model

- Setting carbon reduction targets

- Conclusion

- Integrating ESG Expertise into Operations

- Foreword

- Background – Nurturing integration

- Driving decisions – Portfolio management integration

- Multi-faceted risk management

- Close scrutiny – Monitoring ESG compliance rules

- External experts for execution

- A careful choice

- Using a range of data vendors for ESG data

- Reporting on ESG investing and sustainability

- Conclusion

Foreword

As environmental, social and governance (ESG) concerns grow within the global conscience, institutional investors are further enhancing how they include these issues in their business practices and the way they invest.

From its humble beginnings, rooted in corporate social responsibility and responsible investing, the concept of ESG investing and integration has developed into an approach which is considered by many to be essential. This article will consider the findings from the survey to examine how institutional investors include ESG in the way they operate and how they work with external partners in doing so.

The integration of these criteria is no longer a single task exercise, ESG has permeated several areas of an investment organisation and here we outline the ways in which this is taking place. In the last iteration of the study, BNP Paribas identified that ESG had reached a tipping point. The data collected was evidence that ESG integration has become integral to the investment industry and players could not turn their back on it as a concept or approach; there is no going back and inclusion of these factors in investment processes has become almost standard.

In addition, the research provides evidence that the way ESG is being approached is evolving. The majority of investors use ESG integration specifically in relation to ESG or sustainable investing. However, just over half include ESG in their investment and portfolio management processes. This indicates that although the integration of ESG has become more prevalent, it remains, to some extent, siloed and has yet to be proliferated throughout all levels and processes across an organisation.

THE MAJORITY OF INVESTORS

USE ESG INTEGRATION

SPECIFICALLY IN RELATION TO ESG OR SUSTAINABLE INVESTING

Background – Nurturing integration

As it slowly moves away from being kept in a single part of an organisation, ESG expertise and data is being woven into the fabric of institutional investors’ organisations and is now becoming a core part of integral processes. Research is showing that ESG has evolved from a niche concept to a fundamental practice for institutional investors.

There is growing consensus across the investment community that ESG integration is not only critical to build a sustainable, future-proof portfolio, but can also help enhance returns which meet the needs and requirements of various stakeholders along the whole investment value chain. The BNP Paribas ESG Global Survey demonstrates the continued dominance of ESG integration. Although compared to the previous iteration of this study, the number of respondents who say they use ESG integration as an approach to ESG has dropped, it remains the primary way in which institutional investors employ these criteria within their organisations. The lower reported usage of ESG integration could be taken to mean the approach is becoming integral to investors’ business practice and part of their daily operations.

In 2021, 75% of investors said integration was their approach of choice. This year, 70% of investors say this is an approach they employ within their organisation. Further asserting the persistent influence of ESG integration is the significant gap between the number of investors using integration and those making use of negative screening, which is the second-most dominant approach across the sample.

70%