The Markets in Crypto-Assets regulation focuses on certain categories of crypto-assets which are currently out of scope of existing regulations – i.e., it does not apply to non-fungible tokens (NFTs)[1] or to security tokens qualifying as financial instruments under MiFID – and establishes a legal framework for crypto-asset services providers as well as consumer protection.

About MiCA

MiCA will apply directly across the European Union (EU) without any need for national implementation laws. This approach is in keeping with consumer protection and ensuring effective and harmonised access to the innovative crypto-asset markets across the single market.

The Markets in Crypto-Assets regulation has four essential objectives:

- Ensuring legal certainty by establishing a sound legal framework for crypto-assets in its scope that are not covered by existing financial services legislation;

- Supporting innovation and fair competition in order to promote the development of crypto-assets by instituting a safe and proportionate framework;

- Protecting consumers, investors and market integrity in consideration of the risks associated with crypto-assets; and

- Ensuring financial stability, with the inclusion of safeguards to address potential risks to financial stability.

The entry into application of the Markets in Crypto-Assets regulation was initially expected by mid-2023. However, it has been delayed to late 2024.

Provisions on asset-referenced tokens and e-money tokens have however started to apply as from 30 June 2024 whereas other rules will start to apply as from 30 December 2024 (i.e., rules for issuers of crypto-assets other than asset-referenced tokens and e-money tokens, crypto-assets service providers, and the prevention of market abuse).

Final reports from the European Securities and Markets Authority (ESMA) are also expected by late 2024 on certain key elements such as the qualification of crypto-assets as financial instruments or guidelines on reverse solicitation.

EU Digital finance package: get the full picture

Digital Operational Resilience Act

DORA aims to prevent increased fragmentation of rules applicable to ICT risk management. Find out what this means for financial entities.

Read moreDLT Pilot Regime

Market participants can benefit from regulatory exemptions through the DLT Pilot Regime. Find out more in our regulation memo.

Read moreLet’s get in touch

Scope of the Markets in Crypto-Assets Regulation

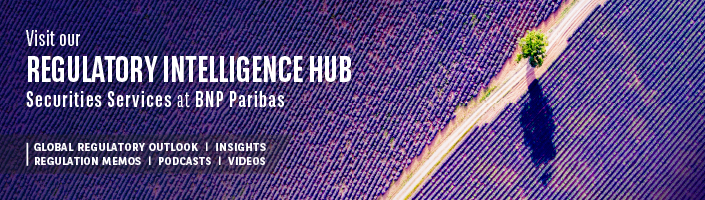

Crypto-Assets in scope of MiCA

A majority of crypto–assets which are not already governed by other regulations, such as security tokens and central bank digital currencies, shall fall into the scope of MiCA:

- E-money tokens

- Asset-referenced tokens

- Utility tokens

Crypto-assets, other than e-money tokens or asset-referenced tokens, offered to the public are also in scope of the regulation, underlining the objective to have a broad scope.

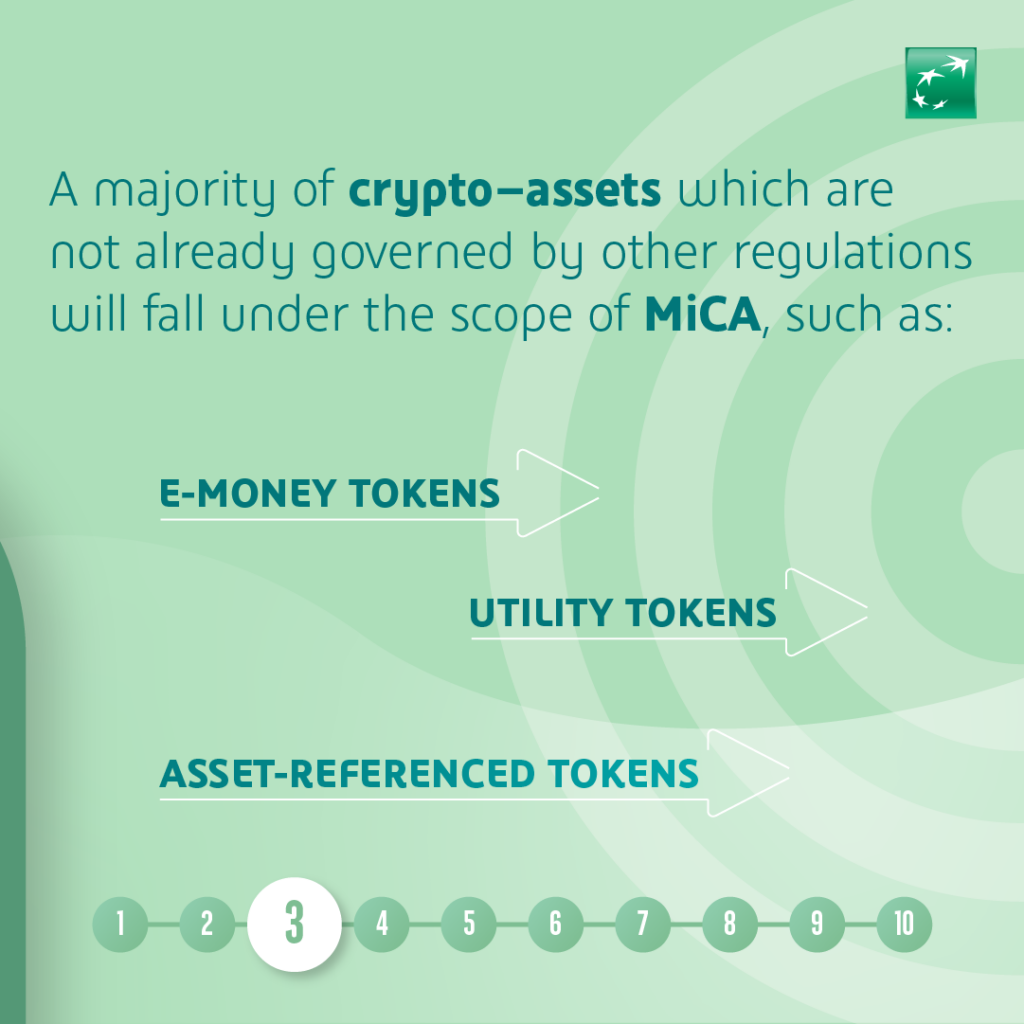

Obligations for issuers of crypto-assets under MiCA

Issuers of crypto-assets falling into the scope of MiCA, namely those offering crypto-assets to third parties, may be subject to several obligations including, without limitation:

- The publication of a whitepaper having some similarities with prospectuses published under the prospectus regulation

- The necessity to be authorised to issue crypto-assets

- Compliance with certain prudential rules when marketing crypto-assets

- The obligation to act honestly, fairly and professionally vis-à-vis crypto-asset holders, in particular in relation to conflict management and prevention or maintenance of security access protocols

The applicable regime depends on several elements considering notably the type of crypto-asset offered and the amount of the offer.

Crypto-asset services providers, services in scope of MiCA

Certain standard services, when performed and provided with respect to any type of crypto-asset falling into the scope of MiCA, shall be captured and regulated under MiCA. The custody and administration of crypto-assets on behalf of third parties as well as the provision of advice on crypto-assets are part of the services qualifying as crypto-asset services. Entities providing crypto-asset services shall qualify as crypto-asset service providers.

Crypto-asset service providers shall be licensed to provide crypto-asset services. Some criteria shall be satisfied by crypto-asset service providers applying for the authorisation to benefit from a European passport. To a certain extent, the applicable regime mirrors the existing MiFID and market abuse regimes with respect to satisfying conditions as well as observing and complying with prudential rules.

Industry implications of the Markets in Crypto-Assets regulation

The MiCA initiative will affect the ability of market players to diversify their business by developing a crypto-asset strategy. The regulation is likely to provide a harmonised legal framework with strong safeguards for historically non-regulated crypto-assets as well as for the service providers engaged in that business and, ultimately, the consumer.

The Markets in Crypto-Assets regulation should not be considered as a standalone initiative. The European Commission’s digital finance strategy not only relies on MiCA, but also on the DLT Pilot Regime and the Digital Operational Resilience Act (DORA), thus demonstrating transversal reach. In addition, it cannot be excluded that market players are likely to have to observe certain ESG standards while engaging in digital finance.

Securities Services’ view

We commend this initiative and the effort to leverage on existing regulations to develop the digital finance framework.

Business opportunities are likely to appear in response to clients’ appetite for diversification, digitalised operations and the desire to benefit from an efficient support of crypto-asset services providers.

Key dates of the Markets in Crypto-Assets regulation

24 September 2020 – Adoption by the Commission of the proposal for a regulation on Markets in Crypto-Assets

19 February 2021 – European Central Bank opinion

24 February 2021 – European Economic and Social Committee opinion

24 June 2021 – European Data Protection Supervisor opinion

30 June 2022 – Provisional agreement reached between European Parliament and Council

20 April 2023 – Plenary vote by the European Parliament

9 June 2023 – Publication in the Official Journal

30 June 2024 – Entry into application of provisions relating to ART and EMT

30 December 2024 – Full application of the regulation

This article was published in April 2022. It was last updated in July 2024.

[1] Certain categories of NFTs are however likely to fall in scope