Clients that elected to remain active lenders throughout 2021 have performed well, as have many beneficial owners and agents.

But what does the coming year have in store for the securities lending market? Will 2022 see a continuation of the recent volatility and regulatory trends? And what else can we expect?

Global securities lending markets bouncing back*

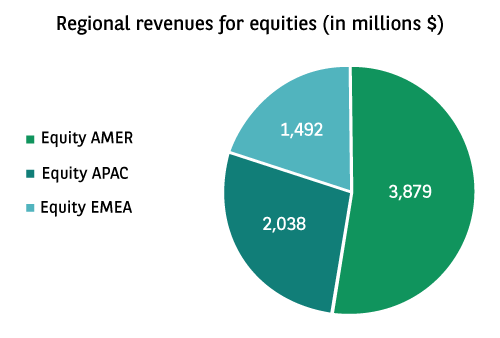

After a dip in activity in 2020, global securities lending revenues bounced back across every market segment in 2021. Figures from IHS Markit show annual industry revenues totalled $10.98 billion, up 18.1% year-on-year and well ahead of the $10.1 billion generated by lenders in 2019.

Performance in the APAC equity markets – where revenues surged 35.8% to over $2 billion – was particularly strong, in sharp contrast to the low single figure growth seen in the Americas (2.08%) and EMEA (6.57%) equities. Despite slower growth, the American equities market remains the largest region globally.

Revenues from American Depository Receipts (up 178% year-on-year), Exchange-Traded Funds (+60%) and corporate bonds (+33.7%) also enjoyed notable jumps on the previous year. Government bonds experienced a less stellar 7.3% rise.

While the return of revenues to pre-Covid crisis levels is welcome, the outlook for 2022 performance is mixed. In the year ahead, we envision revenue opportunities around increased M&A activity and the associated corporate action trading for our agency lending programme. Volatility linked to the withdrawal of liquidity from a coordinated central bank tightening campaign will also provide opportunities across the collateral transformation segment. The lifting of short-selling bans is expected to provide additional revenue potential. The combination of reduced liquidity, health of corporate balance sheets and new market entrants will present opportunities which we will help clients to monetise.

*Source: Aggregated data from IHS Markit Securities Finance Snapshots, aggregated on 2022/02/15.

Securities lending prospects for 2022

For the securities lending market, 2022 may be a year of two halves. The first will likely see a continuation of the patterns evident last year – perhaps with some uptick in market activity and volatility, with specials, M&A activity, etc. emerging in greater quantities as we move into the second half. Equity markets in general had a good run through 2021. However, the start of 2022 has seen a turnaround, although it is too early to say if it marks the beginning of a longer-term correction. The equity market trading strategy we employ across our agency lending business is designed to meet the longer-term requirements of the borrower community with larger, long-duration, modest fee loan baskets and the optionality to re-rate when specials materialise.

On the fixed income side, government balances increased over Q4 and in particular for year-end. Fee levels remained fairly static though, with some balances rolling off to pre year-end levels. We expect no material change in balances and fees for the first quarter of this year.

However, other trends will require dedicated care:

Outstanding market risks

How the Covid-19 pandemic plays out, and what ongoing impact it will have on global markets and the securities lending industry, is a major question.

The Omicron variant has shown the virus’ continuing potential to mutate and disrupt people’s daily lives. While the variant appears milder and less damaging to national economies, global growth remains susceptible to further outbreaks.

Unblocking supply chains and getting economies back to firing on all cylinders may take us some way into 2022 before we see a marked change in recovery and growth. Any pickup could be undone though if new (and potentially more dangerous) variants emerge. The impact on the economic activity and market volatility that would result means the Covid effect will remain a risk for the securities lending industry worldwide for the foreseeable future.

Resurgent inflation also looks set to impact global equity and bond markets through 2022 and beyond. How “transitory” the current inflationary spikes prove to be is open to debate. Yet after more than a decade of low interest rates and excess liquidity, a period of progressive monetary tightening now looms. Interest rate increases predicted for the coming year in the US – with the growing prospect of a 50bps rise as early as March – could stifle growth and impact wages/spending power. The energy crisis is a further headwind, requiring energy supplies to expand in order to stimulate production beyond current levels.

Further ramp-up of regulation

Regulation will remain a key theme for the securities lending market throughout 2022.

In Europe, the Central Securities Depositary Regulation (CSDR) aims to augment settlement discipline in its in-scope markets. The regulation will affect all settlements whatever their origin, including securities lending and repo transactions. All participants (buyers, sellers, lenders, borrowers and service providers) should benefit from the CSDR rules and mechanisms once they are bedded-in, but it will take some adjustment.

In the short-term, we anticipate two effects:

- A change in market participant behaviours. Borrowers may increase borrowing activities to ensure greater settlement efficiency, with lenders potentially looking at larger buffer reliance. Some behaviours will be formed in the early months of the regulation.

- Rapid development of the partial settlement mechanism in all markets that fall under the regulation. This would prevent a potential liability gap stemming from the difference between the size of a failing sell and the size of a failing loan recall at the origin of the failing sell.

To minimise penalties, custodians are making sure partial settlements are available to clients, while buyers and sellers are encouraged to select the partial settlement option when available. In parallel, service providers such as agent lenders need more than ever to prove their capacity to manage recalls efficiently by receiving sales instructions on time and substituting when possible.

Across the Atlantic, two critical pieces of legislation were proposed in Q4 2021 which, if passed in their current state, will lead to significant market disruption.

The first, Securities and Exchange Commission (SEC) Exchange Act Rule 10c-1, aims to increase transparency in the US securities financing markets in a similar way to the EU’s SFTR. Rule 10c-1, in its existing form, requires market participants to report all transactions to a registered national securities association, such as the Financial Industry Regulatory Authority (FINRA), within 15 minutes of execution.

The comment period closed on 7 January. At this stage, industry participants are seeking greater clarity around the scope of the proposal. Question marks include which assets are affected, what transactions are excluded from the reporting requirements and how much extraterritorial reach it would have.

The second SEC proposal is a revision to Rule 2A-7, specifically institutional prime and tax-exempt money market funds. The proposed increase in overnight and one-week liquidity buffers, along with implementation of “swing-pricing”, will present operational challenges if the rule is implemented. There is a possibility these new liquidity and pricing mechanisms will deter investors from allocating new assets to prime money funds. This would create a potential opportunity for beneficial owners to capture any dislocation in the market.

Regional multi-speed market evolution

Global markets in the year ahead will transition towards monetary policy normalisation. This coordinated global tightening will affect lending markets. Throughout EMEA, the increase in SCRIP and DRIP opportunities will lead to significant revenue growth potential. In APAC, the lifting of short-selling bans, combined with new market openings, will contribute to revenue generation.

However, the ability to quickly monetise opportunities in these markets can be challenging. Reliance upon a global custody network infrastructure will help with the opening of new markets, and in staying abreast of market settlement practices and post-trade reporting requirements.

In the United States, the pace and timing of a new phase of balance sheet normalisation – with ongoing tapering of the Federal Reserve’s bond-buying programme and a ratcheting up of interest rates – will take centre stage. Balance sheet normalisation will drive liquidity normalisation, which will benefit clients owning high quality liquid assets (HQLA). Equity markets will continue to present opportunities, although SPACS and meme stocks will likely have less of an impact on performance than in previous years. The strength of corporate financial conditions may also lead to increased M&A activity, presenting opportunities for beneficial owners.

No going back on ESG

Environmental, social and governance (ESG) issues have become a central focus as beneficial owners seek to develop their internal ESG policies, and relate those to their securities lending business.

Lack of clarity around the categorisation of products and services under the Sustainable Finance Disclosure Regulation (SFDR) is one sticking point. Under the advocacy of the International Securities Lending Association, the industry is reviewing the legislation to determine which aspects of their lending programmes market participants may need to consider with an ESG lens. Whether the envisaged ESG promoted changes to investment behaviour and capital allocation impact revenue streams, positively or negatively, remains to be seen. With its experience in sustainable finance, BNP Paribas Securities Services is working with clients to align their lending programmes with their internal ESG policies.

We expect the adaptation of detailed ESG-driven metrics on lending programmes to gather pace through 2022. Agents are mobilising to create coordinated working groups tasked with establishing ESG standards in a bid to develop universal criteria that market participants can abide by. At the same time, beneficial owners have unique requirements, with each putting forward a bespoke set of parameters. Adaptability to accommodate these bespoke client requirements and changes to client programmes will be paramount.

Many of our client discussions around ESG focus on proxy voting and collateral requirements. Historically, an agent may have offered clients three collateral buckets: for example, main index equities, G7 sovereigns and corporate bonds. The wider the collateral schedule, the greater the market opportunities and the higher the return.

At BNP Paribas Securities Services, we increasingly see clients looking at screening collateral according to ESG criteria. But, for the concept of ESG collateral to gather momentum, the counterparty community must be able to allow such segregation and the implementation of ESG scoring. Additionally, limiting collateral acceptance to specific ESG criteria could potentially affect performance.

To assist our clients with this process, we work closely with external data analytics firms. This helps with the review of collateral portfolios, providing market metric analysis on the suitability of differing types of collateral in line with individual client requirements and wider UN Sustainable Development Goals (SDGs).

Securities lending programme optimisation

Regulatory changes, dynamic markets and ESG considerations are creating an ever more complex environment for lenders. Ensuring they can navigate this environment, and optimise the monetisation of their lending programme within it, is vital.

Access to liquidity has become of primary importance. Firms have been leveraging their securities lending programme to either raise liquidity or use their agent to help them manage excess liquidity post the liquidity injections that have resulted from global central bank easing campaigns.

At BNP Paribas Securities Services, we have worked closely with clients to create the Directed Agent Repo Liquidity Solution (DARLS). This new product leverages the existing operational and trading infrastructure of the agency lending business to help clients invest their excess liquidity into a bespoke, reverse repurchase structure that offers a competitive yield to traditional money market products. While the solution is only available in the US as of the time of writing, we are looking to expand it to other regions.

Liquidity discovery and supply distribution are also critical to helping clients generate additional revenue. Initiatives focused on expanding into new markets, additional collateral sets and trade structures ensure that wherever possible we can monetise market opportunities for our clients beyond their existing securities lending programmes.

Continuing the drive for efficiency through technology and automation is another key focal point for our teams. Deploying a combination of proprietary technology developments and vendor-based applications eases the manual elements of the lending process, while offering enhanced analytics to both the lender and agent.

Ensuring we provide a seamless and efficient offer to any client is a central tenet of BNP Paribas Securities Services’ varied range of securities lending solutions for both the buy and sell side. We will continue to concentrate on that effort through the coming year and beyond.