During the past decade, many forms of regulation and industry standards have been introduced to promote transparency, risk awareness and financial stability in debt capital markets and debt structured finance.

In this demanding environment, issuers need to rely on partners that are able to bring expertise and operational support along the entire life cycle of their transactions.

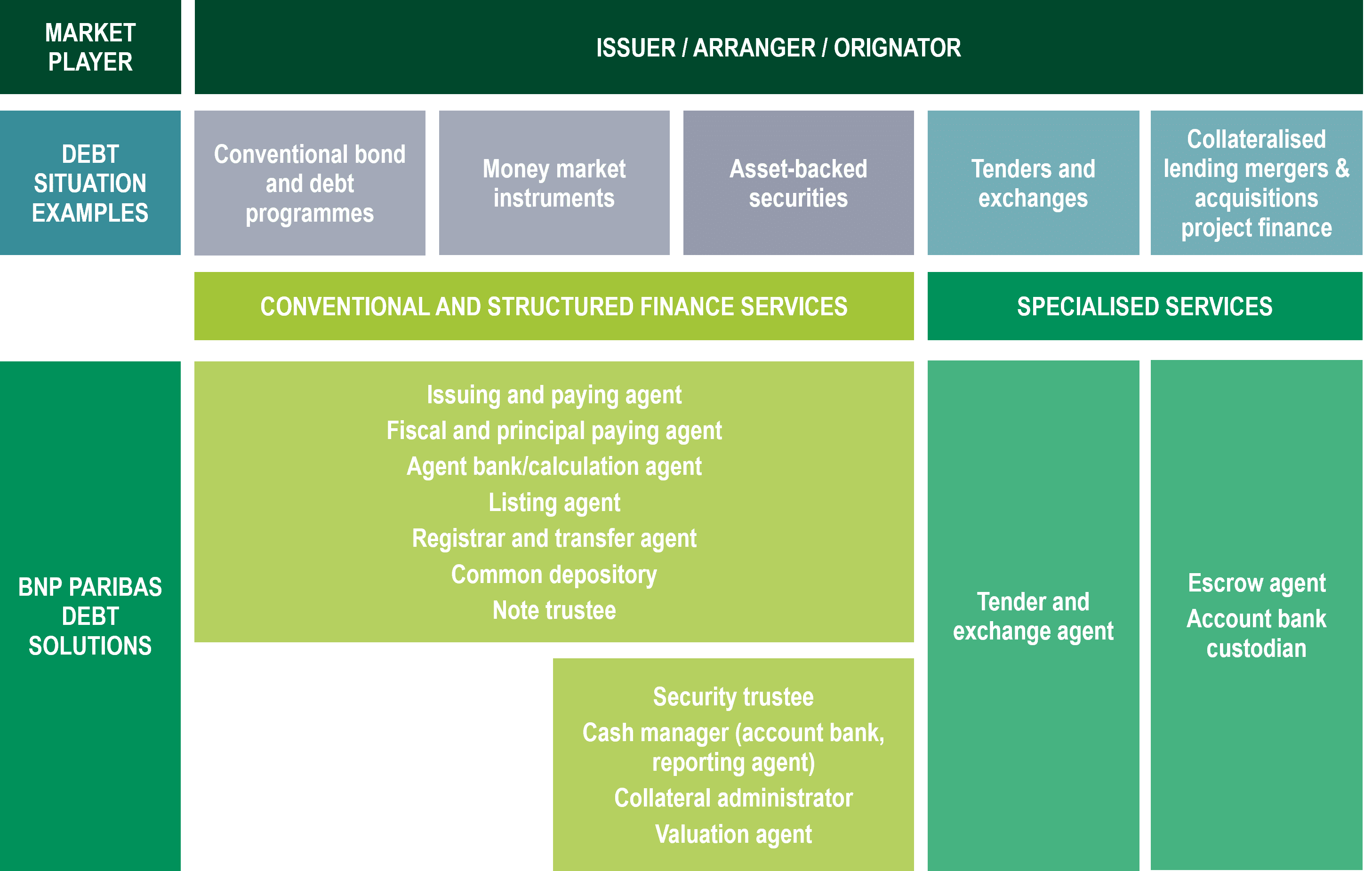

The Securities Services business of BNP Paribas provides end–to-end agency and trustee services for all forms of debt activity, ranging from conventional bonds (stand-alone bonds, debt programmes, green bonds) to structured debt and securitisation issuance.

What sets us apart

Covering both the major domestic and international debt capital markets with a presence across Europe and the United States

Committed provider with long-term presence

A robust infrastructure to support our clients’ transactions throughout their life span

Stability of a prominent international banking institution

Services across the debt market spectrum

Partner with a recognised expert

Our dedicated expert relationship managers endeavour to deliver and customise solutions to our clients according to their specific transaction requirements. Leveraging our on-the-ground operational experts, we connect with local market players, such as CSDs (Central Securities Depositaries) or International CSDs (Clearstream or Euroclear). Our deep know-how and proactive approach will help you achieve technical, legal and regulatory compliance.

Conventional debt services

We ensure end-to-end servicing throughout the entire life cycle of all types of issuance including European debt programmes (Euro Medium Term Note or EMTN, Euro Commercial Paper or ECP), US Money Market Instruments (US MMI) and Warrants.

Securitisation and structured debt services

Securitisation allows originators (e.g. banks, corporates) to remove assets from their balance sheets in return for immediate cash flows. At the same time, investors can diversify and gain exposure to the underlying asset pool (e.g. consumer loans, mortgages), not only the issuer.

Our service model is fully integrated. Depending on your requirements, we can offer a modular approach or an end-to-end solution covering all securitisation and structured debt asset classes including mortgage backed, auto-loans, synthetic, collateralised loan obligations, repackaged and non-performing loan portfolios but also loan funds.

We have developed services allowing French and international asset managers to structure debt to finance the real economy, the energy transition and specific investment projects, leveraging France Titrisation services, a third-party AIFM (Alternative Investment Fund Manager).

“France Titrisation”

“France Titrisation”, a wholly-owned subsidiary of BNP Paribas, is a portfolio management company, with an AIFM licence and a direct lending approval.

We offer a comprehensive range of securitisation and debt fund management services through open architecture, including an independent financial and legal review, a full range of services for portfolio management, fund administration and accounting, as well as regulatory reporting.

We manage

- All types of French AIFs, including public and private “Fonds Communs de Titrisation” (FCT), “Organismes de Financement spécialisé” (OFS) and “Fonds Professionnel Spécialisé” (FPS) structures

- Debt funds (asset-backed securities (ABS), commercial mortgage-backed securities (CMBS), residential mortgage-backed securities (RMBS)) with a long-term investment strategy

We were a pioneer in setting up the first French reinsurance securitisation fund (insurance linked to securities) in 2018.

With over 20 years’ experience and a team of almost 50 professionals, we have the tools to manage highly granular portfolios supporting all types of underlying assets (ABS, CMBS, RMBS) and synthetic structures. We adapt our solutions to the needs of the final investors, and our clients’ systems and management structures.

Tender and exchange, escrow and collateralised lending

Some issuers may need to review their debt maturity profile, or their funding and liquidity costs. We can manage a tender and exchange to recover existing outstanding bonds and redeem them (tender) or exchange for bonds (tender and exchange).

We can also act as an escrow agent for any transaction (e.g. mergers & acquisitions transactions, derivative agreements) which requires the posting and segregation of collateral and can hold assets as custodian in a segregated account in relation to a collateralised lending agreement between two counterparties.

Key facts