Connectivity

Together, we go beyond

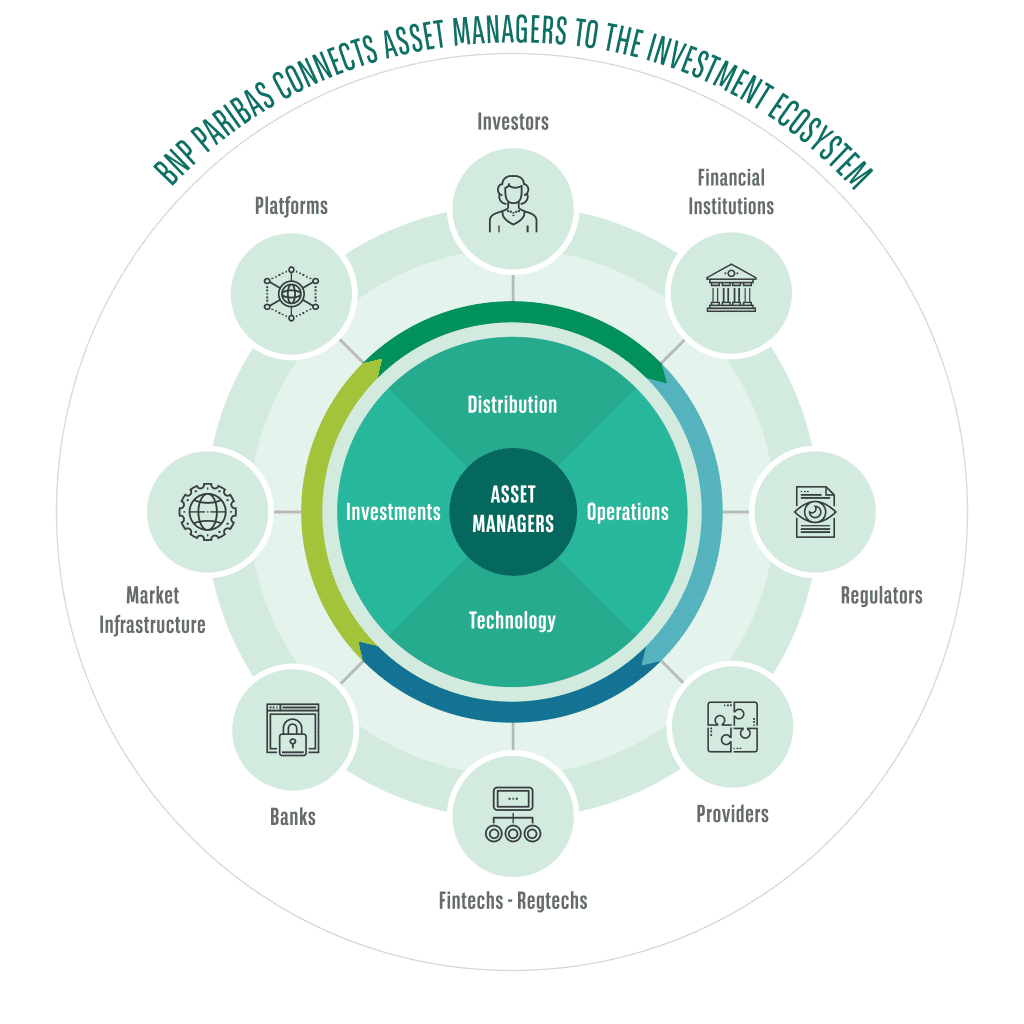

Connecting with the potential of new investment ecosystems, technology and data is key to realising your ambitions in a changing world.

Beyond borders: connecting asset managers to local markets

Securities Services goes beyond a single platform or one-size-fits-all approach. We offer adaptive asset servicing solutions to fit our clients’ current infrastructure and future ambitions. Through our connectivity to industry-leading fintechs, market infrastructure, data providers and tech platforms we enable clients to go beyond traditional industry siloes.

Servicing local funds in 17 locations

Trilion AUA

Distribution analytics for 100,000+ funds

Automated connectivity with all major dealing platforms (Allfunds, FundSettle, Vestima, NSCC, EMX)

*Via our partners AllFunds

More than ever, asset managers need to access local markets to distribute funds efficiently and diversify your investor base. As market practices constantly evolve, we know you need up-to-date operational expertise and resources to sell funds where you want, when you want.

Through our extensive coverage in 17 markets across EMEA, the Americas and Asia, we connect your investors to your products, whatever the channel or underlying tools. Our harmonised, interconnected service model means they can access multiple fund ranges through one account, supported by BNP Paribas contacts acting as one team across regions and timezones. And we can help you to develop the distribution model that best suits you in each market, through our connectivity with the major local infrastructures (Euroclear, Clearstream, NSCC) and dealing platforms.

But that’s not all we do. We go beyond your distribution needs today and work closely with clients to explore the opportunities of Distributed Ledger Technology (DLT) and digital assets. Collaboration and shared learning are central to our approach. Our vision is to offer seamless access to both traditional and digital assets through a consolidated model, preparing for a future of improved investor experience and operational efficiency.

A front-to-back model built around you

Every asset manager has a different operational model, based on legacy infrastructure, investment strategies and historical relationships. Many clients want to transform their model while preserving the efficiencies of their existing set-up. At Securities Services, we want to respect this – and your preferred balance of in-house and outsourced activities.

We selected BNP Paribas for its ability to help us connect our front and middle office flawlessly. This connectivity between our front and middle office will help us enhance operational efficiency and speed up trade processing.

ABN AMRO Investment Solutions

Zoom On:

Strategic alliance with BlackRock and Aladdin Provider:

Using a single platform, we deliver global expertise and outsourced services directly on a client’s instance of Aladdin technology. Our front-to-back model offers a consolidated data source for all your activities.

We selected BNP Paribas for its ability to help us connect our front and middle office flawlessly. This connectivity between our front and middle office will help us enhance operational efficiency and speed up trade processing.

ABN AMRO Investment Solutions

We go beyond a one-size-fits-all platform and offer a modular approach with greater efficiency and flexibility. Our clients use Charles River, BlackRock Aladdin, Bloomberg AIM and SimCorp Dimension for their front office, or a combination. Through our open architecture set-up, we connect efficiently to clients’ platform of choice and deliver the specific middle and back office capabilities that clients need. Asset managers can extract maximum value from their existing ecosystem while ensuring maximum connectivity.

That’s why many of the world’s leading asset managers across Europe, Asia and the Americas, have chosen us as their long-term front-to-back partner. Our 850 middle office experts across 12 operating centers process 5 million trades each year across 100+ markets.

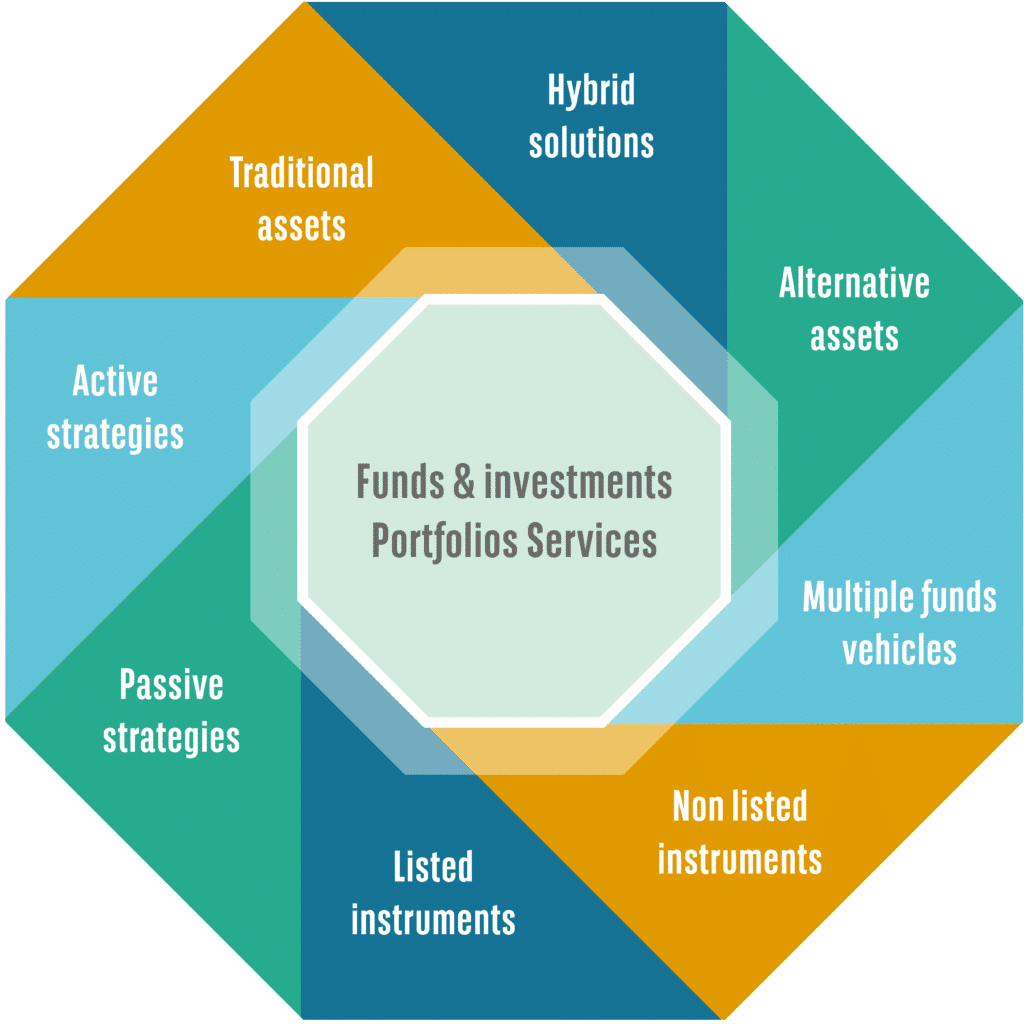

Capturing growing asset classes and fund structures

Alternative asset classes are set to exceed USD 30 trillion by 2030*. Entering this growing market is not straightforward and requires a flexible approach, new technologies and processes.

Beyond a standard solution, we connect clients to specialised solutions and support you in adapting your operating model. Our 900+ private capital staff globally, eFront invest platform and dedicated CapLink Private portal offer best-in-class platforms and expertise for those looking to grow their exposure to private capital.

By connecting asset managers with our asset servicing expertise and processes developed for many of the world’s leading private funds, we help to remove barriers between traditional and alternative asset management.

Another growing area is ETFs, now a significant share of the open-ended fund market and a distribution vehicle for active funds.

We support asset managers in the Americas, Europe and Asia-Pacific to set up and operate their ETFs, through our local expertise and harmonised global processes. We go beyond the basic requirements to deliver the capabilities they need for their ETF model and lifecycle, partnering with leading tech providers such as Ultumus.

Beyond boundaries: connecting asset managers to new worlds of tech and data

The investment ecosystem is changing. We want to connect you to the most innovative platforms and fintechs, while you can continue to benefit from the security and scale we offer as Europe’s largest custodian.

Beyond our own in-house ecosystem, we invest and collaborate with fintechs, platforms and market infrastructures to offer you a wider range of capabilities through our open service model.

External data partners complement our internal data services so that you can select the best set-up and information for your needs

Featured collaborations

Allfunds

Our Fund@ccess platform, created in partnership with Allfunds bank, offers access to 100,000+ funds and advanced analytics to deep dive into your portfolios.

Ultumus

BNP Paribas clients can now access Ultumus’ COSMOS platform to manage their ETF lifecycle including creation and redemption orders

AssetMetrix

AssetMetrix’s leading technology and web services underpins our unique private capital reporting platform, CapLink Private.

NeoXam

Our post-trade data management offer leverages the Investment Data Solution (IDS) of NeoXam, a market leader in financial data technology solutions.