Seamless front- to back-office operating environments have long been a focus for the investment management industry. In an era of margin compression and search for yield, institutional investors face more and more challenges, which put a strain on their resources. They need to adapt constantly to increasingly complex and changing regulation and market practices, and equip themselves to explore new asset classes and geographies.

Connectivity and operating model flexibility in middle office outsourcing

The Securities Services business of BNP Paribas provides flexible operating models to match institutional clients’ outsourcing needs. We have adopted an open front-office strategy that allows us to serve and optimise our clients’ diverse models, taking into consideration their portfolio management system specifics.

We have developed integrated models with the leading system providers, such as BlackRock Solution’s Aladdin , Bloomberg’s AIM and Charles River Development’s portfolio management systems. Therefore, our clients benefit from a seamless front to back operating environment that improves data integrity, cost control and servicing capabilities. Crucially, we constantly endeavour to standardise and simplify our processes in middle office services.

Extensive range of middle-office services

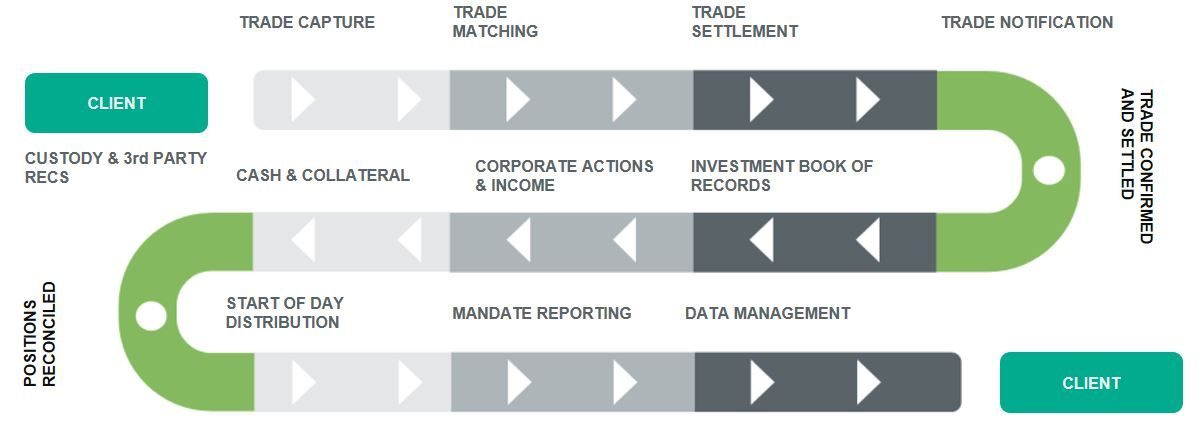

Our team of experts can support you for all post-trade execution services, including

- Multi-asset transaction management including trade capture, trade confirmation, settlement instruction and monitoring, failed trade resolution, claims management and associated reporting

- Investment Book of Record (IBOR) keeping, reconciliations, pricing and data management, corporate actions and income management, cash management, monthly mandate reporting.

Our middle office outsourcing services offer clients:

- Flexibility and adaptability: we enable and support clients’ geographic expansion leveraging our global footprint and network. We continuously invest to keep pace with rapid industry developments and the ever-evolving regulatory landscape.

- Specialised operations and IT skills: clients have immediate access to our expertise, specialised processes and market skills allowing for solution optimisation and related best practices. We invest heavily in all aspects of resource management so that service standards are continuously optimised.

- Premium technology: clients benefit from premium technology and fully integrated, global single-instance platforms on our core operating platforms supporting transaction management, OTCs, collateral management, …

- Scalability: by outsourcing to us, clients are able to convert a large proportion of their fixed cost base to variable costs, scaled according to their business size and the services required, benefitting from our global footprint and resilient model.

- Efficient middle office data management: Our middle office platform manages a wide range of data including transactional data, lifecycle, referential, pricing, supporting regulatory data requirements. We collect and reconcile information from multiple sources, enrich the data, ensure compliance with evolving regulatory frameworks. We make it available for client usage such as oversight and front office enrichments.

By leveraging our middle office services , you benefit from:

A true front-to-back solution regardless of your choice of front office architecture

Exhaustive asset classes (including derivatives) and market coverage

A follow-the-sun model with local points of contacts for greater client proximity

Strong capabilities to adapt to complex open architecture (execution counterparties, clearers, custodians or accountants)

Key middle office figures1

markets

brokers and counterparties

Custodians

transactions per year

[1] BNP Paribas, December 2024

Fund administration

We are a leading global custodian and a global provider of accounting and administration services for funds, supporting clients across multiple domiciles.

Private Capital

We take care of the technicalities of fund administration, middle office, and investor services in private capital asset servicing for you. These capabilities are delivered through BNP Paribas' CapLink Private – the window to all your transactions, portfolio management, investor registry, digital workflow management, and much more.

BNP Paribas’ Securities Services business launches new data management services in partnership with NeoXam

BNP Paribas’ Securities Services business today announces the launch of new post-trade data management services, leveraging the Investment Data Solution (IDS) of NeoXam.

Let’s get in touch