Private capital managers get more involved in sustainable investing

ESG and sustainable investing themes are becoming increasingly attractive for private capital managers as opportunities in private markets and alternative assets continue to grow. The survey findings show that private capital managers believe ESG investing can add value, improve alignment with asset owners, satisfy their stakeholders and enable them to benefit from critical investment themes around decarbonisation and the shift to a low-carbon economy. Sustainable investing can still be considered nascent in the alternative investment industry and integrating this approach could serve as a differentiating factor for these investors.

Many of the private capital managers surveyed are relatively small, specialist organisations. Just over two-thirds (67%) manage assets of less than USD25 billion and almost three quarters (72%) have 500 employees or less. The overwhelming majority of the private capital managers we surveyed, are located outside the USA, in Europe, the Middle East, China and Hong Kong, Singapore, Australia and New Zealand and Latin America.

For a greenfield wind or solar farm development, land will be allocated to ensure that biodiversity is conserved as part of it. And there is a lot of adaptation work now, i.e. to take account of nesting seasons or migrating species. We are much more conscious of our actions.

Global Head of Sustainability, renewable energy fund manager, Spain

Private capital managers are relatively advanced users of ESG investing. Private capital managers are more likely to be pacesetters or Steady Performers and less likely to be Followers. Almost four-in-ten (36%) are pacesetters, compared to 42% of asset managers and 22% of asset owners. Over a third (36%) of private capital managers are steady performers, more than the comparative figures for asset managers (29%) and asset owners (32%).

This shows ESG is now embedded in their investment approach. Investor demand has been a key driver here, as clients now expect to see at least a cursory level of sustainability included in most private asset classes.

1. Private capital the strongest ESG advocates

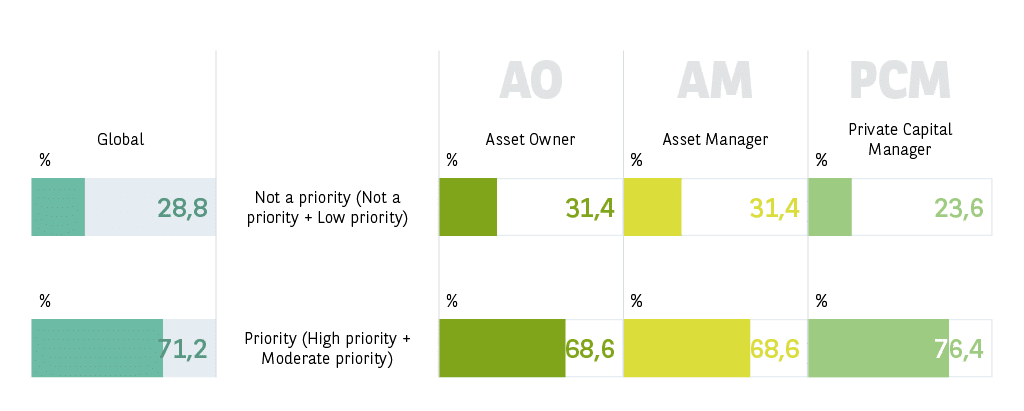

Private capital managers are emerging as the strongest advocates for ESG and sustainable investing. As detailed in chapter 2, institutional investors overall are firmly committed to their sustainability goals. Geopolitical complexity has affected private capital managers’ even less, with 56% saying that this has no influence on their objectives, compared to 41% of asset owners and 40% of asset managers.

They are also likely to remain vocal on their ESG and sustainable investing achievements, as only 34% say they will be less public about their process, compared to 45% of conventional asset managers.

Private capital managers are leading in ESG because they are directly involved in real infrastructure—building wind farms, solar plants, and sustainable infrastructure.

Global Head of Sustainability, renewable energy fund manager, Italy

These investors expect pressure to rise around ‘governance issues related to executive pay and confidence’ (50% vs. 40% overall). Private capital managers also anticipate growing investor appetite for reducing emissions and a just transition to a low-carbon economy in the next five years.

On their biggest priorities for voting, engagement and possible investment changes compared to other organisations, private capital managers stand out for ‘carbon capture and storage’ (31% vs. 22% overall), followed by ‘a just transition to a low-carbon economy’ (25% vs. 20% overall).

2. Championing the social dimension

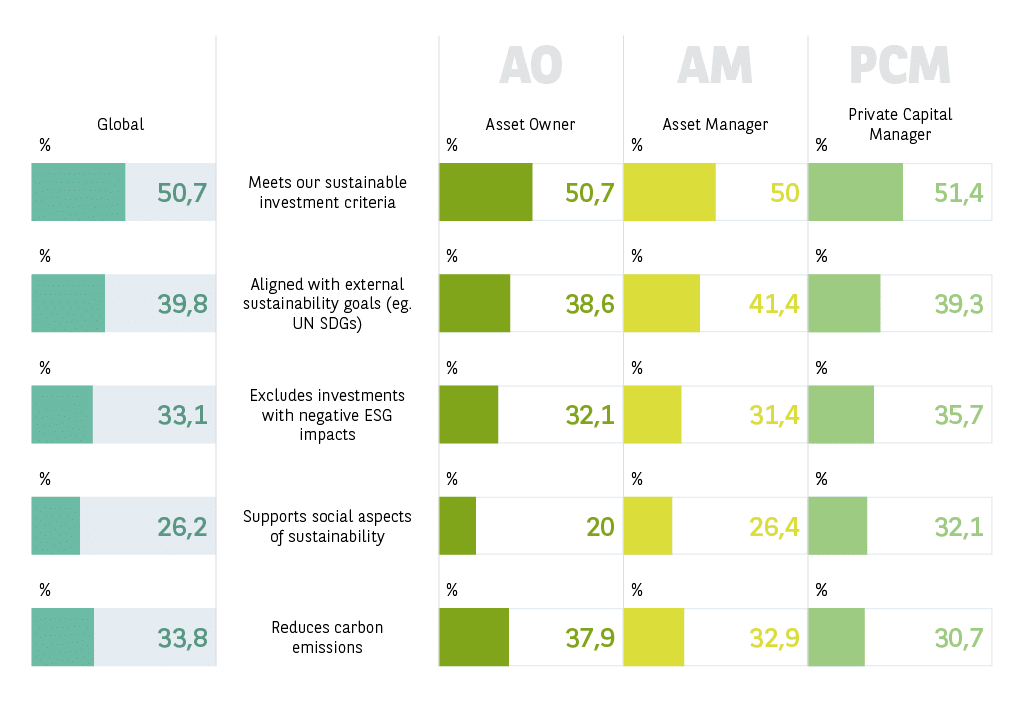

Private capital managers place particular emphasis on the social aspects of sustainability; 32% consider this to be the most important element in their definition of sustainable investment (26% overall). Private capital managers are also slightly more likely to consider biodiversity and nature-based solutions, reinforcing the emphasis towards thematics.

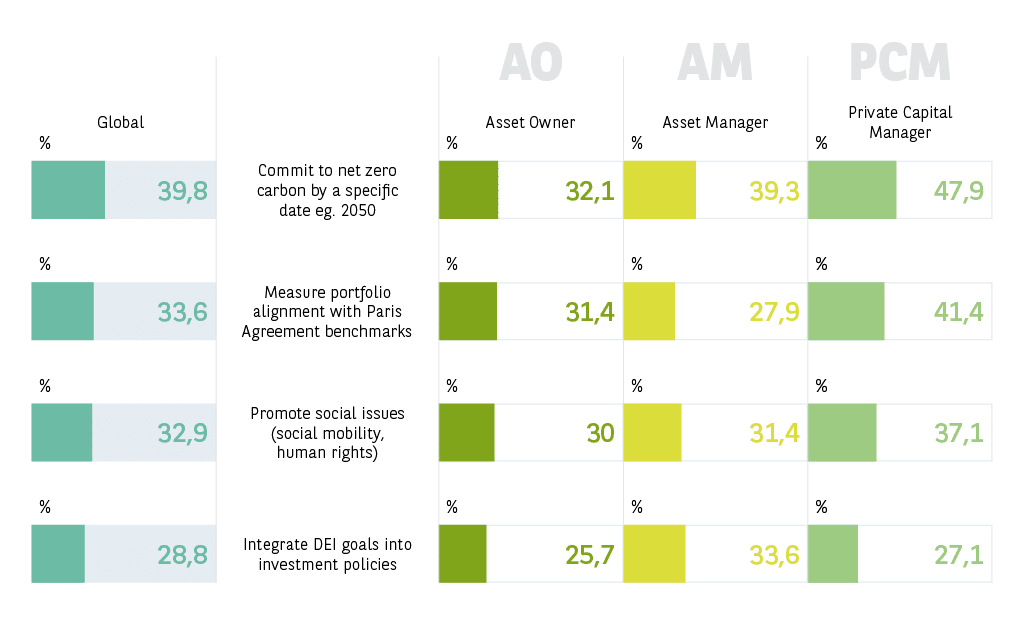

Within their key sustainability/ESG objectives in the short-term, issues relating to the social aspects of sustainability feature strongly. For example, 38% of private capital managers cite ‘integrating DEI goals into investment policies’ (vs. 33% overall), while nearly half (47%) ‘promoting social issues, such as human rights and social mobility’ to be an objective compared to 39% overall.

Compared to the other two groups, private capital managers are also more likely to say that ‘social issues’ (76% vs. 71% overall) and ‘supporting a just transition’ (63% vs. 52% overall) are priorities for their investment strategy.

The greater importance attached to social issues is also seen in the fact that private capital managers are more likely to expect increasing pressure related to such concerns, with 41% saying this compared to 32% overall..

The social dimension, however, does not preclude the focus on decarbonisation, or committing to net zero carbon emissions by a specific date, such as 2050. Here, private capital managers are very close to asset managers in valuing this as a key objective in the short-term (31% vs. 33%), although both lag asset owners here (41%). However, private capital managers are more likely to add ‘committing to net zero carbon emissions by a specific date’ as a key objective over the next five years (48% vs. 40% overall). So although decarbonisation remains part of their approach to ESG/sustainability, the social aspects of sustainability are taking precedence in the coming two years. As evidence of this, 47% of private capital managers say that ‘promoting social issues’ is a key sustainability objective in the next two years, compared to 41% of asset managers and 30% of asset owners.

3. Staff influence

Additional data insights from the survey can help explain the importance private capital managers are placing on social issues. For example, more private capital managers say they ‘have access to specialist expertise in ESG and sustainable investing’ (45% vs. 35% overall). They are also more likely to have ‘increased the headcount of ESG experts within their portfolio management and investment decisions team’ (59% vs. 50% overall).

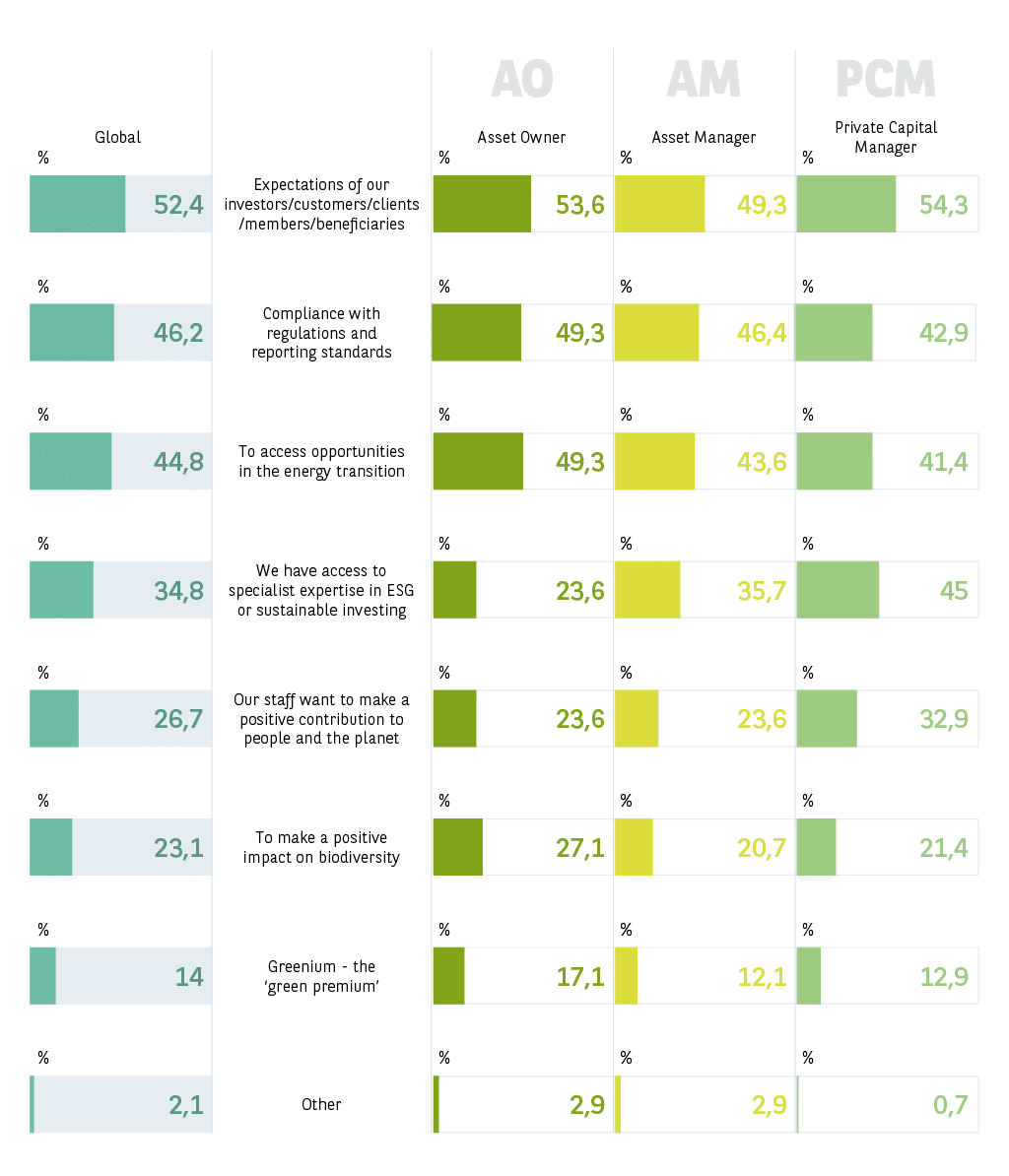

In addition, staff at private capital managers are more likely to ‘want to make a positive contribution to people and the planet’, as 33% cited this as the most important reasons for taking account of ESG or sustainable investing criteria, compared to 27% overall.

Staff exposure to ESG and sustainability expertise, particularly in smaller teams, facilitate the integration of these perspectives into investment approaches. Broader staff support can also reinforce private capital managers’ positioning on sustainability, contributing to cohesion and retention.

4. Decarbonisation – a long-term objective

Given they often exercise leverage through a direct stake in a business, with board representation for instance, private capital managers can be a powerful force for change. This means that they can help drive policies supporting decarbonisation, and other ESG and sustainability practices.

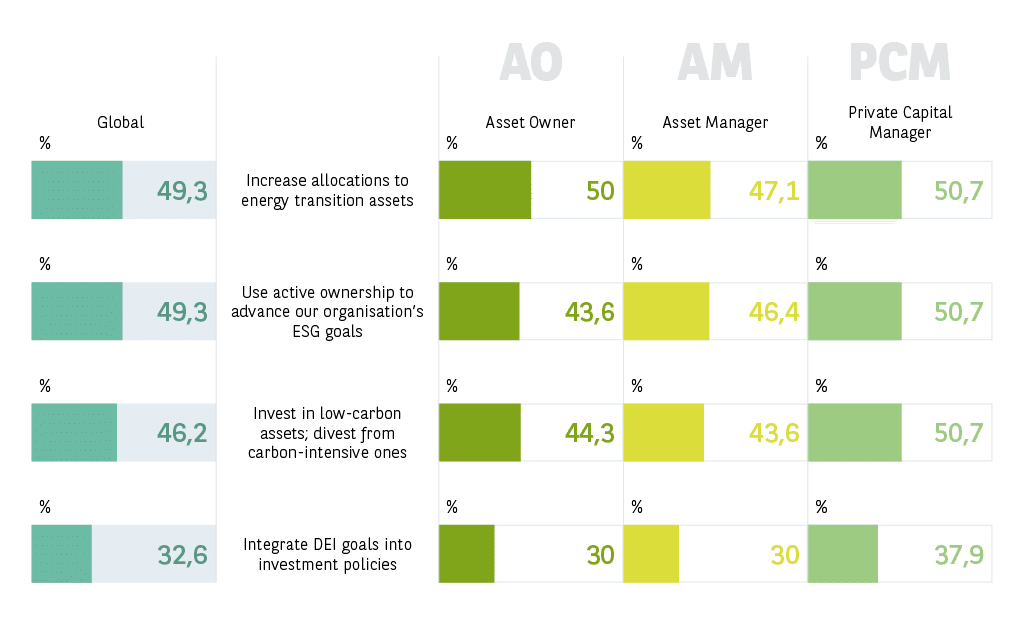

The data indicates many private capital managers consider decarbonisation as more of a long-term project. Asked what they expect to add as key objectives in the next five years, private capital managers scored above average for the following: ‘committing to a net zero goal by a specific date’ (48% vs. 40% overall); ‘increasing allocations to energy transition assets’ (35% vs. 29% overall); ‘reporting carbon emissions’ (35% vs. 29% overall); and ‘measuring portfolio alignment with Paris Agreement benchmarks’ (41% vs. 34% overall).

For assets such as real estate, the lifespan of the assets is measured in decades, and it is easier to reach net zero in a real estate portfolio than in other asset classes. And with closed-end funds, with lock-ins of seven to 12 years, capital is quasi-permanent. That enables the manager to have a real impact on challenging issues and take a long-term approach

Head of Investment Sustainability Solutions, asset manager, the UK

So we can expect to see private capital managers ramp up their decarbonisation activity in the near future. The complexity of this process makes it well suited to being a longer-term objective given the need for specialist expertise, access to relevant and reliable data and a planned but flexible pathway to a lower carbon future, as new technologies become available.

5. Agents of change

Private capital managers clearly have a distinctive approach to ESG and sustainability investing and they see long-term value in applying these principles to their investment strategies. This, in conjunction with their potential to influence investee company policies makes them likely to be very strong agents of change in the march towards sustainability.

Their focus on social issues and the input of their staff on these matters is unique among institutional investors. They may be leveraging these topics in demonstrating their commitment to ESG and differentiating themselves in an increasingly crowded market.

Alongside this, they have a long-term commitment to decarbonisation, as they are more likely to see committing to a net zero target as a key sustainability objective over the next five years, rather than in the next two years. At the same time, in the short term, private capital managers see increasing allocations to energy transition assets, investing in low-carbon assets and reporting carbon emissions as key ESG/sustainability objectives. This suggests that private capital managers are taking measured, deliberate approach to decarbonisation, based on a thorough understanding of the steps they need to take in order to decarbonise.