A continuation fund is a secondary vehicle established by private equity managers to transfer one or more assets from an existing fund nearing the end of its lifecycle in a bid to extend ownership beyond the original fund’s term.

Although not a new concept, the use of continuation funds has surged in recent years, driven by longer value creation timelines, rising investor demand for liquidity, and a rapidly evolving secondary market. This shift has provided sponsors with greater flexibility, enabling more efficient capital recycling and continued asset management.

While continuation funds can offer upside to both sponsors and investors, they are not without their challenges. These include managing conflicts of interest, the need for transparent valuation mechanisms, and varying levels of Limited Partner (LP) acceptance, all of which can create complexity. As the market for continuation funds develop, General Partners (GPs) must navigate these factors by delivering a well-defined investment rationale, and develop an alignment of interests between GPs and LPs.

The Rise of GP-Led Secondaries

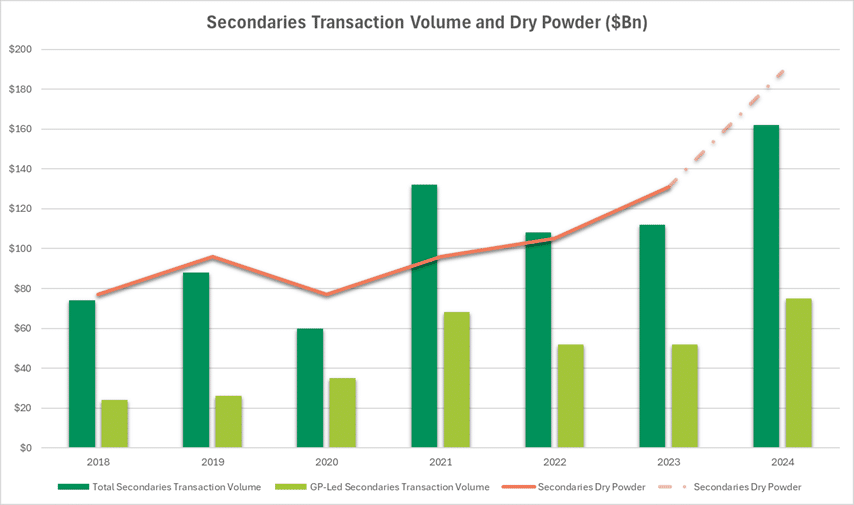

The market for GP-led secondaries has seen significant growth. According to Jefferies[1] , $28bn in transaction volume was recorded in the first half of 2024, marking a 56% increase compared to the same period in the previous year, with an acceleration of volume in H2 at $47bn, marking a 44% increase in total volume from 2023. As the search for liquidity grows, continuation fund transactions play a key part in this growth, accounting for close to 90% of the total GP-led secondaries volume.

Historically GP-led secondaries, being undercapitalised, has been a buyer’s led market, however with the growing availability of dry powder, there is a shift to more a balanced match between deal supply and available capital.

Source: Evercore, Jeffries

This rise in GP-led secondaries reflects a maturing market where capital is being deployed more strategically, where these dynamics enhance capital utilisation and allow for more targeted value creation. As the secondary market becomes more institutionalised, LPs are not only realising benefit from additional liquidity but also for more collaborative relationships with GPs that extend beyond the original fund’s lifecycle. The shift from opportunistic sales to structured, long-term value creation is becoming an increasingly attractive feature of continuation funds.

The Upsides and Complexities

Benefits for GPs and LPs

Continuation funds offer several compelling advantages that has seen their increased adoption, making them an attractive tool in today’s private equity landscape.

- Extended Life of a Trophy Asset: For GPs, continuation funds provide an opportunity to extend the life of high-quality assets when market conditions or asset valuations may not support an attractive exit. This flexibility allows GPs to continue managing and optimising the asset, with the opportunity of realising greater value in the long term.

- Liquidity and Distribution to Paid-In (DPI): Providing liquidity to LPs by generating distributions, even without an asset exit, which is particularly beneficial for investors seeking liquidity in the absence of a traditional sale. However, it’s important to note that while continuation funds can generate liquidity, it is often considered artificial, as it doesn’t necessarily reflect a true exit from the asset.

- Increased Flexibility for LPs: LPs benefit from enhanced optionality as they are given the choice to either roll their stake into the continuation vehicle, potentially maintaining exposure to the asset as it matures, or sell their stakes, realising liquidity. This flexibility empowers LPs to align their portfolio strategies with their evolving investment goals.

Whilst providing a range of benefits, continuation funds also introduce complexities and risks that both GPs and LPs must carefully manage. Key considerations such as valuation challenges, investor alignment, and market dynamics can significantly impact the success of the fund. If not addressed properly, these factors can pose obstacles to execution or even preventing the fund from launching successfully, with failed launches commonly attributed to misalignment between existing and new investors, valuation disputes, or in-balance between supply and demand.

Challenges and Considerations

Conflicts of Interest

As the sponsor sits on both sides of the transaction, acting as both the seller from the existing fund and the buyer through the continuation vehicle, navigating conflicts of interest is critical.

- The sponsor must balance the interests of different investor groups, including those fully exiting, those rolling their stakes, and new investors entering the fund. This complexity is further heightened when existing structures, such as co-investment vehicles, are involved, as they may have different rights and expectations that need to be addressed

- To attract capital for the continuation fund, sponsors often introduce additional incentives, such as stapled primary transactions, where investors commit to both the continuation vehicle and a new fund. However, as GPs have a duty to secure the best possible exit value for LPs in the existing fund while simultaneously seeking fresh capital for future investments, if not carefully managed, these dual objectives can lead to misalignment. In cases where a GP clearly benefits from these types of transactions (through additional fees or a stappled commitment), the recommendation from ILPA[2] is that the GP should clearly disclose these benefits.

Transaction Economics and Alignment

Achieving alignment between sponsors and investors is fundamental.

- Transparency is particularly important regarding fund terms and economics, for example when addressing issues such as whether carried interest from the original fund has been fully realised or if any portion is being rolled into the new vehicle.

- Pricing can become a point of contention since GPs are balancing the interests of new and existing investors. Establishing a fair valuation for these assets is crucial to maintaining investor confidence with an independent valuation process typically necessary to provide an objective assessment and prevent disputes between exiting and rolling LPs.

- Disclosures of relevant information should be presented in a timely and comprehensive manner to facilitate informed decision-making for LPs. This includes details on the selected assets, the rationale behind their transfer, the valuation process, and the bids received. The LP Advisory Committee (LPAC) plays a critical role in reviewing conflict waivers, while broader LP communication is essential to allow investors to make fully informed choices about whether to roll their stakes or exit the fund.

Financing and Security: An evolving landscape

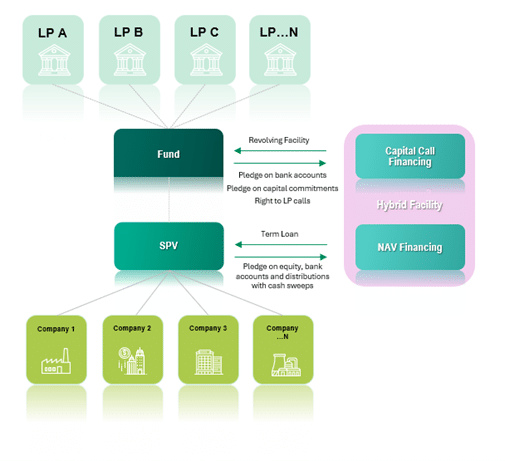

Given the bespoke nature of continuation funds, tailored financing solutions are required, as traditional fund financing facilities and respective terms are often unsuitable. As a result, different structuring considerations are often considered which are determined by the continuation fund’s specific characteristics, such as the underlying assets and the investor composition. Whilst continuation fund financing is an evolving area, the common financing options remain:

- Subscription lines: Offer liquidity in the early stages of a fund’s lifecycle, by providing immediate access to a capital pool for investments. This allows sponsors to avoid lengthy timeliness when calling on capital from investors and create a more even pattern of capital calls for investors, as the facility can bridge financing gaps. Security packages for subscription lines can vary but are typically secured either through the unfunded capital commitments of investors, the right to make capital calls from investors, or the bank accounts to which the capital calls are funded.

- NAV-based financing: Similarly to subscription lines, these facilities can help enhance liquidity, particularly in the latter stages of a fund’s term. Unlike a subscription line, NAV financing is typically used after all LP capital has been called and lent to a vehicle owning the underlying portfolio companies of the fund; secured by the value of the underlying fund’s assets, with lenders having recourse to the cash flows and distributions from these investments.

- Hybrid facilities: Combining elements of both subscription and NAV facilities, hybrid facilities offer greater flexibility throughout the fund’s lifecycle. Secured both by uncalled capital commitments in addition to the underlying fund’s assets, allowing lenders to secure against a broader collateral base. These facilities are more favoured by lenders due to the nature of the fund’s composition, typically a smaller pool of investors and less diversified asset base, meaning the broader collateral base can enable lenders to spread risk and provide better pricing.

Similarly to traditional private equity funds, continuation fund financing serves a variety of strategic purposes, supporting both the operational needs of the fund, and the growth of the portfolio. This includes financing acquisitions for the initial asset(s) transaction, providing additional liquidity to meet fund distributions or to cover a capital gap, and support portfolio growth initiatives where additional capital can be used for further investments such as follow-on investments in the portfolio for example.

Potential Market Developments

While continuation funds have primarily been used in private equity, we may see greater adoption in the private credit space as the market matures. Unlike private equity, where continuation funds help extend ownership of high-growth assets, private credit is structured around fixed-income instruments with defined maturities, making these funds less common. The lack of significant value appreciation of debt assets, limited secondary market depth, and predefined loan repayment schedules are key reasons why private credit continuation funds have not been widely used to date.

However, there are scenarios where private credit continuation funds could become more relevant. They can provide liquidity solutions for LPs, particularly as the secondary market for private credit expands. They may also allow GPs to extend exposure to performing loans in scenarios where refinancing would be costly or unattractive for borrowers. Additionally, for yield-focused investors, continuation funds could offer access to seasoned, income-generating portfolios with lower risk than new originations. As private credit grows in scale and sophistication, continuation funds may emerge as a more viable tool, particularly for large, diversified credit portfolios.

Balancing Opportunities and Risks

Continuation funds have increasingly become a widely used tool in the private equity toolbox, driven by investor pressure on improving liquidity and flexibility, and providing an opportunity to extend value creation.

As we look beyond, and as the market develops, we may see greater development across financial practices, for example an evolving fund financing landscape, and adoption across other asset classes, specifically in the private credit space which has yet to see a broader adoption of this technology.

There are several considerations however, which will determine the success of a continuation fund, both in terms of formation and value creation, with several factors at play including a robust investment rationale, the selection of the right asset, and managing conflicts of interests.

BNP Paribas offers one-stop shop asset servicing and financing solutions to GPs so they can scale and operate more efficiently. As a full-service bank active across the globe, we combine comprehensive solutions in fund administration, middle office, depositary, cash processing, financing and investor services reporting under one roof.

References

[1] Jeffries Global Secondary Market Review January 2025

[2] Continuation Funds: Considerations for Limited Partners and General Partners | Institutional Limited Partners Association