Triparty Collateral Management

Our triparty collateral management platform supports clients by combining advanced technologies, a seamless experience and a rich network.

Collateral Management is set on a digital path, read our article and learn about the common domain model, DLT and future digital assets impacts.

Collateral management has come to the fore in recent years.

For many firms, the process had historically been handled manually using fragmented processes, which could make it difficult to get reliable data or end-to-end visibility during an exposure’s lifecycle.

Recent volatile market conditions and ongoing regulatory obligations have put pressure on these systems and shown the need for infrastructure able to manage, mobilise and analyse collateral inventory and obligations effectively and flexibly. Momentum around solving specific transactions or removing market pain points indicates that collateral will continue to evolve across the securities financing ecosystem.

Leveraging digital innovation is one such way to help address operational limitations and risks, and reduce inefficiencies in areas including asset valuations, data reliability and portfolio management. Digitalisation and automation are playing an ever more important role. The digitalisation of collateral is one area where advances are currently being made: digitised securities could be mobilised without the potential complexities surrounding physical securities, while automated processes could support smoother transaction flows.

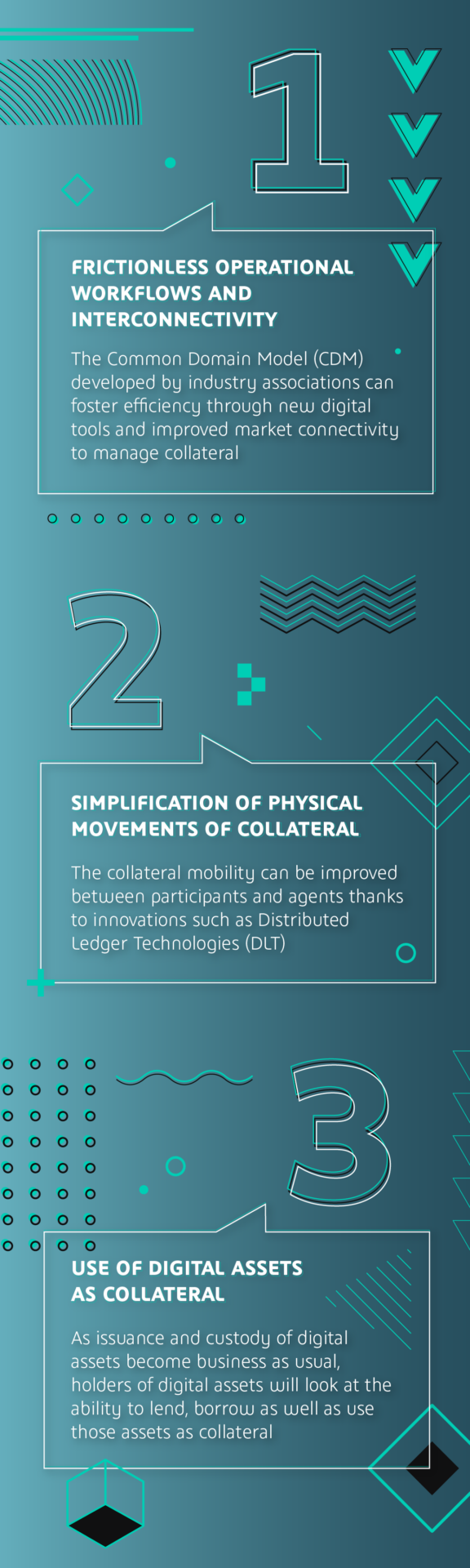

According to Johann Palychata, Head of Partnerships and New Platforms for Securities Services at BNP Paribas, there are three different levels worth exploring where the digitalisation of collateral is having an impact and could “bring major efficiencies to the industry in the long run”.

The first area of focus is automating the operational workflow between counterparties. The idea is to create a set of digital standards so parties can not only communicate better with each other using more reliable data, but also make their respective workflows and processes run more smoothly and responsively.

Some work has already been done at industry-level on these for several years now, with more underway: the Common Domain Model (CDM), a standardised blueprint which provides common terminology on how financial products are traded and managed throughout a transaction’s lifecycle.

This has become all the more relevant with the introduction in 2016 of the European Securities Financing Transactions Regulation (SFTR), which sets out various reporting requirements for securities financing activities.

For securities lending purposes, the CDM is used in loan documentation to detail eligible collateral and describe various data points and properties – for instance, the type and description of the asset, its maturity profile or various credit risk ratings. The CDM and DLT could be natural allies: after all, the latter relies on standardised data and processes when it comes to smart contracts.

“We are now studying how we can integrate the CDM in the next generation of tools and have a digital representation of products and events to foster automation efficiency in the industry,” explains Palychata. “We are still considering the ‘where’ question at present: if you look at application design, for example, where do you leverage the CDM?”

Should we re-design our existing tools and put the CDM at the core data model, or use it as a translation layer between our tools and those of our counterparties? We may get an idea of the direction we are going in in the coming months, as more tools are released and we see how they perform.

Another area where leveraging the CDM could also show promise is the management of information relating to the transaction itself. The primary aim of the CDM has been to provide standardisation of the data format across all parties. Palychata notes that rolling out a CDM would bring more transparency, facilitate the exchange of data as well as interoperability between software.

BNP Paribas is working on several initiatives with client to design how digital solutions could look like in practice. An example of this is a web portal and additional tools to manage the collateral eligibility matrix.

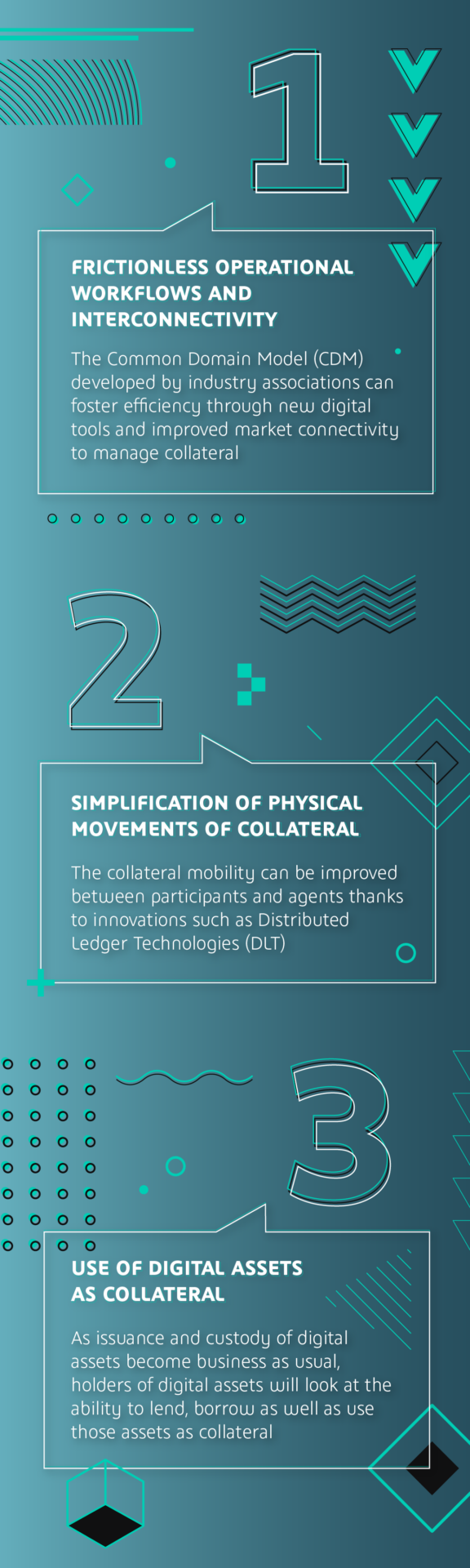

The second area to highlight is the development of solutions to simplify the physical movement of collateral between triparty agents and custodians. Firms’ internal systems and the different products they manage can suffer from a lack of interoperability, causing varying levels of operational and management friction, and at times, lead to trapped assets.

One solution to this would be relying on distributed ledger technologies (DLT), which use smart contracts (self-executing programmes whose terms are written directly in the underlying code) to finalise a transaction. DLT has the potential to impact the securities post-trade and could change how custodians and central securities depositories (CSD) manage and store assets.

While the technology has been around for some time, it is only recently that it has been put to use in practical scenarios. In the case of collateral management, DLT could have some advantages as underlying securities would not need to be moved and would remain available at all times. This would also have positive effects on collateral monitoring and reconciliation, regulatory transparency, and cost management.

Securities Services is an investor in fintech HQLAx, alongside other major players in the industry. Its aim is to foster collateral mobility between triparty agents and custodians by ‘transferring ownership of securities across disparate collateral pools at precise moments in time’ without the need for the underlying securities to move.

“It’s based on the concept of interoperability between triparty agents,” says Palychata. “Because it implements innovations like delivery vs. delivery [known as DvD] of securities instead of triparty payment, settlement and delivery, it has real benefits on risk management and available liquidity for a transaction.”

Banks’ existing infrastructure will have to co-exist alongside newer technologies such as DLT for some time, at least until these newer technologies become more widespread. Palychata notes that when solutions such as the one developed by HQLAx becomes more widely used, they can have a “positive impact on intraday liquidity and more generally provide capital savings for financial institutions”.

The main challenge will be carrying out the work for these to adapt to regulatory and operational requirements.

The third and final area – and perhaps the one where the most work still needs to be done – is digital assets.

“It’s still a bit of a blank canvas, but it’s very much on everyone’s agenda at industry and regulatory levels,” says Palychata. “There are many discussions happening on how digital assets need to be designed to support and to be used as collateral.”

Authorities globally, including at EU-level, are looking at regulating the digital asset sector, which has been quite volatile in the past couple of years. Plans focus on defining what exactly falls under the definition of a ‘digital asset’ and how these function in practice.

The International Securities Lending Association (ISLA) recently announced it was reviewing its Global Master Securities Lending Agreement (GMSLA) in the context of digital assets. It said it was looking at what should be ‘extended, added, or changed to cater for digital assets’. ISLA lists tokenised traditional assets, native digital securities, and types of digital cash as categories of assets covered by this review. This effort could spur new agreements emerging for purely digital assets in the event they were to remain separate from existing pool of collaterals.

When it comes to the issuance, settlement and custody of these assets, Securities Services is working with a number of fintech partners to develop its digital asset custody offering and help clients issue, transfer and safekeep regulated digital assets alongside traditional assets. In July 2022, it took part in an experiment which saw it support the settlement and custody process of a non-listed digital bond on the French market. It was also responsible for its distribution to investors.

According to Palychata, the issuance and custody process is maturing, and the door is now open to investigating collateral use cases and processes encompassing digital assets.

“It’s important that we master these elements in the transaction chain first before we look at anything else,” he says. “But for them to be widely adopted, it will depend on the ability of holders of digital assets to use them for more complex use cases, such as developing how you can lend or borrow these assets as well as use them as loan collateral.”

The legal work is ongoing, as noted above, but from an operational standpoint, the bulk of the work remains to be to be done. Digital assets rely on a specific bookkeeping process because they are recorded on a digital ledger. Their settlement is also different – traditional settlement relies on TARGET2-Securities (T2S), where the delivery of securities can happen at the same time as payment. Traditional assets are also registered in a CSD.

“How do you move digital assets, monitor them, who owns them, even – these are questions that need to be worked on,” says Palychata. “It remains to be seen, for instance, if custodians will provide a full interoperability layer, so that a counterparty would not necessarily know if it is a digital or a traditional asset.”

Our triparty collateral management platform supports clients by combining advanced technologies, a seamless experience and a rich network.