With SEC (Securities and Exchange Commission) Rule 15c6-2, affirmation by the end of trade date will become a regulatory requirement in a T+1 settlement cycle for US broker-dealers. In this article, we provide an overview of the main steps of the affirmation process and the role it plays in the settlement cycle in the US market.

Table of Contents

- What is an affirmation?

- Who is the affirming party?

- What time is the affirmation cut-off in the US T+1 settlement cycle?

- Which trades are eligible for affirmation?

- What is TradeSuite ID?

- Does affirmation guarantee settlement?

- What are the benefits of affirming by the cut-off time?

- What happens if transactions are affirmed late or not affirmed?

- With trade date affirmation being a regulatory requirement, is there a consequence of missing the affirmation deadline?

- Are there penalties for affirming late?

- Since the trades are already matched in Client Trade Manager, why is there another layer of affirmation?

- Is it possible to cancel a trade that has been matched and affirmed in Client Trade Manager?

- Affirmation and the US T+1 settlement cycle timeline

- How BNP Paribas can support your affirmation model

- What BNP Paribas recommends to clients regarding affirmation and the move to T+1 in the US

What is an affirmation?

Affirmation refers to the action taken by an institutional investor, or its representative such as a custodian, investment manager, or prime broker, to agree the details of a broker-dealer’s TradeSuite ID Confirm.

The process of allocation, confirmation, and affirmation in the US is somewhat similar to matching processes of other markets. An affirmation is an acknowledgement by an affirming party that the trade details of an institutional investor agree with those of its broker-dealer.

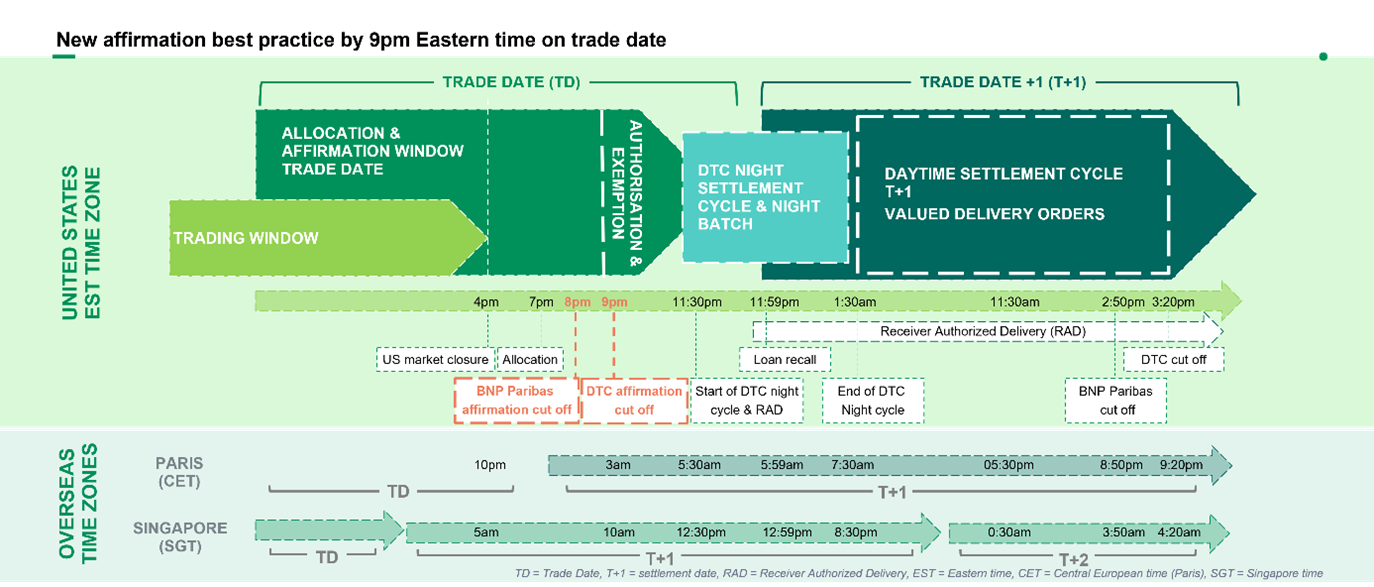

In the US T+1 settlement cycle, affirmation must happen by the DTCC (Depository Trust & Clearing Corporation) cut-off at 9pm Eastern Time (ET) on trade date.

Who is the affirming party?

Affirmation is done by the instructing party, or its authorised representative (such as a custodian or a prime broker).

BNP Paribas as a custodian acts as an affirming party for clients who delegate the affirmation responsibility to us.

What time is the affirmation cut-off in the US T+1 settlement cycle?

In the US T+1 securities settlement cycle, the DTCC cut-off is 9pm ET on trade date.

BNP Paribas cut-off for affirmation will be at 8pm ET on trade date.

Which trades are eligible for affirmation?

Trade affirmation applies to institutional trades only (ID Settlements).

Free of payment trades, money market instruments, primary issuance, repo or lending transactions are not eligible for affirmation in a US T+1 settlement cycle.

What is TradeSuite ID?

Affirmation happens on TradeSuite ID, a DTCC platform.

TradeSuite ID is used by participants to electronically affirm the confirm ID of their brokers presented at the depositary for matching. The platform also integrates SWIFT messaging/translation in and out.

TradeSuite ID is used by BNP Paribas for affirmation (MT515, MT517) and is linked to client status reporting (MT548 – MACH).

Does affirmation guarantee settlement?

Affirmation does not guarantee settlement.

Affirmation provides certainty that both parties agree that the trade details are comparable. If a delivering party is short of shares, or a receiver short of cash, the trade details may match but the transaction will not settle until the stocks are available.

What are the benefits of affirming by the cut-off time?

Affirming by the cut-off time (i.e., on trade date by 9pm ET in the US T+1 settlement cycle) increases the probability of settling transactions during the nighttime cycle of DTCC and reduces the risk of failed transactions. The cost of settlement at DTCC for transactions that are affirmed on time is lower.

What happens if transactions are affirmed late or not affirmed?

If transactions are affirmed late or not affirmed via TradeSuite ID by the 9pm ET cut-off time, trades can still settle. The delivering party needs to issue a Night Deliver Order (NDO) or Day Deliver Order (DDO) to the Depository Trust Company (DTC). Upon matching, TradeSuite ID converts the confirm ID into a settlement instruction that is delivered to the custodian and is automatically queued for settlement at DTCC.

Market data revealed that unaffirmed transactions are more likely to get DK’d (“don’t know”) by the other settling party, and delay or simply fail settlement on the contractually agreed settlement date.

Affirmation is mandatory for US broker-dealers. Therefore, they are likely to encourage their buy side counterparties to affirm their transactions by 9pm ET on trade date. As stated above, affirming on trade date by 9pm ET increases the probability to settle transactions during the nighttime cycle of DTCC and reduces the risk of failed transactions.

With trade date affirmation being a regulatory requirement, is there a consequence of missing the affirmation deadline?

Affirmation by the end of trade date is a SEC regulatory requirement for US broker-dealers. Missing the deadline means that concerned US broker-dealers have failed to comply with their obligation to affirm trades by the end of trade date. No penalties have been implemented yet, but the cost of settlement at DTCC is higher.

US T+1: get the full picture

T+1 settlement: Are you ready?

Settlement cycles around the world have been shortening for years, but the changes required for T+1 are of a different order of magnitude.

Read moreT+1 for asset owners and asset managers in Europe and APAC

Canada, Mexico and the US decided to shorten their securities settlement cycles to T+1. What are the impacts on front- to back-office operations?

Read moreT+1 impact on custody operations

BNP Paribas hosted a webinar on the impact of T+1 on custody operations

Read moreAre there penalties for affirming late?

There are no penalties for affirming late. However, transactions that do not settle during the nighttime cycle will incur higher DTCC charges.

Since the trades are already matched in Client Trade Manager, why is there another layer of affirmation?

The process of allocation, confirmation, and affirmation is somewhat similar to matching processes of other markets. The affirmation process varies depending on who is the affirming party.

Client Trade Manager (CTM) is a confirmation platform that is used by many market participants to confirm the details of transactions and settlement instructions of securities.

Confirmation happens between a broker-dealer and an institutional investor, or its representative. When an institutional investor sends allocation instructions, whether after a block trade or not, TradeSuite ID matches the allocation instructions against the data input by the broker-dealer.

If the details agree, TradeSuite ID distributes matching confirmations to the parties named in the confirmation. If the institutional investor is the affirming party, the confirmation produced by TradeSuite ID is a matched/affirmed confirmation. However, if the affirming party is a third party named in the confirmation, such as a custodian, the third party is notified that the trade is confirmed and that it needs to be affirmed.

Is it possible to cancel a trade that has been matched and affirmed in Client Trade Manager?

It is possible to cancel or reverse affirmed trades in TradeSuite ID if both the affirming party and the broker agree.

Affirmation and the US T+1 settlement cycle timeline

How BNP Paribas can support your affirmation model

BNP Paribas supports multiple affirmation models, including affirmation through BNP Paribas’ own omnibus institutional ID (standard model). We can support clients who have their own TradeSuite ID and wish to self-affirm their trades. For more information, please reach out to your BNP Paribas representative.

What BNP Paribas recommends to clients regarding affirmation and the move to T+1 in the US

Clients, including foreign investors, should scrutinise their operating models, focus on the time needed to perform post-trade activities (confirmation, allocation, and affirmation), and identify opportunities for enhancement and automation within their processes and technologies.

Institutions located in Europe and the Asia-Pacific region need to take into consideration time zone differences and explore overnight processing during US hours. Clients should also review the lack of alignment in global markets and operations related with cash funding, foreign exchange, and securities lending activities. Institutions should engage with their counterparties, their brokers, investment managers, and custodians to establish a timeframe, support, and end-to-end processes to ensure a successful migration to a US T+1 equities settlement cycle.

Let’s get in touch