BNP Paribas’ Securities Services business is a leading custodian providing multi-asset post-trade and asset servicing solutions to buy-side and sell-side market participants, corporates and issuers.

$13.67 tn

assets under custody

$2.72 tn

assets under administration

9,208

funds administered

144.1 m

transactions settled in 2023

*As of 31 December 2023

Our custody services

Our custody solutions aim to provide best-in-class services with a strong focus on asset protection, network robustness and innovation.

Clients can access more than 90 markets through our custody network, 27 of which are proprietary, offering our clients a direct connection to the most active markets. This global reach is further supported by local expertise providing clients with the proper support for growth.

Our custody solutions focus on safe and efficient management of your assets. We deliver a flexible range of services to manage all securities-related activities from pre-trade to post-trade. For custody activities, this notably includes full execution, clearing and settlement capabilities, as well as all the asset services you may require.

In addition, we are closely following and shaping market trends (e.g. regulations, new technologies) at global and local levels. Our clients can rely on timely and accurate updates on worldwide market practices thanks to our rigorous monitoring.

Discover our custody services:

Our global custody offer is a core component of BNP Paribas’ Securities Services, operating as a connector to other transversal added value services. We continuously invest into our offer to ensure a seamless experience for clients. It evolves over time in harmony with our proprietary local network and market leading providers, ensuring clients receive the first-class level of service they require.

We provide our clients with a follow-the-sun model and sound asset protection.

As our client you benefit from:

- Asset safety from the leading European custodian and backed by robust operational processes trusted by clients around the world.

- Global reach combined with local presence across regions supporting your cross-border investments and global operating model.

- More time for your investment decision making and processing thanks to efficiencies and automation brought by our Augmented Custody programme. Clients benefit from faster corporate action announcements and better cut-off times.

- Enhanced monitoring and oversight of your activity with transparent and multi-channel reporting flows sourced from local markets.

- For our sell-side clients, we have designed global clearing and settlement services connecting clients’ trading activities to post-trade market infrastructures, either through a single global window or a multi-direct setup.

The key to successful post-trade processing is a partner who is ‘at home’ in local markets. Clients can rely on our deep understanding of local practices and rules, relationships with market authorities, and knowledge of the operational and strategic challenges created by new regulations and market initiatives.

Our local custody offer allows you to benefit from:

- Direct access to experienced on-the-ground experts, also enabling BNP Paribas to be your voice in major industry bodies (e.g. AFME, AMI-SeCo and many local industry groups).

- Competitive prices as we optimise layers to access local markets and leverage on significant efficiencies of scale (e.g. CSD family pricing, settlement internalisation, strong client base).

- Flexible setups to match your business requirements.

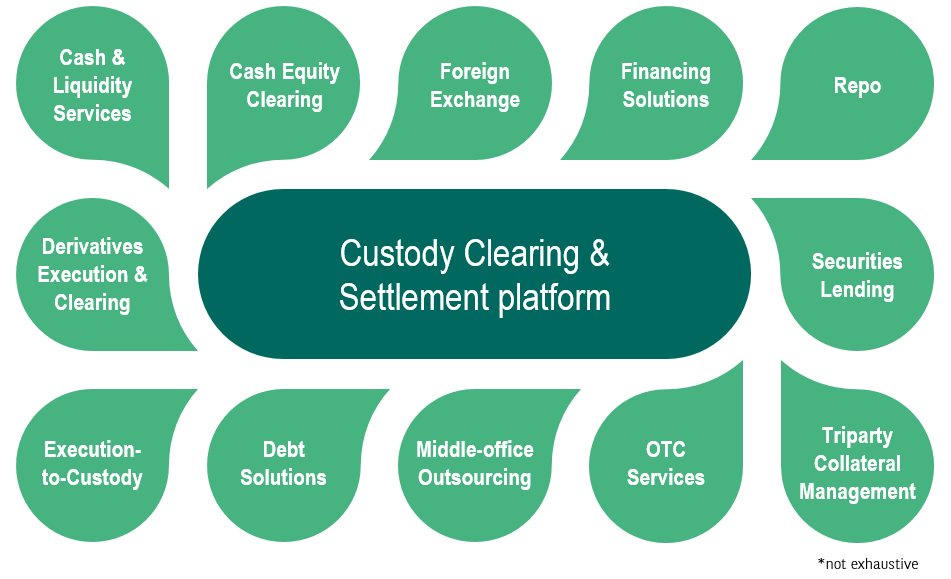

More than custody

By appointing us as custodian, you get access to a full range of solutions addressing your needs. Be it core or value added services, we have a complete suite of solutions fully integrated with our custody offering.

At BNP Paribas, developments are made on a continuous basis following – and shaping – market trends. BNP Paribas is a key vector for sustainable finance, developing tools allowing clients to follow their ESG policies. We are at the forefront of digitalisation, supporting the latest technologies through numerous projects globally. Through innovation we aim to provide an optimal client experience across the board (e.g. account opening, digital services, connectivity, service review).

Selecting BNP Paribas as your custodian, you partner with a global universal bank supporting your investments today and tomorrow.